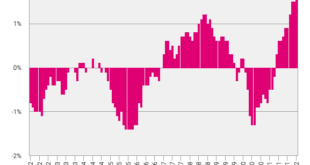

Swiss consumer price inflation increased in January, data from the Federal Statistical Office showed on Friday. Consumer prices rose 1.6 percent in January, following a 1.5 percent increase each in December and November. Economists had forecast inflation to remain unchanged at 1.5 percent. On a monthly basis, consumer prices grew 0.2 percent in January, after a 0.1 percent fall in the previous month. Prices for hotel accommodation and second-hand cars increased in...

Read More »Money and Savings Are Not the Same Thing

In the National Income and Product Accounts (NIPA), savings are established as the difference between disposable money income and monetary outlays. Disposable income is defined as the summation of all personal money income less tax payments to the government. Personal income includes wages and salaries, transfer payments, income from interest and dividends, and rental income. The NIPA framework is based on the Keynesian view that spending by one individual becomes...

Read More »Bitcoin-Spenden an Freedom Convoy auf Blacklist

In Kanada hat Premiere Minister Trudeau eine Art Notfallsituation im Zusammenhang mit Trucker-Protesten ausgerufen. Diese Maßnahme erlaubt es der Regierung Bankkonten ohne Gerichtsbeschluss zu beschlagnahmen. Doch wie versucht die kanadische Regierung an die Bitcoin-Spenden an die Trucker des Freedom Convoys zu kommen? Bitcoin News: Bitcoin-Spenden an Freedom Convoy auf Blacklist Ohne die Keys für Bitcoin-Wallets, kommt die Regierung zwar nicht an die gespendeten...

Read More »Glencore sets aside $1.5bn to settle UK, US and Brazil probes

Glencore says that the market is deteriorating for lead smelters with no active mine. (Image of Sudbury nickel smelter.) Courtesy of Glencore. Glencore expects to resolve bribery and corruption investigations in the UK, US and Brazil this year and has set aside $1.5 billion (CHF1.4 billion) to cover potential fines and costs. Neil Hume, Financial Times News of the provision came as the London-listed miner and commodity trader announced record earnings on the...

Read More »Switzerland and the EU: close, but not too close

The European Union assumed that Switzerland would one day join the club. But, if anything, the Alpine country in the heart of Europe is moving further and further away. It has no intention of joining. The EU considers Switzerland a troublesome country. In 1992 it said no to the European Economic Area. In 2021 it unilaterally broke off negotiations on a framework agreement with the EU. It says “Yes, gladly!” to economic cooperation, but “No, thanks!” to more political...

Read More »Financial Times says Fed is central – We Disagree [Eurodollar University, Ep. 186]

Journalists Kate Duguid and Eric Platt explain that US government bond markets believe the Federal Reserve will be able to tame inflation. Actually bond markets believe the Fed doesn't know what it's doing AND they believe consumer prices increases are not caused by the Fed. ------EP. 186 TOPICS------ 00:00 INTRO: The Financial Times says the Federal Reserve will control inflation; Jeff reacts. 01:25 The Federal Reserve will use the labor market data to support rate hikes. 04:24 Are...

Read More »Swiss women in space

Far more men have been to space than women. The European Space Agency is recruiting and would be happy to hire females. To be considered, you need a master’s degree in a STEM subject (science, technology, engineering and mathematics), a medicine degree or a pilot’s license. The problem is that many girls in school consider STEM subjects to be a male domain. One Swiss woman who may have the right stuff is Deborah Müller, an engineer and manager at the space company RUAG. She...

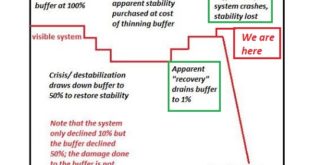

Read More »How Empires Die

When the state / empire loses the ability to recognize and solve core problems of security and fairness, it will be replaced by another arrangement that is more adaptable and adept at solving problems. From a systems perspective, nation-states and empires arise when they are superior solutions to security compared to whatever arrangement they replace: feudalism, warlords, tribal confederations, etc. States and empires fail when they are no longer the solution, they...

Read More »Outlook on Gold 2022

Last week we published our Gold Outlook 2022 Report, our annual analysis of the gold and silver markets from CEO Keith Weiner. In it, Keith explains the market players, dynamics, fallacies, and drivers for gold and silver. The report also includes analysis of Bitcoin and its effect on the gold market as well as inflation, interest rates and other macroeconomic factors. Last but not least, we give our price predictions for gold and silver for the year. In this week’s episode of the...

Read More »Ep 27- Entrepreneurship and Regulation with Per Bylund

CEO of Monetary Metals Keith Weiner interviews Professor of Entrepreneurship at Oklahoma State University Per Bylund on regulation, entrepreneurship and more. Dr. Bylund has published research in top journals on both entrepreneurship and management. He has also published in the Quarterly Journal of Austrian Economics and the Review of Austrian Economics. He has founded four business startups and writes a monthly column for Entrepreneur magazine. Per and Keith discuss:...

Read More » SNB & CHF

SNB & CHF