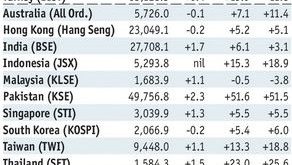

Stock Markets EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling. Markets ignored reports that the PBOC has asked banks...

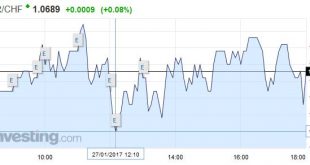

Read More »FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

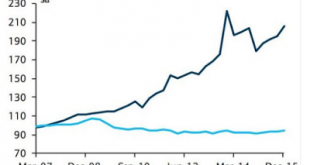

Swiss Franc Currency Index The Swiss Franc index has a solid performance of 2.5% in the last month, while the dollar index is down nearly 3%. Trade-weighted index Swiss Franc, January 28(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three...

Read More »Great Graphic: Mexico and China Unit Labor Costs

Summary: Mexico has been gaining competitiveness over China before last year’s depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest. This Great Graphic was posted by David Merkel on his AlephBlog with a hat tip to Sober Look. It looks at the...

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Those over 25 may pay more for Swiss health insurance

© Shannon Fagan | Dreamstime.com 20 Minutes. The Swiss States Council commission on public health endorsed a plan that could lead to higher health insurance premiums for those over 25. Swiss health insurance providers are required to pay into a communal pot to spread risk between insurance companies. The latest plan would reduce the amounts paid into this communal pot for every insured individual between 19 and 25 by...

Read More »The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

Summary: The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker. The rise of the populist-nationalism over the past year or so is partly predicated on a realist view of international relations. ...

Read More »Emerging Markets: What has Changed

Summary Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative. Mexican announced another hike in...

Read More »With Trump Optimism of Small Business Soars

Pledges for Trump “You boys know what makes this bird go up? Funding makes this bird go up. That’s right. No bucks, no Buck Rogers.” – Gordon Cooper and Gus Grissom, The Right Stuff (film) Things are looking up for the United States economy in 2017. You can just feel it. Something great is about to happen. Sam Sheppard in “The Right Stuff” – a 1983 docudrama about the Mercury 7 program and “the...

Read More »FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

Swiss Franc EUR/CHF - Euro Swiss Franc , January 27(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Sterling Swiss Franc Exchange Rate Update Sterling vs the Swiss Franc has been going in an upwards direction this week after the Brexit verdict released on Tuesday morning. Initially this caused the Pound to fall vs the Swiss Franc but since then Sterling has continued to go upwards. Later today UK Prime...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More » SNB & CHF

SNB & CHF