The latest ECB's lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.Net demand for bank loans to enterprises increased further in Q3, in line with banks’ expectations. The low level of interest rates was the key factor behind the rise in corporate loan demand. M&A activity as well as inventories and working capital continued to have a positive impact on demand, albeit less than in the previous quarter. Looking ahead, banks expect credit demand to rise further in

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB policy normalisation, Euro area banking lending survey, euro area credit, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest ECB's lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.

The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.

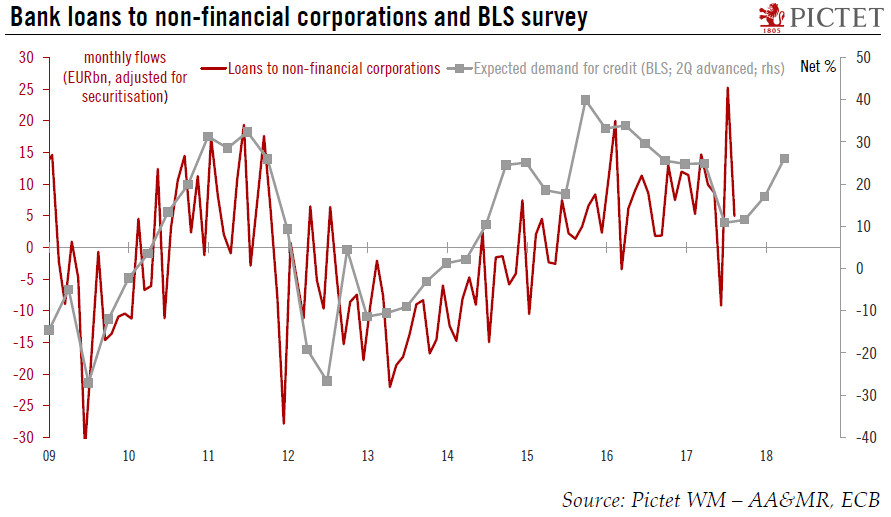

Net demand for bank loans to enterprises increased further in Q3, in line with banks’ expectations. The low level of interest rates was the key factor behind the rise in corporate loan demand. M&A activity as well as inventories and working capital continued to have a positive impact on demand, albeit less than in the previous quarter. Looking ahead, banks expect credit demand to rise further in Q4 for all types of loans.

The BLS also reported the effects of the ECB’s Asset Purchase Programme (APP) and negative deposit facility rate (DFR) on bank lending conditions and lending volumes. The APP was said to be continuing to have a positive impact on banks’ liquidity and financing conditions, but this positive effect was described as smaller than in previous quarters. Similarly, the positive impact of negative DFR on net lending volumes may not be large enough to offset the adverse effect of negative DFR on banks’ profitability, which the survey suggested was being amplified by renewed competitive pressure.

Overall, the BLS looks consistent with a cautious ECB normalisation under the current sequencing: first, QE recalibration, then, rate hikes. In particular, one would need to see more evidence of the adverse effects of negative rates, and the ECB to explicitly acknowledge them, before a deposit rate hike could be envisaged. Either way, we expect no hike in the ECB’s main refi rate before mid-2019 at the earliest.