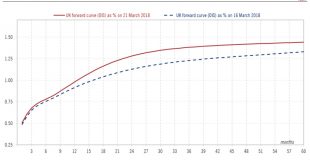

Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD....

Read More »British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD....

Read More »Europe chart of the week – monetary policy

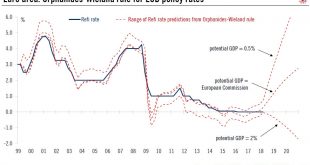

ECB ‘higher potential’ rhetoric comes with some difficulties.Much of recent ECB dovish rhetoric has been building around the (not-so-new) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.We...

Read More »Europe chart of the week – monetary policy

ECB ‘higher potential’ rhetoric comes with some difficulties.Much of recent ECB dovish rhetoric has been building around the (not-so-new) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.We...

Read More »Euro area Flash PMIs: “Growing pains” but no reason to panic

ECB policymakers can be expected to set aside a fall in the March euro area composite PMI index which was likely amplified by unusual circumstances.Euro area flash PMI indices fell sharply in March, below consensus expectations for the second month in a row. However, details were still largely consistent with a robust, broad-based economic expansion this year, if only at a slightly slower pace than last year. We forecast euro area GDP to expand by 2.3% in 2018.The correction in business...

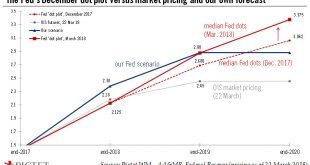

Read More »March Fed review – Mr. Middle Ground

In line with expectations, the Fed raised rates at its last meeting. Chair Powell was keen to underline his “middle ground” approach to normalising monetary policy. We still expect 3 additional rate hikes in 2018.On 21 March, the Federal Reserve hiked rates by one quarter point, as widely expected, nudging the interest rate on excess reserves (IOER) to 1.75%.Chair Jerome Powell’s press conference and the accompanying material – in particular the forecasts for future rate hikes (the ‘dots’) –...

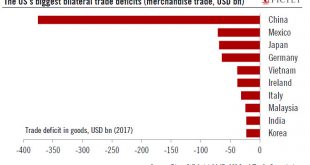

Read More »US trade policy update – Eyeing China

US trade policy's attention is now turning towards China, with a threat of new tariffs. But we see here a lot of political rhetoric.After the tariffs on steel and aluminium, the Trump Administration’s attention now seems to be focused on China as the US’s merchandise trade deficit with China rose to a new high of USD 375bn in 2017. The trade hawks close to Trump – Ross, Lighthizer and Navarro – seem to be having an increasing influence on Trump, and they seem eager to reach a new deal with...

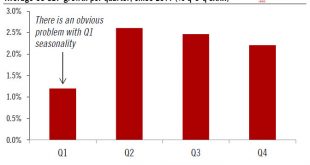

Read More »US Chart of the week – Statistical issues

Weak US Q1 GDP growth revives debate about seasonality issues, as solid macroeconomic signals suggest that growth will rebound sharply.Do US statisticians have a problem with seasonal adjustment? The question is likely to arise once again this year as Q1 GDP growth looks set to be on the weak side, despite most other macroeconomic signals – including solid employment growth – flashing green. The Atlanta Fed GDP tracker is now at 1.8%. That would mark a slowdown from 2.5% q-o-q SAAR in...

Read More »The role of cities in the global economy

The Executive Director of the UN Human Settlements Programme describes the reasons why more than half the world’s population has moved into cities and the challenges that need to be confronted to reap the benefits.For almost all of human history, people have lived in small towns, villages or the countryside. But the proportion of the world’s population living in cities has rapidly grown over the last two centuries, from 5 per cent in 1800, to 13 per cent in 1900 and 34 per cent by 1960. In...

Read More »Fed preview: all eyes on the ‘dot plot’

This week’s Fed meeting will likely to see a rise in Fed policy makers’ forecasts for 2018 growth and rates.The Federal Reserve meets on 20–21 March and is widely expected to hike rates by a quarter point (moving the interest rate on excess reserves up to 1.75%). This decision is ‘priced in’ at 100% according to Bloomberg data.The focus will be on signals for further tightening in the rest of the year, especially as there will be plenty of materials to consider (including a fresh ‘dot plot’...

Read More » Perspectives Pictet

Perspectives Pictet