© Bekirugur Bekir Ugur | Dreamstime.com In October 2021, Switzerland’s government created a law requiring online streaming services to pay money into a Swiss cinema fund. Under the law, from 2024, streaming services such as Netflix and Disney+ will need to pay a levy equivalent to 4% of their Swiss turnover into the fund, which would be spent on producing Swiss films. A group of young politicians objecting to the 4% surcharge on streaming services decided to organise...

Read More »The Cult of Speculation Is a Cult of Doom

Surely the Fed gods will affirm the cult’s most revered articles of faith. But false gods eventually fail, even the Fed. Every once in awhile the zeitgeist sets up an either / or: either the zeitgeist is crazy or I’m crazy. (OK, let’s agree I’m crazy; see, it’s not that hard to find something to agree on, is it?) What strikes me as crazy is the global Cult of Speculation which has recruited virtually the entire human populace in a bizarre cult in which speculating...

Read More »It’s Time to Break Up New York State

Neil Sedaka said it best – “breaking up is hard to do”. Ask any 16-year-old and they’ll tell you that’s certainly true, but Rep. Marjorie Taylor Greene (R-GA) recently made headlines when she suggested not just a breakup, but a “National Divorce” on social media. Of course, there was the typical incoherent shrieking and pearl clutching from progressives, neoconservatives, and other lizard-people, but there was also general acknowledgement from many regular folks that...

Read More »Krypto-Miner in Russland wegen Diebstahls von Energie verurteilt

Ein Regionalgericht hat einen Mann, der beschuldigt wurde, seine Kryptofarm illegal an das Stromnetz angeschlossen zu haben, zu zwei Jahren Gefängnis verurteilt. Die Entscheidung kommt zu einem Zeitpunkt, an dem sich die Behörden in Moskau darauf vorbereiten, den Mangel an angemessenen Vorschriften für das Mining von Kryptowährungen zu beheben, das in Russland zu einer beliebten Einnahmequelle geworden ist. Das Stadtgericht in Syktyvkar, der Hauptstadt der...

Read More »Singapur: Krypto-Geldautomaten wegen Zentralbank außer Betrieb

Wegen einer neuen Richtlinie der Monetary Authority of Singapore (MAS), der Zentralbank des Stadtstaates, wurden sämtliche Kryptowährungs-Geldautomaten außer Betrieb gesetzt. Singapurs größter Betreiber von Kryptowährungs-Geldautomaten, Daenerys & Co., teilte Bloomberg am Dienstag mit, dass er seine Dienste eingestellt hat, um der Aufforderung der MAS nachzukommen, und fügte hinzu: “Die neuen Richtlinien der MAS für Geldautomaten waren eine unerwartete...

Read More »Weekly Market Pulse: Fear Makes A Comeback

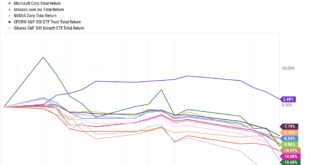

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

Read More »The Federal Reserve Keeps Buying Mortgages

The Federal Reserve now owns $2.6 trillion in mortgages. That means about 24 percent of all outstanding residential mortgages in this whole big country reside in the central bank. Original Article: “The Federal Reserve Keeps Buying Mortgages” Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and...

Read More »The Swiss banker managing Senegal’s first private bank

Olivier Santi, managing director of Dakar’s Outarde Bank, says there is no doubt that Swiss experience is a “label of quality” within the banking world. ©SWI/Pauline Turuban After working in finance in Geneva for 15 years, Olivier Santi emigrated to Dakar in 2017 to head a new bank founded by one of Senegal’s richest businessmen. His career to date demonstrates both the central role Switzerland plays in the finance and raw materials sectors, and the vitality of West...

Read More »Oklahoma to Consider Holding Gold and Silver, Removing Income Taxes

(Oklahoma City, Oklahoma — January 20, 2022) – An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver. Introduced by Rep. Sean Roberts, HB 3681 would include physical gold and silver, owned directly, to the list of permissible investments that the State Treasurer can hold. Currently, Oklahoma money managers are largely...

Read More »Coinbase geht Partnerschaft mit Mastercard für NFT Marktplatz ein

Es scheint schließlich der NFT Marktplatz zu werden, der die Mass Adoption auf ein neues Niveau hebt. Seitdem traditionelle Unternehmen erkannt haben, dass es mit NFTs viel Geld zu verdienen gibt, können sie nicht schnell genug ihre eigenen Crypto-Projekte starten. Nun hat auch Mastercard seinen Einstieg angekündigt. Crypto News: Coinbase geht Partnerschaft mit Mastercard für NFT Marktplatz ein Für sein eigenes NFT-Projekt hat Mastercard eine Partnerschaft mit der...

Read More » SNB & CHF

SNB & CHF