After years of low interest rates, investors need to prepare for a rise in the cost of credit. Since the financial crisis, investors have benefitted from rising bond price, while companies have seen their funding costs decline to the lowest point in decades. But with central banks scaling back their support in response to good economic growth, the years ahead will be very different. Investors need to prepare for a rise in the cost of debt, says Global Strategist Alexandre Tavazzi....

Read More »What happens when rates rise?

[embedded content] Since the financial crisis, investors have benefitted from rising bond price, while companies have seen their funding costs decline to the lowest point in decades. But with central banks scaling back their support in response to good economic growth, the years ahead will be very different. Investors need to prepare for a rise in the cost of debt, says Global Strategist Alexandre Tavazzi.

Read More »Financial Accounting &Reporting Group 6

Latest data point to moderate deceleration in Chinese growth

Early 2018 data releases are general upbeat, but some details indicate that growth momentum could slow.The first batch of 2018 Chinese data on investment and industrial production came in stronger than expected. However, details of the data suggest that actual growth momentum may not be as strong as the numbers indicate.Property investment rebounded to 9.9% y-o-y in the first two months of 2018 from 7.0% in 2017, while investment in the manufacturing sector and infrastructure moderated...

Read More »Japan: Land-sale scandal comes back to haunt prime minister

Were Shinzo Abe forced to resign, the impact on monetary and fiscal policy would be limited, in our view, but there is a moderate downside risk for growth and financial markets.A land-sale scandal that first emerged last year involving Japanese Prime Minister Shinzo Abe and his wife is back in the spotlight. Although it is still premature to tell if the scandal will end Abe’s tenure, the probability has risen notably If more evidence emerges in this scandal, it’s not inconceivable that Abe...

Read More »Europe chart of the week – Employment

Average number of hours worked per employee suggests there is still slack in the euro area job market.Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level.The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total...

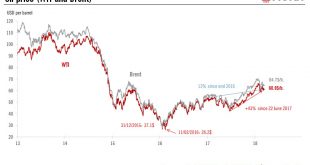

Read More »Limited upside potential for oil

The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on...

Read More »Too early for Switzerland’s central bank to change policy…

…but it could start tightening at the end of this yearAt its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.Importantly, the central...

Read More »US consumption update – Getting stingy

Retail sales posted their third consecutive monthly decline in February, but there is no need to worry, for now.The US consumer has shown surprising stinginess lately. Soft February retail sales data continue the uneven pattern of consumption data since the beginning of the year. On a y-o-y basis (and nominal terms) they were up only 4.0% in February, below the 1-year average of 4.4%.This soft consumption data is even more surprising as all consumption signals are flashing green for the US...

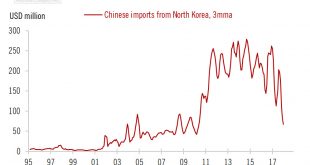

Read More »A surprising turn of events in North Korea

Huge uncertainties hang over the proposed summit between the US and North Korea leaders.The South Korean national security director announced that the US President Donald Trump had accepted an offer of a meeting from Kim Jong Un, the leader of North Korea before May. While it has long been our view that a military conflict between the US and North Korea is relatively improbable, the announcement still came as a surprise.The proposed summit is definitely a big step in the right direction that...

Read More » Perspectives Pictet

Perspectives Pictet