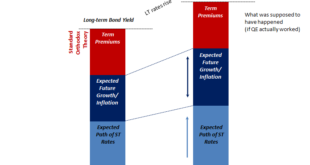

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission. Rates have gone up, he reasoned reasonably, therefore it would seem to follow how the market must be shifting expectations toward the more optimistic...

Read More »Germany’s New Green Stimulus Plan Won’t Fix the Economy

Recently, there has been a debate in Germany on the constitutionality of additional government borrowing of €60 billion. The borrowing is debated because Germany has a constitutional debt brake. The debt brake limits the possibility of the government to indebt itself and pushes it toward a balanced budget in normal times. In times of emergency, however, the debt brake allows for exceptions and higher deficits to fight the emergency. Unsurprisingly, huge amounts of...

Read More »Visa: Eines von vier Unternehmen will Zahlungen in Kryptowährungen akzeptieren

Die Akzeptanz von Kryptowährungen im Geschäftsleben nimmt zu. Dies zeigt eine Umfrage des Zahlungsdienstleisters Visa. Der Zahlungsriese Visa hat eine Umfrage unter kleinen Unternehmen durchgeführt und festgestellt, dass fast ein Viertel der Befragten plant, in diesem Jahr Zahlungen in Kryptowährungen zu akzeptieren. “Ich denke, dass mehr Menschen mehr Vertrauen in Kryptowährungen haben”, sagte ein Visa-Manager. Visa hat am Mittwoch eine Studie über digitale...

Read More »China’s Real Estate Poses Risk to the World

It’s no secret inflation is ravaging through the world. In fact, the CPI likely rose 0.6% last month, probably the fastest rate of increase in three decades. Consumers are feeling the surge pricing in everything: gas, airfare, hotels, used and new cars, and food. The dovish Fed will begin to taper bond purchases later this month and warns that China’s real estate problems could spell trouble for the entire world—and not just the U.S. economy. Jeffrey Snider, head of global...

Read More »Keith Weiner, CEO of Monetary Metals, Will Pay You to Store Gold

Check out https://monetary-metals.com/ and get paid to store gold! Get a two-week free trial of my precious metals newsletter The End Game Investor: https://seekingalpha.com/author/austrolib/research Join my Patreon for exclusive content, including the research I'm doing for a libertarian commentary on the Torah, "Liberty on the Tablets" drawn from medieval sources. https://www.patreon.com/endgameinvestor Follow me on Twitter @RafiFarber Folllow me on Gettr @Endgameinvestor...

Read More »Pakistans Zentralbank beschließt vollständiges Verbot von Kryptowährungen

Die State Bank of Pakistan (SBP), die Zentralbank des Landes, hat Berichten zufolge beschlossen, die Verwendung aller Kryptowährungen innerhalb des Landes zu verbieten. Die Zentralbank hat außerdem das Oberste Gericht von Sindh gebeten, den “nicht genehmigten Betrieb” von Krypto-Börsen zu verbieten und Strafen gegen sie zu verhängen. Ein hochrangiges interministerielles Komitee, das Empfehlungen zu der Frage abgeben soll, ob irgendeine Form von Kryptowährung nach...

Read More »Crisis-Filled Lives

No one can deny that we Americans live crisis-filled lives. Right now, there is a major crisis in Ukraine with Russia. There is also an ongoing crisis with China. Other foreign-policy crises, such as with Iran, Yemen, Afghanistan, Cuba, Iraq, and North Korea. There is a terrorism crisis. Healthcare crisis. Social Security crisis. Drug-war crisis. Immigration crisis. Debt crisis. Inflation crisis. Fiscal crisis. Monetary crisis. There is a common denominator to all...

Read More »Pandemic drives Swiss Post parcel deliveries

All-time record for Swiss Post: it processed more than 200 million parcels last year. Keystone/Laurent Gillieron The state-owned Swiss Post processed a record number of parcels last year, but the downward letter mail continued. Parcel deliveries increased by 9.6% to 202 million in 2021, according to the state-owned company. “This rise is due to the boom in online retail, which has been driven in part by Covid restrictions and working from home,” it said on Tuesday....

Read More »Is the luxury watch market facing a democratic revolution?

Game changer? Baillod’s tourbillon watch has already made waves in the watch community Baillod Entrepreneur Thomas Baillod has just launched a “Swiss Made” tourbillon watch for under CHF5,000 ($5,450), a marketing coup which shows that mid-range watches still have a place in a watch industry increasingly focused on ultra-luxury. Patented in 1801 by Abraham-Louis Breguet, the tourbillon still fascinates lovers of fine mechanical watchmaking. The mechanism, a small...

Read More »Thailand: Opposition gegen den Regierungsplan zur Besteuerung von Kryptogewinnen

Während Thailand sich darauf vorbereitet, eine Abgabe auf Kryptogewinne zu erheben, haben mehrere Parteien Bedenken über den aktuellen Vorschlag der Regierung geäußert. Eine Reihe von politischen Persönlichkeiten haben darauf bestanden, dass wichtige Aspekte geklärt werden müssen, um eine Doppelbesteuerung von Einkommen im Zusammenhang mit Kryptowährungen zu vermeiden. Vertreter von Parteien aus verschiedenen Ecken des politischen Spektrums in Thailand haben ihre...

Read More » SNB & CHF

SNB & CHF