In spite of an initial rise in 10-year Bund yields after the ECB’s latest stimulus, our central scenario is for a renewed decline by year’s end.The 10-year Bund yield moved up from its recent lows of -0.71% to -0.45% on September 16, driven mostly by an element of disappointment regarding the European Central Bank’s (ECB) latest stimulus measures and some renewed hopes for a US-China trade truce. In particular, we suspect the rebound in yields was triggered by the ECB’s failure to increase...

Read More »ECB Forward Guidance: the Devil is in the Detail

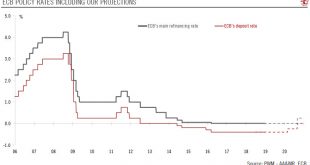

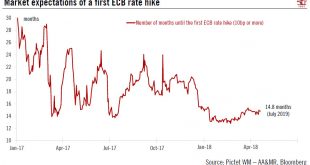

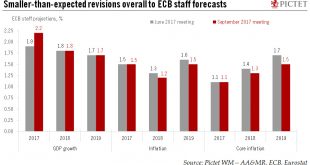

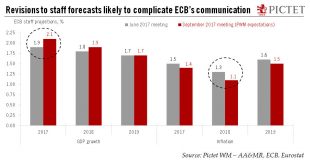

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates. Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions...

Read More »ECB rates and TLTRO-III: the devil in the details

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB...

Read More »ECB, in search of a comprehensive strategy to tackle bad loans

Greater visibility on the ECB’s plans for dealing with the overhang of non-performing loans would help banks and the euro area recovery.The ECB has become under renewed pressure over its recent guidance on non-performing loans (NPL) and its plan to force banks to increase provisions against bad loans. The backlash, including at this week’s European parliament hearing of Danièle Nouy, Chair of the Supervisory Board, was fuelled by various gripes, including whether the ECB has gone beyond its...

Read More »Small dip in headline PMI hides robust domestic momentum

The euro area composite PMI index fell slightly in October, consistent with our forecast of a moderate slowdown in activity in Q4.The euro area composite flash PMI declined to 55.9 in October, from 56.7 in September, below consensus expectations, led by a drop in the services sector which offset an increase in manufacturing. However, survey details were fairly strong, especially in terms of job creation.In Germany, the survey points to robust private sector growth. The PMI index decreased,...

Read More »ECB preview: slower, longer, stronger

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September...

Read More »ECB hints at October decision on QE

In spite of euro strength, a decision on tapering QE will likely come in October. We believe a reduction in monthly asset purchases could commence in H1 2018.The ECB left its assessment and communication broadly unchanged at its meeting on 7 September. Draghi confirmed that “the bulk of the decisions” on QE extension should be made at the 26 October meeting.The statement mentioned recent currency volatility as “a source of uncertainty” to be monitored in the future, and the staff...

Read More »Slow-motion exit from QE

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org