But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. Long cycles operate at such a glacial pace they’re easily dismissed as either figments of fevered imagination or this time it’s different. But since Nature and human nature remain stubbornly grounded by the same old dynamics, cycles eventually turn and the world changes dramatically. Nobody thinks the...

Read More »The Bank of Canada’s Failed Mission to “Preserve the Value of Money”

In Canada, inflation hit 4.7 percent in October, and is expected to go even higher. According to a recent survey, 46 percent of Canadians are struggling to feed their families because of the rising cost of living. Perhaps they are also struggling to understand the logic of the Bank of Canada’s (BOC) mission statement: “We work to preserve the value of money by keeping inflation low and stable.” That’s the BOC’s objective, but it’s impossible to achieve. Preserve...

Read More »Mickey Fulp Interview: Investing in Interest-Bearing Gold Bonds

Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals’ CEO Keith Weiner to discuss the maturity of Monetary Metals’ recent gold bond. Gold bonds are denominated in gold, with principal and interest payable in gold. Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933. Listen to their conversation below. [embedded content]...

Read More »Investing in Interest-Bearing Gold Bonds

Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals' CEO Keith Weiner to discuss the maturity of Monetary Metals' gold bond, which is denominated in gold and pays interest in gold. Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933. They discuss: - How Monetary Metals is making an old idea new again - What happened to gold as money in the...

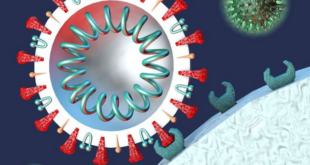

Read More »FX Daily, December 02: Calm Surface Masks Lack of Conviction

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated. The S&P 500...

Read More »Swiss Retail Sales, October 2021: +0.6 percent Nominal and +1.2 percent Real

02.12.2021 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.6% in nominal terms in October 2021 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 1.2% in October 2021 compared with the previous year. Real growth takes...

Read More »The evolution of money: Keith Weiner

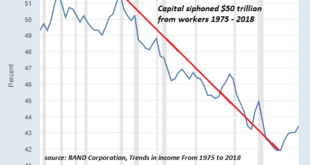

Keith Weiner, CEO, Monetary Metals joins Kerry Stevenson to discuss money and its evolution over time and why right now is not the best of times. The evolution of money and the coincidence of wants What is the debt loop? Why does the dollar have so much value? Interest rates lower, asset prices higher Why the system is so perverse The wealth affect who wins and who loses How you can earn interest on gold How to help the world have a more rational monetary system Guest Links: Twitter:...

Read More »Government interventions and the Cobra effect – Part I

Part I of II Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for. The term was inspired by an incident that took place in India during the British rule, when the authorities tried to reduce the number of deadly cobras in Delhi by offering a cash reward to citizens for...

Read More »Omicron exposes our pandemic failures

They say a week is a long time in politics – last week we discovered it’s a long time in a pandemic as well. We started the week anxiously watching the rising Covid cases in Europe, and wondering what new restrictions might be heading our way for Christmas. At the same time here in Geneva journalists were preparing for a special session of the World Health Assembly, swiftly followed by a ministerial meeting of the World Trade Organization (WTO). Both meetings were...

Read More »This Is A Big One (no, it’s not clickbait)

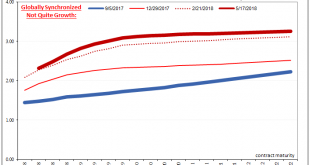

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two. Twenty-eighteen, right? Yes. And also today. Quirky and kinky, it doesn’t seem like a lot,...

Read More » SNB & CHF

SNB & CHF