This week’s Fed meeting will likely to see a rise in Fed policy makers’ forecasts for 2018 growth and rates.The Federal Reserve meets on 20–21 March and is widely expected to hike rates by a quarter point (moving the interest rate on excess reserves up to 1.75%). This decision is ‘priced in’ at 100% according to Bloomberg data.The focus will be on signals for further tightening in the rest of the year, especially as there will be plenty of materials to consider (including a fresh ‘dot plot’ and economic projections, and Jerome Powell’s first post-meeting press conference as Chair). In a nutshell, we think the dots might be seen as becoming more hawkish. The press conference might add a more subtle dovish nuance to the otherwise hawkish dots and economic projections. Overall, the risks are

Topics:

Thomas Costerg considers the following as important: Fed dots, Fed meeting, Fed outlook, Fed preview, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

This week’s Fed meeting will likely to see a rise in Fed policy makers’ forecasts for 2018 growth and rates.

The Federal Reserve meets on 20–21 March and is widely expected to hike rates by a quarter point (moving the interest rate on excess reserves up to 1.75%). This decision is ‘priced in’ at 100% according to Bloomberg data.

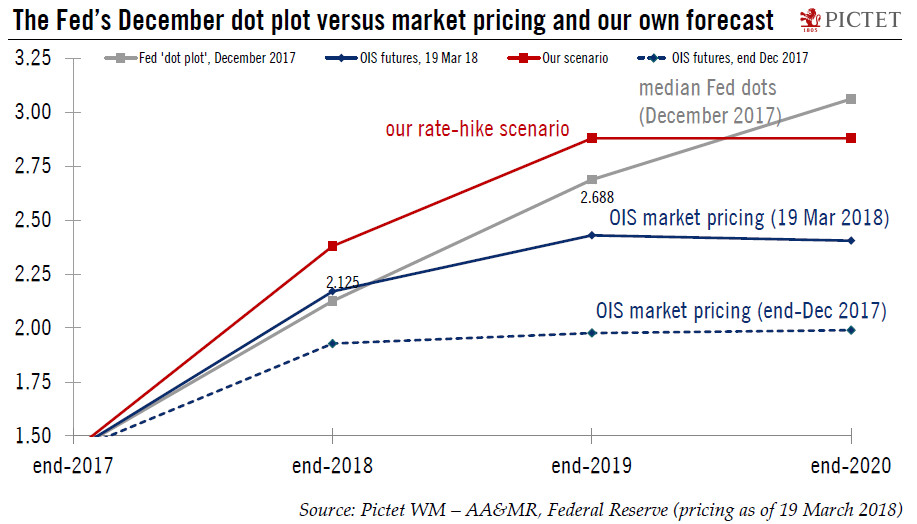

The focus will be on signals for further tightening in the rest of the year, especially as there will be plenty of materials to consider (including a fresh ‘dot plot’ and economic projections, and Jerome Powell’s first post-meeting press conference as Chair). In a nutshell, we think the dots might be seen as becoming more hawkish. The press conference might add a more subtle dovish nuance to the otherwise hawkish dots and economic projections. Overall, the risks are still that the meeting is slightly hawkish, especially as we think the Fed will signal that the bar to change the now-engrained routine of one rate hike per quarter is high.

In particular, Chair Powell is unlikely to worry too much about recent trade actions from the Trump Administration, in our view, and he is likely to try to avoid addressing this (very sensitive) theme. Meanwhile, the Fed is unlikely to be anxious after recent disappointing ‘hard data’ in January-February; rather, it is likely to retain a confident outlook due to strong employment data, and the ongoing strength in business and consumer surveys.

Our view remains that the Fed will hike rates four times this year and twice more next year. This is more than the market is currently pricing in.