The Swiss central bank says it is to enhance flexibility in steering money market interest rates This will be added to the SNB’s monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory. The full...

Read More »In 2020, the median wage was CHF 6665

28.03.2022 – For the entire Swiss economy (private and public sectors together), the gross monthly median wage for a full-time job was CHF 6665 in 2020. The gap between the highest and lowest earners in the wage pyramid remained stable overall between 2008 and 2020. The Swiss wage landscape continues to be characterised by major differences between the economic sectors and regions. More than a third of employees (36.3%) received bonuses and one in ten people...

Read More »Can Russia Evade Sanctions via the Gold or Bitcoin Trades?

Can Russia Evade Sanctions via the Gold and Bitcoin Trades? [embedded content] [embedded content] You Might Also Like Gold Price Today – Gareth Soloway 2022-03-24 Dave Russell of GoldCore TV welcomes back Gareth Soloway of InTheMoneyStocks.com where we ask if the bull market for stocks is back and if $2,500 on gold is still on the cards for 2022? The Fed Has No Idea...

Read More »Central Banks Have Broken the True Savings-Lending Relationship

Most people believe lending is associated with money. But there is more to lending. A lender lends savings to a borrower as opposed to “just money.” Let us explain. Take a farmer, Joe, who has produced two kilograms of potatoes. For his own consumption, he requires one kilogram, and the rest he agrees to lend for one year to another farmer, Bob. The unconsumed kilogram of potatoes that he agrees to lend is his savings. By lending a kilogram of potatoes to Bob, Joe...

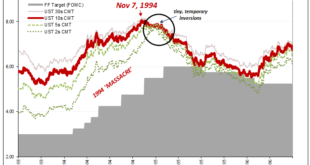

Read More »We Can Only Hope For Another (bond) Massacre

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them. I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995. Fearing inflation (the only time in its history, including much of the Great Depression, the Fed didn’t fear inflation...

Read More »Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe’s Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias. The US 10-year yield is up a few basis points to 2.50%,...

Read More »A Review of Nik Bhatia’s Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies

For understanding our modern monetary troubles, Nik Bhatia’s pamphlet-sized book from last year hits exactly the right intersection between money and banking, between the past and the future. Clocking in at around 150 pages of easy prose, it’s accessible but not dumbed down, revealing but not inaccurate. It has a simple framework that Bhatia explains and explores with great expertise. As an introduction to what bitcoin is as a monetary technology, Layered Money: From...

Read More »The birth of modern democracy in the heart of Europe

The "Swiss Revolution" brought democracy to Switzerland. It was an uprising against the aristocracy – and the beginning of a long journey that the country could only complete with foreign help. On a spring day in 1798, Peter Ochs of Basel declared the birth of the Helvetic Republic from a balcony of the Aarau city hall. There was great rejoicing on the streets because this marked the liberation of the central territories from their Bernese masters. Two democratic...

Read More »Most Swiss would support tougher sanctions against Russia

A new poll shows that a majority of the Swiss population would be in favour of tougher sanctions against Russia for invading Ukraine, even if it results in higher energy costs in Switzerland. The poll published on Monday by the Institute Link found that 57% of people surveyed would support the freezing of all assets held in Switzerland by high-ranking Russian officials and government allies. Those questioned would also support de-linking Russian banks from the Swiss...

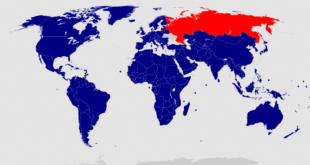

Read More »Russia Isn’t Nearly as Isolated as Washington Wants You to Believe

Those gloating about Russia being “cut off” are overstating the case. In fact, many of the world’s largest countries have shown a reluctance to participate in the US’s sanction schemes, and even close US allies aren’t going along with it. Original Article: Some US policymakers and pundits are declaring that Russia—and its population—are cut off from the rest of the world. For example, political scientist Nina Khrushcheva has declared “Russia is hated by the...

Read More » SNB & CHF

SNB & CHF