Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD. The UK and the EU have reached an agreement on the terms of a 21-month transition deal after Brexit, which lifts the risk of a cliff-edge scenario in the coming months. The UK agreed to almost all the EU’s conditions, notably a full alignment of Northern Ireland with the EU regulatory framework until a

Topics:

Luc Luyet considers the following as important: Bank of England outlook, Brexit, GBP outlook, GBP-USD, Macroview

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.

The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD. The UK and the EU have reached an agreement on the terms of a 21-month transition deal after Brexit, which lifts the risk of a cliff-edge scenario in the coming months. The UK agreed to almost all the EU’s conditions, notably a full alignment of Northern Ireland with the EU regulatory framework until a definitive solution is found. The one notable EU concession was the authorisation it gave to the UK to negotiate trade agreements during the transition period. For sterling, this agreement removes short-term concerns on growth, allowing investors to focus on other drivers.

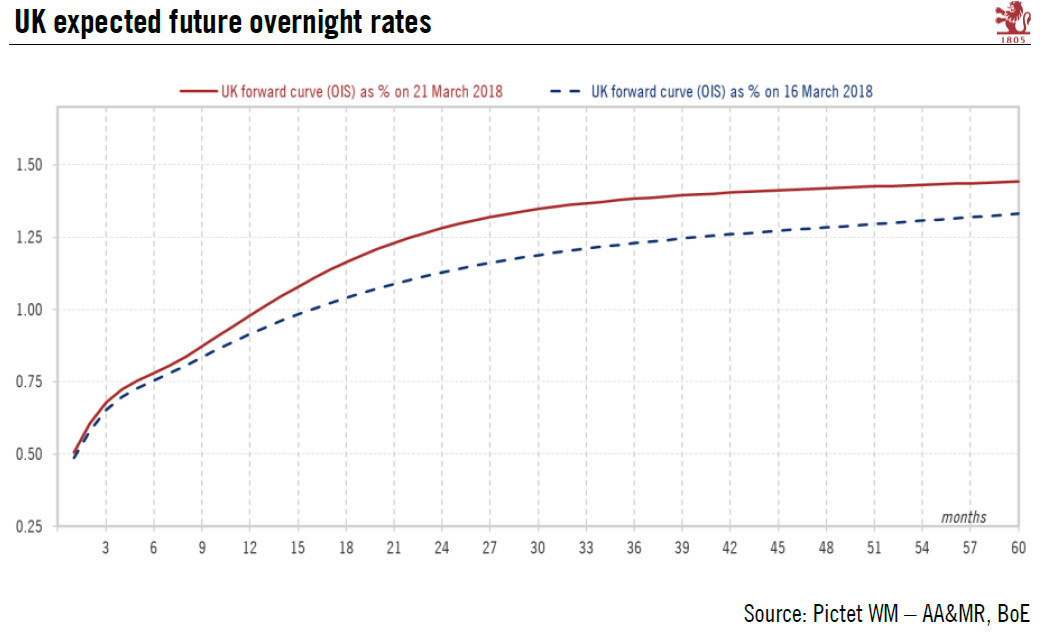

Sterling is likely to be further supported by a more hawkish Bank of England (BoE) in the short term. The January labour report, namely the rise in real wage growth, should make the BoE more comfortable with tightening monetary policy. Coupled with a rather neutral view on growth, the BoE is likely to raise rates twice more this year (in May and November). Given that sterling is quite sensitive to short-term rate differentials, and given the somewhat reduced Brexit, sterling should remain supported through the rest of 2018.

Overall, the key positive factors for sterling remain a more hawkish BoE and its undervaluation. But while the short-term outlook has improved for sterling, we remain rather cautious on the longer term. Political uncertainty should remain quite elevated. Moreover, sterling is somewhat expensive relative to the US dollar in terms of short-term rate differential. This should somewhat limit sterling’s upside potential given our scenario for a more hawkish Fed. Finally, UK growth should remain rather weak. Coupled with a negative basic balance, capital flows do not provide a compelling case for prolonged outperformance by sterling.