The influence of the oil price on financial markets has grown in importance recently. The dampening effect of low oil prices on import prices makes the work of central bank work more difficult as they are already struggling to bring back low inflation closer to their targets. The fall in the oil price has increased concerns about deflation and exacerbated investors’ sentiment that monetary authorities are running out of effective tools to reflate economies. We have argued in the past few weeks that a recovery in oil prices could be one of three factors to drive a sustained equity market rally. Looking at the fundamentals can give a glimpse into what might be the future for oil prices over a 12-month horizon. Current crude oil over-supply is acting as a dampener on the pace of recovery in oil prices. The International Energy Agency (IEA) expects that the mismatch between supply and demand will not be absorbed until 2017. The long-term relationship between the oil price, the US dollar and world economic activity can also help us to guess how the future of oil prices might pan out. Indeed, the rising oil price in the 2000s and its recent fall is largely attributable to this relationship. Current low oil prices are to a large extent justified by the long-term relationship. Over a 12-month horizon, however, if world real GDP grows as expected (3.

Topics:

Jean-Pierre Durante and Zlatan Plakalo considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The influence of the oil price on financial markets has grown in importance recently. The dampening effect of low oil prices on import prices makes the work of central bank work more difficult as they are already struggling to bring back low inflation closer to their targets.

The fall in the oil price has increased concerns about deflation and exacerbated investors’ sentiment that monetary authorities are running out of effective tools to reflate economies.

We have argued in the past few weeks that a recovery in oil prices could be one of three factors to drive a sustained equity market rally.

Looking at the fundamentals can give a glimpse into what might be the future for oil prices over a 12-month horizon.

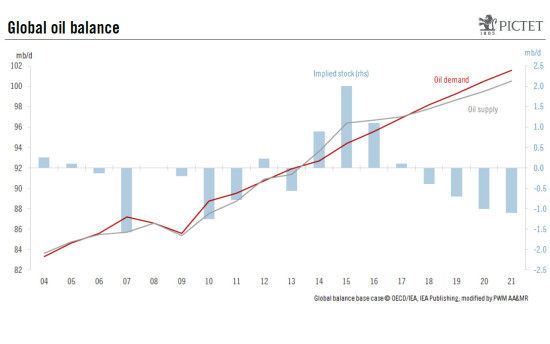

Current crude oil over-supply is acting as a dampener on the pace of recovery in oil prices. The International Energy Agency (IEA) expects that the mismatch between supply and demand will not be absorbed until 2017.

The long-term relationship between the oil price, the US dollar and world economic activity can also help us to guess how the future of oil prices might pan out. Indeed, the rising oil price in the 2000s and its recent fall is largely attributable to this relationship.

Current low oil prices are to a large extent justified by the long-term relationship. Over a 12-month horizon, however, if world real GDP grows as expected (3.4%) and the dollar remains pat, the WTI price fair value could climb to $50/barrel (currently at $34/b), suggesting that fundamental forces will tend to push the oil price higher in 2017.

Imbalances in oil production and demand

In its report1) published recently, the IEA says that oil prices are unlikely to recover rapidly owing to the lasting oil glut. Even as non-OPEC production dips, ballooning stocks that prevent a recovery in prices are likely to continue into 2017. Without a larger drop in output than expected from non-OPEC producers this year, or a jump in demand growth, it is unlikely that we will see oil prices recover significantly in the short term. The enormous stocks that have accumulated since 2014 will act as a dampener on the pace of recovery in oil prices.

A key question is when the oil market will return to equilibrium between supply and demand? The agency expects that production in 2016 will outpace demand by close to 1mb/d – a sharp reduction from the close to 2mb/d recorded in 2015, but still a significant surplus that is likely to weigh on crude prices this year. Oil supply is not expected to be aligned with demand until 2017 but the enormous stocks accumulated since 2014 will act as a dampener on the pace of recovery in oil prices.

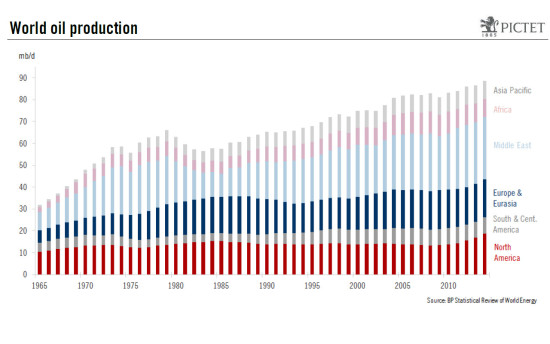

Unabated supply

One of the most striking recent surprises behind the current balance mismatch was the resilience of high-cost oil production in the US despite lower prices. As oil prices collapsed from $115/b in June 2014 to close to $30/b today, the extraordinary growth in total US crude oil production – from 5mb/d in 2008 to 9.4mb/d in 2015 – was expected to move rapidly into reverse. In fact, though, growth ceased in mid-2015, but since then the pull-back has been modest, given that in February 2016 total US crude oil production was still close to 9.0mb/d.

What fundamentals tell us

At this point it might be interesting to look at fundamentals so that we can obtain some details on the future of oil prices. Aside from geopolitical events, the crude oil price is an actively traded commodity that responds to supply-demand forces. Demand could be proxied by commonly available global activity indicators and the pricing process modelled to obtain a fundamental – or fair – value of the barrel of crude oil.

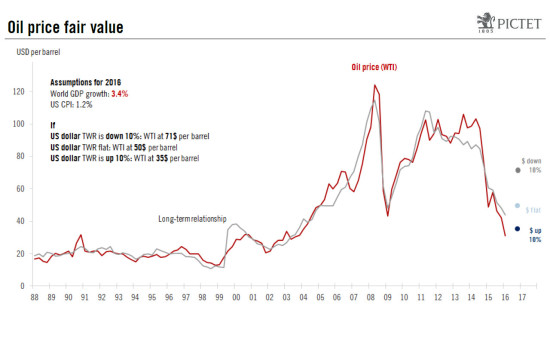

A long-term relationship

A long-term relationship between the oil price, the US dollar and global economic activity can be evidenced2). It shows that the impressive rise in the price of crude from below $15/b in 1999 and above $130/b in 2008 was largely justified by the acceleration of economic activity and the depreciation of the US dollar, which occurred in the second part of this period.

In the same way, the dramatic collapse of the crude oil price that we have witnessed since 2014, bottoming at below $27/b recently, is also largely attributable to the economic slowdown since the crisis and the 19% appreciation of the US dollar’s trade-weighted exchange rate.

Fair value as an “attractor”

The oil price is clearly not determined by just two variables. Many more factors play a role in determining the price per barrel. To mention just a few, we have geopolitical factors, inventories, technology, investment in extraction, meteorological conditions, etc. Some of these factors (inventories and oil production) have been taken into account to estimate the long-term relationship, whereas others like geopolitical ones are difficult to quantify. This explains why the spot oil price could depart from the fair value – by 28% in Q3 2005 and by -19% in Q2 2007! However, the cointegration relationship between the crude oil price, the US dollar and global economic activity is fairly stable. Consequently, the fair value works as an “attractor” where the spot price will converge if it departs too far from its fair value.

What oil price can we expect in 2016?

The long-term relationship between oil price, economic activity and the US dollar suggests that the current fair value is $44/b – $10 above today’s WTI price ($34/b). So currently, the long-term relationship is already playing in favour of a stabilisation in the oil price.

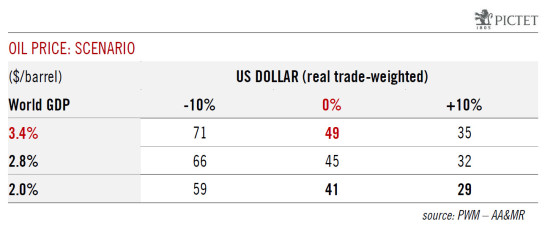

On a 12-month horizon, it is worth introducing the 2016 economic assumptions into the model to assess their implications in terms of fundamental forces on the supply-demand balance. If the world economy grows by 3.4% in 2016 (IMF forecast) and the US dollar remains flat in real trade-weighted exchange-rate terms, the WTI fair value would rise to $49/b. Based on the same assumption of GDP growth but with a 10% rise in the dollar, the crude fair value would decline slightly to $35/b.

To sum up, if the consensus scenario does materialise, fundamental forces are likely to already act in favour of a stabilisation or even a higher oil price.

What happens in the event of global recession?

Recently the “R” word has reared its head again in the financial world. The reason: a bunch of lower-than-expected economic news in the US and concerns over the Chinese economic slowdown. So what would be the impact on the oil price if the world were to go into recession in 2016? World GDP growth is rarely negative (once in 2009 and temporarily in 1982 in y-o-y terms). GDP growth has fallen below 2% on only three occasions in the last 44 years. So what would be the consequences on the oil price if world GDP growth were to slow abruptly to 2% in 2016? The long-term relationship says that with a US dollar remaining constant, the fair value for the WTI would be $41/b. If the dollar were to appreciate by 10% the fair value would fall to $29/b, suggesting that the oil price could stay at current low levels for a while.

Oil price recovery 2017

To sum up, the current environment, consisting of crude over-supply, slow economic growth and a rather strong US dollar, would tend to justify the current low oil price. Our estimation of the long-term cointegration relationship between the oil price, the US dollar and global activity suggests that the crude price was not that far off its fair value at the end of 2015. However, the fall towards $30/b that occurred has since appeared as an overshoot.

Moreover, the mismatch between crude supply and demand is expected to be absorbed in 2017 and the long-term relationship between the oil price, global economic activity and the US dollar suggests that in the event of a favourable economic scenario (world real GDP growth at 3.4% and a flat US dollar in 2016), the oil price fair value will rise from its current $44/b to $49/b, adding upward pressure on the oil price.

The oil price can, of course, depart from its fair value for a while; however, the rise of the fair value and the expected reduction of the oil glut are likely to act in favour of an increase in the spot price in 2017 towards $50/b. As a result, equity markets could be supported by the movement in the oil price between now and 2017.

1)International Energy Agency, Oil Medium-Term Market Report 2016, 22 February 2016

2)For a description of the model, see: Jean-Pierre Durante and Zlatan Plakalo, Crude oil price, global economic activity and the US dollar: A cointegration analysis, Elements, PWM – AA&MR, forthcoming April 2016