“If you can’t hold it in your hand, you don’t own it.” That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake. This popular phrase conflates and entangles two different concepts. Gold owned for emergency use or as a financial insurance policy Gold owned for investment purposes In this article, we’ll untangle those ideas and offer a different way to think about owning gold. The Dangers of Holding Too Much in Hand Reductio ad absurdum is helpful here. Immediately, we can think of many things that we really do own, but that we cannot hold in our hand. More importantly though, taking this phrase to its logical conclusion introduces

Topics:

Erik Oswald considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, blog, Featured, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

“If you can’t hold it in your hand, you don’t own it.”

That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake.

This popular phrase conflates and entangles two different concepts.

- Gold owned for emergency use or as a financial insurance policy

- Gold owned for investment purposes

In this article, we’ll untangle those ideas and offer a different way to think about owning gold.

The Dangers of Holding Too Much in Hand

Reductio ad absurdum is helpful here. Immediately, we can think of many things that we really do own, but that we cannot hold in our hand.

More importantly though, taking this phrase to its logical conclusion introduces a multitude of risks.

Imagine taking all your money out of the bank, taking physical delivery of paper stock and bond certificates, and of course all your gold and silver, then storing your wealth within arm’s reach.

Suppose you’re robbed? A fire or some other natural or manmade disaster strikes?

You could lose or forget where you put things or forget an important safe combination.

Even if the risk were acceptable, there’s still the issue of practicality, which grows more difficult the wealthier you become.

“If you can’t hold it, you don’t own it” may be a catchy slogan, but following this logic alone is impractical and extremely risky.

Gold for Emergencies and as a Financial Insurance Policy

Given the risks inherit in the financial system, keeping some physical gold and silver at home as an emergency fund or as a financial insurance policy is warranted.

The threshold for how much to keep at home is different for everybody. Beyond that, it’s time to put that metal in a secure depository with insurance and professional security. However, now you must pay yearly storage fees, which will perpetually eat away at your principal.

Gold for Investment Purposes

If gold isn’t owned as an emergency fund or insurance policy, what other purpose does it serve? The fundamental purpose of savings and investment is to deploy capital productively so that it produces a yield. You had always been able to do this with dollars, but your options are looking fairly bleak and with the Fed continually issuing more dollars, any dollar yields will be hit with the ever growing inflation tax.

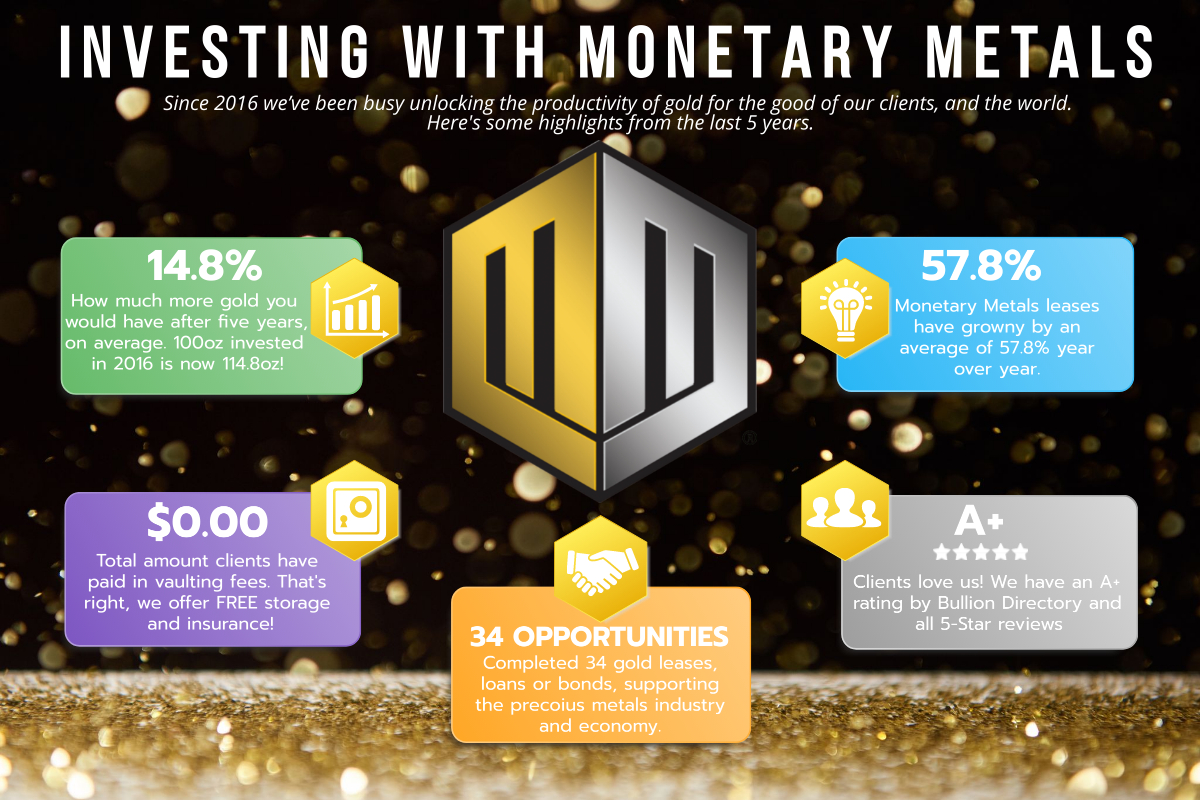

Monetary Metals has made it possible for investors to earn a yield on gold and silver. Precious metals are no longer relegated to mere financial insurance but can be used to grow your net worth in real terms.

Purchasing gold with the expectation of selling it for more dollars is not an investment, but a speculation. An investment finances production, and the profit to investors comes from that production. A speculation finances nothing, just a bet on the price of an asset, and the profit comes from the capital paid by the next speculator who buys it from you. To understand the difference between gold speculation and gold investment, I recommend two articles:

Investing in Gold vs Gold Investing.

There are those who will continue to speculate for more dollars with gold, bitcoin, tulips, or penguin GIF NFT’s. However, gold under the mattress isn’t going to sprout any additional ounces.

Civilization was not built or advanced by speculation. It was built on productive investment. This is what Monetary Metals offers, an inflation-resistant return on invested capital, paid in gold and silver. Not mere protection of wealth, but the power to grow that wealth year over year.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Tags: Blog,Featured,newsletter