The ECB has hinted it intends to remain flexible when it comes to the composition of future asset purchases, with a chance that corporate bonds will play a bigger role.Arguably, the most important aspect of last week’s ECB quantitative easing (QE) announcement was that the programme will remain open-ended. As we have long suggested, the pledge to extend asset purchases beyond September 2018 can only be credible if there are enough German Bunds for the ECB to buy. Bund scarcity could be...

Read More »ECB preview: slower, longer, stronger

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September...

Read More »Scenarios for QExit

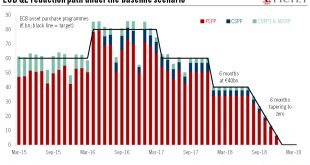

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

Read More »ECB, a forced taper

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks...

Read More »Slow-motion exit from QE

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per...

Read More »Upward momentum in euro area inflation is building

A close look at recent data suggest that core inflation in the currency area is edging higher, supporting the ECB ‘s plans for policy normalisation.Euro area flash HICP inflation rose to 1.5% y-o-y in August from 1.3% in July, while core inflation remained stable at 1.2% year on year. In our opinion, modest upward price momentum has started to build over the past few months, with core inflation likely to edge slightly higher from here.Euro area core inflation has broken out of the tight...

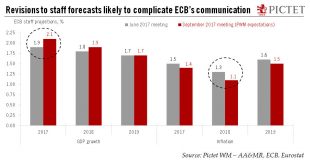

Read More »The ECB and the euro, from Amsterdam to Sintra

The threat to the ECB’s inflation targets posed by the appreciation of the euro is being offset by strengthening growth in the euro area. The ECB should pursue its cautious exit strategy.The trade-weighted EUR has appreciated by 4.8% since the ECB’s June meeting. ECB models and Mario Draghi’s rule of thumb suggest that a stronger currency could lower euro area inflation by about 30-40bp in 2018-2019, all else being equal.But all else is not equal, and the euro area economy is in a very...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org