There seems to be a broad consensus on the trajectory of policy in the remaining weeks of the year. Barring a major shock or surprise the Federal Reserve will hike rates next month. The ECB’s course is set until at least the middle of next year when the current policy will begin to be debated in earnest. The BOJ’s Kuroda has made it clear that the BOJ will continue to pursue Quantitative and Qualitative Easing (QQE) and...

Read More »04 08 15 – MACRO ANALYTICS – Nature of Work – w/ Charles Hugh Smith

Video Content Abstract at: LINK

Read More »03-23-13-Macro Analytics – Market Clearing Event – Charles Hugh Smith

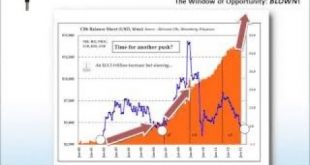

QUESTIONS ON THE TABLE 1- How Large can Central Bank's Balance Sheets actually get before too much is too much? 2- Is Public Debt Monetization A

Read More »One in five Swiss avoids visiting doctor due to costs

A doctor looks at an X-ray of a torso with her patient Just over 20% of Swiss residents decided not to see a doctor last year for medical treatment due to the high costs, according to a new report. This is one of the findings of the Health at a Glance 2017 report published by the Organisation for Economic Co-operation and Development (OECD) on Friday. The share of the population foregoing a doctor’s consultation due to...

Read More »Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

– Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China – Chinese investors bought price dips, notching up fourth consecutive quarter of growth– Jewellery, ETF demand fell while gold coins and bars saw increased demand – Central banks bought a robust 111t of gold bullion bars (+25% y-o-y) – Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand – Turkey increased gold...

Read More »Swiss tax spy avoids jail time as Frankfurt trial ends

Daniel M. (standing) at the trial. A Swiss man on trial in Frankfurt has been found guilty of spying on the tax authorities of the German state of North Rhine-Westphalia (NRW). ‘Daniel M.’ was handed a suspended sentence of 22 months and a fine of €40,000 (CHF46,600). The verdict brings to a premature end the twists and turns of a case that brought scrutiny on Swiss-German diplomatic relations since the arrest of the...

Read More »Heat Death of the Economic Universe

Big Crunch or Big Chill Physicists say that the universe is expanding. However, they hotly debate (OK, pun intended as a foreshadowing device) if the rate of expansion is sufficient to overcome gravity—called escape velocity. It may seem like an arcane topic, but the consequences are dire either way. If the rate of expansion is too low, then it will get slower and slower until expansion stops entirely, then finally,...

Read More »Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that...

Read More »12 14 13 – Macro Analytics – 2014 Themes w/ Charles Hugh Smith

sh429

Read More »07-13-13 Macro Analytics – Blown Opportunity – w/ Charles Hugh Smith

jchyz

Read More » SNB & CHF

SNB & CHF