US trade policy's attention is now turning towards China, with a threat of new tariffs. But we see here a lot of political rhetoric.After the tariffs on steel and aluminium, the Trump Administration’s attention now seems to be focused on China as the US’s merchandise trade deficit with China rose to a new high of USD 375bn in 2017. The trade hawks close to Trump – Ross, Lighthizer and Navarro – seem to be having an increasing influence on Trump, and they seem eager to reach a new deal with China.According to media reports, there is an ongoing threat of USD 60bn of trade tariffs that could be applied on imports from China as the US believes that China is not playing by the rules of global trade, and is distorting fair competition – particularly with regard to intellectual property (IP).

Topics:

Thomas Costerg and Dong Chen considers the following as important: Chinese imports, Macroview, Trump trade tariffs, us china trade, US protectionism, US trade policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US trade policy's attention is now turning towards China, with a threat of new tariffs. But we see here a lot of political rhetoric.

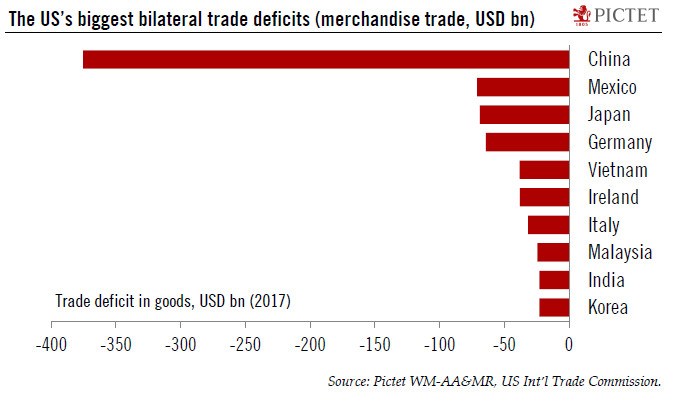

After the tariffs on steel and aluminium, the Trump Administration’s attention now seems to be focused on China as the US’s merchandise trade deficit with China rose to a new high of USD 375bn in 2017. The trade hawks close to Trump – Ross, Lighthizer and Navarro – seem to be having an increasing influence on Trump, and they seem eager to reach a new deal with China.

According to media reports, there is an ongoing threat of USD 60bn of trade tariffs that could be applied on imports from China as the US believes that China is not playing by the rules of global trade, and is distorting fair competition – particularly with regard to intellectual property (IP). However, there have also been more cooperative messages: Chinese authorities have reportedly been asked to help craft a plan to reduce the bilateral deficit by USD 100bn.

Our relatively bullish US growth scenario (in which we expect 3% economic growth this year, up from 2.3% last year) is based on the Trump Administration’s pro-growth, pro-business policies, including the December tax cuts. The recent turn of events on trade reveals the inconsistency in Trump’s policies, however: more trade protection is by definition anti-business.

Our central scenario sees trade threats staying at the rhetorical level – they might just be for domestic political purposes ahead of the mid-term elections. But a further escalation in rhetoric and Trump implementing more protectionist trade policies would lead us to shift towards our alternative, downside growth scenario.