The ECB is comfortable with current market expectations for rate hikes. At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have...

Read More »European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have deteriorated further, notably in France and Germany. While risks have...

Read More »Europe chart of the week – UK households

ONS data suggest that UK households lived beyond their means in 2017 as they became net borrowers for the first time in nearly 30 years.The latest UK sectoral accounts from the Office for National Statistics (ONS) has received considerable attention over the past few days as it shows UK households’ outgoings surpassed their income in 2017 for the first time in nearly 30 years. The ONS noted that, on average, each UK household spent or invested around GBP 900 more than it received in income...

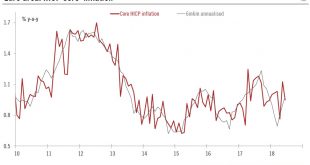

Read More »Services dent euro area core inflation in June, but no reason to panic

We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The...

Read More »Euro area: a slight rebound

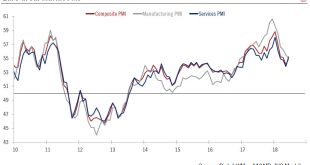

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey.The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political...

Read More »Watch out for a rebound in euro area core HICP in November

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the...

Read More »ECB, in search of a comprehensive strategy to tackle bad loans

Greater visibility on the ECB’s plans for dealing with the overhang of non-performing loans would help banks and the euro area recovery.The ECB has become under renewed pressure over its recent guidance on non-performing loans (NPL) and its plan to force banks to increase provisions against bad loans. The backlash, including at this week’s European parliament hearing of Danièle Nouy, Chair of the Supervisory Board, was fuelled by various gripes, including whether the ECB has gone beyond its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org