ECB policymakers can be expected to set aside a fall in the March euro area composite PMI index which was likely amplified by unusual circumstances.Euro area flash PMI indices fell sharply in March, below consensus expectations for the second month in a row. However, details were still largely consistent with a robust, broad-based economic expansion this year, if only at a slightly slower pace than last year. We forecast euro area GDP to expand by 2.3% in 2018.The correction in business sentiment, from very high levels, was largely driven by the manufacturing sector and could reflect global trade concerns to some extent. However, some special factors appear to have amplified the drop, including large swings in inventories and supply chain delays, especially in Germany.The correction in

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

ECB policymakers can be expected to set aside a fall in the March euro area composite PMI index which was likely amplified by unusual circumstances.

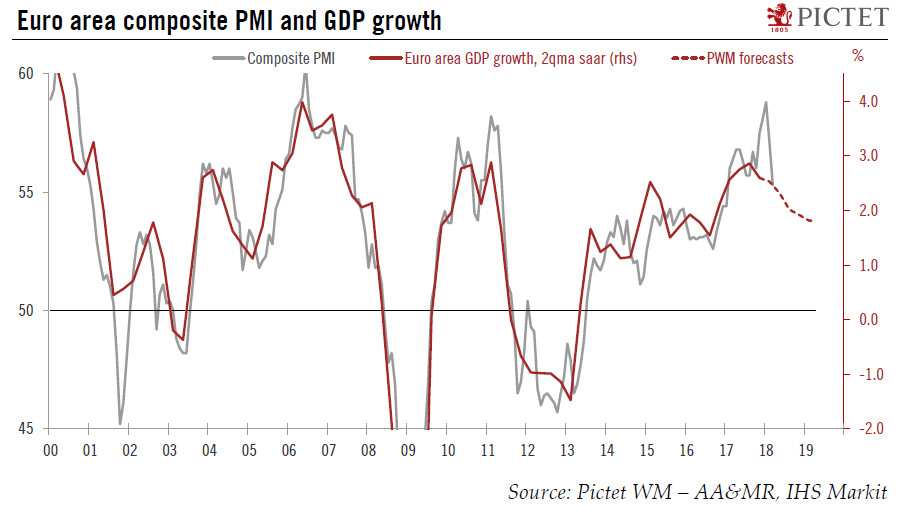

Euro area flash PMI indices fell sharply in March, below consensus expectations for the second month in a row. However, details were still largely consistent with a robust, broad-based economic expansion this year, if only at a slightly slower pace than last year. We forecast euro area GDP to expand by 2.3% in 2018.

The correction in business sentiment, from very high levels, was largely driven by the manufacturing sector and could reflect global trade concerns to some extent. However, some special factors appear to have amplified the drop, including large swings in inventories and supply chain delays, especially in Germany.

The correction in euro area business surveys in Q1 may well fuel additional ECB dovishness in the near term, but not to the point where the upcoming policy normalisation can be challenged, in our view.