The rise in the US deficit may sap support for Trump’s ambitious plans to cut taxes.US fiscal year 2017, which ended on September 30, did not end on a high note. The deficit rose to 3.5% of GDP, edging up 0.3 percentage point from fiscal year 2016. This deterioration stands in stark contrast to the overall improvement in the US economy. GDP growth remains above potential, and unemployment has been on a downward trend throughout the year.What is particularly puzzling, if not worrying, is the ongoing stagnation in fiscal revenues, with a stark decoupling from GDP growth since Q1 2016 (see Chart). The two-year compound annual growth rate (CAGR) in tax revenues has been a meagre 1.0%. By comparison, fiscal spending has remained firm, with a 2Y CAGR of 3.9%, above nominal GDP growth of

Topics:

Thomas Costerg considers the following as important: Macroview, Trump tax cuts, Trump tax plans, US budget deficit, US economy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The rise in the US deficit may sap support for Trump’s ambitious plans to cut taxes.

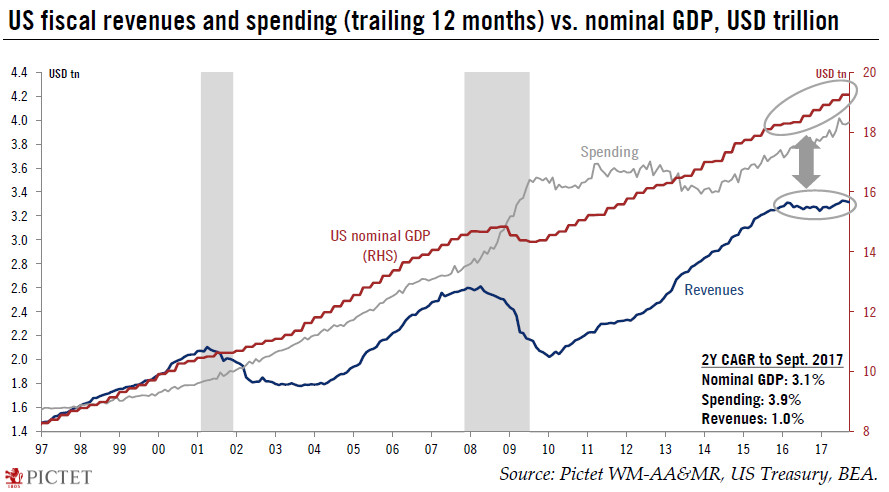

US fiscal year 2017, which ended on September 30, did not end on a high note. The deficit rose to 3.5% of GDP, edging up 0.3 percentage point from fiscal year 2016. This deterioration stands in stark contrast to the overall improvement in the US economy. GDP growth remains above potential, and unemployment has been on a downward trend throughout the year.

What is particularly puzzling, if not worrying, is the ongoing stagnation in fiscal revenues, with a stark decoupling from GDP growth since Q1 2016 (see Chart). The two-year compound annual growth rate (CAGR) in tax revenues has been a meagre 1.0%. By comparison, fiscal spending has remained firm, with a 2Y CAGR of 3.9%, above nominal GDP growth of 3.1%.

These deteriorating metrics constitute an additional headwind for the Trump Administration’s push to lower taxes. While Republicans in Congress are on average more ‘deficit friendly’ than a few years ago, some remain anxious about fiscal metrics. Senate majority leader Mitch McConnell said that he was still counting on a “revenue neutral” tax plan, for instance. At the time of the last major tax cuts in 2001/03, the federal budget was in surplus.

It may be that individual investors have delayed selling their financial investments until they see what Trump’s tax cuts mean for them. Indeed, revenues seem to have been affected by a sharp drop in taxes from capital gains on financial holdings, like stocks. ‘Non-withheld’ tax receipts were 2.2% lower over the fiscal year, despite a sharp rise in many financial markets. By contrast, withheld gross receipts, which are more correlated with the labour market because taken directly from salaries, rose 5.1%.