Millions of people watch others play games on live streaming portals. One of the biggest gaming platforms is Twitch. It's where you can find Stefanie "Stefy" Holenweg. Under the name "8bitblonde", she is one of the best-known Twitch users in Switzerland. She gives us a glimpse into her world, which is not just about games but also about social encounters. Private topics, such as heartbreak, are also discussed in her community. Stefy sees this as one of the advantages of...

Read More »Präsident Erdogan weist Regierungspartei an, Kryptowährung und Metaverse zu untersuchen

Der türkische Staatspräsident Recep Tayyip Erdo?an hat Berichten zufolge die Regierungspartei des Landes angewiesen, eine Studie über Kryptowährungen und das Metaverse durchzuführen. “Es ist ein sensibles Thema, eine gute und sorgfältige Studie sollte durchgeführt werden”, sagte Präsident Erdo?an. Der türkische Präsident Recep Tayyip Erdo?an hat Berichten zufolge auf der zentralen Vorstandssitzung der Partei für Gerechtigkeit und Entwicklung, die am Dienstag unter...

Read More »Indonesiens Aufsichtsbehörde verbietet Finanzunternehmen den Krypto-Handel zu erleichtern

Die indonesische Finanzaufsichtsbehörde (OJK) hat Finanzunternehmen die Nutzung, Vermarktung und/oder Erleichterung des Kryptohandels verboten. Die Finanzaufsichtsbehörde warnte die Öffentlichkeit außerdem davor, sich vor betrügerischen Schneeballsystemen unter dem Deckmantel von Kryptowährungen in Acht zu nehmen. Die indonesische Finanzdienstleistungsbehörde (OJK), die in Jakarta ansässige Regierungsbehörde, die den Finanzdienstleistungssektor reguliert, warnte am...

Read More »How Not to Think About Gold

Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong. Whether it’s a company trying to sell you something, or a big investment bank. Gold and silver defy conventional commodity analysis. And plotting the gold price against the money supply, or...

Read More »SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs Jordan Strong CHF limits swiss inflation See no sign swiss wage price cycle Inflation stubbornly above 2% would lead to policy tightening Difficult to say whether global rates have turned, much still depend on economic development CHF has remained stable in real terms Asked about real estate prices, Jordan says monetary policy aims primarily at price stability The SNB is not investing in crypto currencies The USDCHF has moved to new session lows (higher CHF)...

Read More »Swiss vote on animal testing ban

On February 13, the Swiss will vote for the fourth time on whether to ban animal testing in this country. The people’s initiative calls for a halt to all experiments on humans and animals and a ban on the import of new products developed using such methods. About 556,000 animals were used for experimental purposes in Switzerland last year, according to official statistics. That's a decrease of 18% relative to 2015, when the downhill trend started. However, around 1,400 more animals...

Read More »What to do with abandoned stables? A thorny issue in Switzerland

This old farm building in the Valais has been converted into a holiday home. Hallenbarter AG Many people dream of owning a mountain home, especially in Switzerland, where the Alps are within easy reach of major towns and cities. But few come on the market and, when they do, they can be quite expensive. Trained as a picture journalist at the MAZ media school in Lucerne. Since 2000 she has worked as a picture editor in various media concerns and as a freelancer....

Read More »When Higher Prices Are Not Inflation

Monetary inflation results in a general rise in prices, often called “price inflation.” But rising prices are not always “inflation.” In any case, more government regs and subsidies won’t help. Original Article: “When Higher Prices Are Not Inflation” Back to 2020, the federal government’s covid-mandated shutdown of meat production plants hobbled the nation’s meat production capabilities, leaving farmers with nowhere to send their beef. This resulted in them...

Read More »Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness. I know a lot of people liked that rally into the close on Friday and it was a nice way to end a wild week but it also shows that traders/investors are all too...

Read More »Russland wird Bitcoin nicht verbieten

Viele Staaten haben die Schrauben zuletzt angezogen und den Cryptomarkt angezählt. Auch in Russland wurden Stimmen laut, die ein komplettes Verbot forderten. Da hier sogar die russische Zentralbank involviert war, wurde befürchtet, dass Bitcoin und Co. schon bald in Russland verboten werden könnte. Nun gibt es jedoch Entwarnung. Bitcoin News: Russland wird Bitcoin nicht verbieten Die russische Regierung selbst hat angekündigt, kein Verbot auszusprechen – und damit...

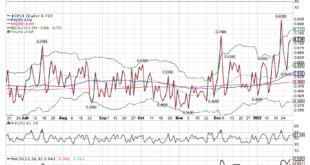

Read More » SNB & CHF

SNB & CHF