European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills. According to Bank of America, European household gas bills are expected to rise to €1,850 in 2022 from €1,200 in 2020 (an ~55% increase). Natural gas prices have pulled back from the December peak. However, it remained high and it could get worse over the remainder of the winter months....

Read More »The discreet charm of antiquarian booksellers

Thomas Kern/swissinfo.ch Despite the demise of many antiquarian bookshops in Switzerland, the trade is alive and well in the Alpine country. Dealers in Geneva, Basel and Zurich give a glimpse into this exclusive business, where a gentleman’s code still rules. Thomas Kern was born in Switzerland in 1965. Trained as a photographer in Zürich, he started working as a photojournalist in 1989. He was a founder of the Swiss photographers agency Lookat Photos in 1990....

Read More »The Fed, Inflation, & Bond Yields | Jeffrey Snider ICW Rajeev Suri

The new year has gotten off to a start, with stocks yo-yoing and moves in the bond market causing a flutter. With the US inflation hitting 7%, the highest in 40 years, and the Fed clearly tightening to a hawkish stance, what does 2022 hold for the investor and how should they be positioned? In this edition, Rajeev Suri, partner at Orios, speaks with Jeff Snider of Alhambra Investments, one of the most well-regarded deflationists. This conversation touches on what the bond markets are...

Read More »Pro-Sound Money Lawmaker Wants To End Income Taxes on Gold and Silver in Oklahoma

(Oklahoma City, Oklahoma, USA – January 20, 2022) – Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions. Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver. Arizona, Utah, and Wyoming have enacted similar measures into law. Idaho has considered this measure recently and a...

Read More »Swiss firms rank low in European ‘Gender Diversity Index’

Philomena Colatrella has been the chief executive officer of CSS Insurance since 2016. Switzerland has the second-lowest score for female CEOs, the study found. Fabian Biasio The proportion of women in leading positions at major European companies rose slightly last year but progress is slow, according to a new study that compares 19 countries. Switzerland was ranked near the bottom of the 2021 “Gender Diversity Index”. Female representation at board level in...

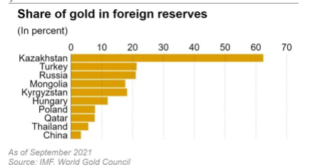

Read More »Central Banks’ record gold stockpiling

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related...

Read More »Swiss ‘Unicorn’ Banking App Reincarnates as Bitcoin Vault

Swiss fintech company Numbrs has blamed jealous banks for killing off its original business model as a third-party provider of financial products. So it has reinvented itself under the banner of the ultimate bank killer – bitcoin. The company, fêted as a rare Swiss fintech unicorn (worth at least CHF1 billion), has just announced it has transformed into a bitcoin storage vault. This is quite a startling strategic shift. More than two million people (mainly in...

Read More »Stop Trying to Turn Economics into a Branch of Psychology

Recently, a relatively new economics called behavioral economics (BE) has started to gain popularity. Its practitioners, such as Daniel Kahneman, Vernon Smith, and Richard Thaler, were awarded Nobel Prizes for their contribution in the field of BE. The BE framework emerged because of dissatisfaction with the neoclassical theory regarding consumer choices. In the neoclassical theory, individuals are presented as if a scale of preferences is hard-wired in their heads....

Read More »Will 2022 Be “The Year of Sound Money” in the States?

Last year was a good year for state-level sound money legislation across the United States. 2022 could be even better. Building on the success enjoyed by sound money advocates in Arkansas and Ohio last year, more than a half dozen states are now considering legislation that rolls back discriminatory taxes and regulations on the sale, use, and purchase of gold and silver. More States Are Removing Sales Taxes on Gold & Silver To date, 42 states have removed some or...

Read More »Tonga könnte Bitcoin als gesetzliches Zahlungsmittel einführen

Das Königreich Tonga könnte Bitcoin als gesetzliches Zahlungsmittel einführen, so ein ehemaliges Mitglied des tongaischen Parlaments, Lord Fusitu’a, der in einem Tweet einen möglichen Zeitplan für dieses Ereignis nannte. Lord Fusitu’a, der Vorsitzende der Commonwealth Pacific Parliamentary Group on Human Rights in Tonga, ist ein Befürworter von Bitcoin und erklärte am 11. Januar auf Twitter, dass die Regierung des Königreichs Tonga Bitcoin als gesetzliches...

Read More » SNB & CHF

SNB & CHF