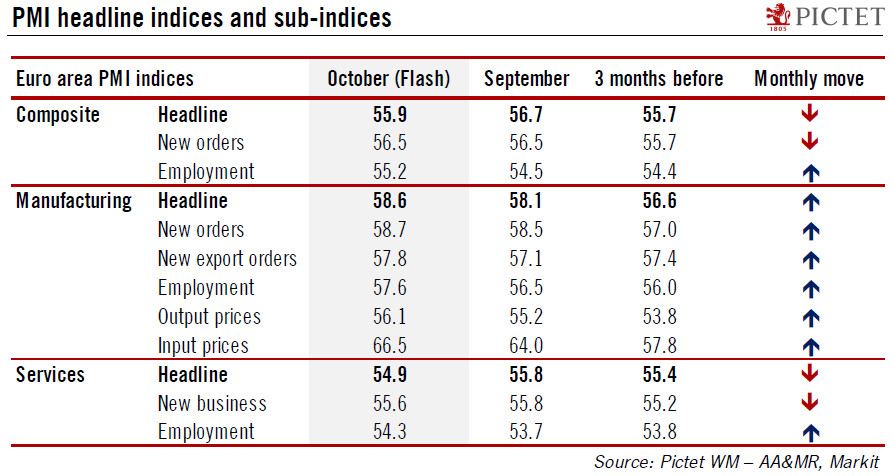

The euro area composite PMI index fell slightly in October, consistent with our forecast of a moderate slowdown in activity in Q4.The euro area composite flash PMI declined to 55.9 in October, from 56.7 in September, below consensus expectations, led by a drop in the services sector which offset an increase in manufacturing. However, survey details were fairly strong, especially in terms of job creation.In Germany, the survey points to robust private sector growth. The PMI index decreased, led by the services sector, while the manufacturing index remained broadly stable. In France, business sentiment started Q4 on a strong note. The flash composite PMI increased (+0.4), along with the headline PMI, lifted by a rise in both service and manufacturing sectors. Outside the two largest euro

Topics:

Frederik Ducrozet considers the following as important: ECB monetary policy, ECB policy normalisation, euro area composite PMI, Flash PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro area composite PMI index fell slightly in October, consistent with our forecast of a moderate slowdown in activity in Q4.

The euro area composite flash PMI declined to 55.9 in October, from 56.7 in September, below consensus expectations, led by a drop in the services sector which offset an increase in manufacturing. However, survey details were fairly strong, especially in terms of job creation.

In Germany, the survey points to robust private sector growth. The PMI index decreased, led by the services sector, while the manufacturing index remained broadly stable. In France, business sentiment started Q4 on a strong note. The flash composite PMI increased (+0.4), along with the headline PMI, lifted by a rise in both service and manufacturing sectors. Outside the two largest euro area countries, however, Markit noted that “the rate of expansion in business activity was solid, but eased to the weakest for a year”, with the weakness most likely centred on the services sector.

In all, the euro area PMIs remain consistent with a strong and stable expansion of the euro area economy, if at a slightly slower pace than in H1 2017. Crucially, the outlook for job creation continues to improve at a steady pace, with Markit reporting on “a sharp and accelerated rise in employment across the private sector”.

Last but not least, price pressure continued to build, paving the way for the ECB to normalise its monetary stance in the coming months and quarters. We expect the ECB to extend QE for nine months, until September 2018, at a reduced pace of EUR30bn per month.