The acceleration in construction activity is boosting capital expenditure and supporting the euro area’s cyclical upturn.Since the beginning of the year, euro area capital expenditure has picked up noticeably. The acceleration has been mainly driven by the construction sector (which accounts for almost 50% of total capital expenditure), while business equipment has continued to expand strongly. Construction activity is still 19% below its pre-crisis (2008) level, and has room to improve. Favourable factors such as a better economic outlook in the euro area, the ongoing recovery in the housing market, a rise in real disposable incomes, supportive ECB monetary policy and increased immigration have supported the construction sector and are likely to continue doing so in the quarters

Topics:

Nadia Gharbi considers the following as important: Euro area construction sector, euro area economy, Euro area production in construction, euro area soft hard data, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The acceleration in construction activity is boosting capital expenditure and supporting the euro area’s cyclical upturn.

Since the beginning of the year, euro area capital expenditure has picked up noticeably. The acceleration has been mainly driven by the construction sector (which accounts for almost 50% of total capital expenditure), while business equipment has continued to expand strongly. Construction activity is still 19% below its pre-crisis (2008) level, and has room to improve. Favourable factors such as a better economic outlook in the euro area, the ongoing recovery in the housing market, a rise in real disposable incomes, supportive ECB monetary policy and increased immigration have supported the construction sector and are likely to continue doing so in the quarters ahead.

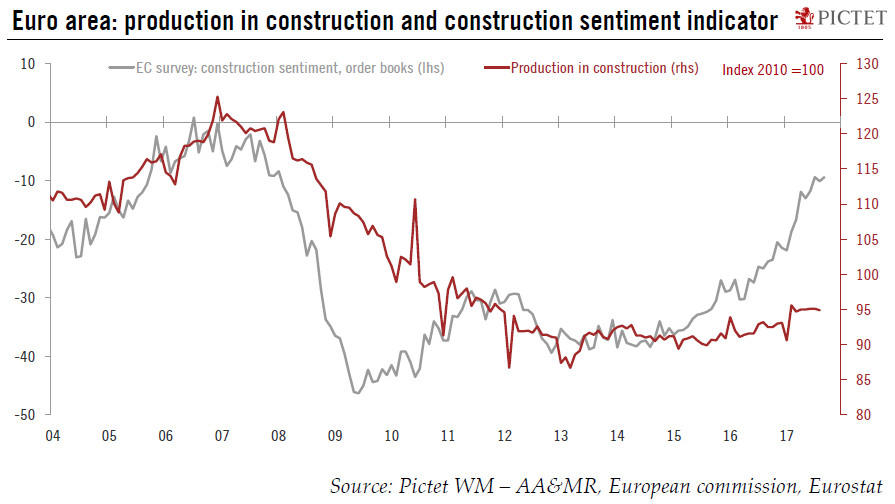

This week, Eurostat published data on production in construction (see Chart) for August. Euro area production in construction fell by 0.2% month-on-month (m-o-m) after having been flat in July. This left the Q3 average slightly down (by 0.04%) relative to Q2 (when it increased by 1.5% quarter-on-quarter). The soft August reading was driven by weak construction activity in Germany and Spain, while it rebounded in France and Italy.

Beyond short-term volatility, the euro area construction sector is likely to continue to support the cyclical upturn in the economy, even if activity moderated somewhat in Q3. The construction sentiment indicator in the European Commission’s business surveys has reached its highest level since January 2008 and order books (see Chart), are surging, suggesting that the modest uptrend in the headline production in construction index is likely to continue and even accelerate in the near future.