The Stress of Losing Billions

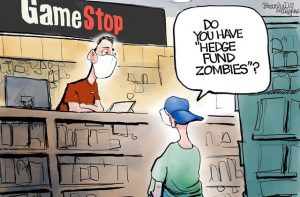

Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

A surprise revival of business at Game-Stop… [PT]

One of the sweetest displays in the world, we’ve been told, is the bursts of digital confetti that shower down Robinhood’s investment app to celebrate the purchase of stocks, options, and cryptocurrencies. These digital confetti bursts – in addition to spinning prices and scratch off rewards – are great entertainment.

So, too, is watching the price of bitcoin quoted in neon pink. It just screams buy!

Trading on Robinhood is designed to be both fun and

Articles by MN Gordon

Grantham’s ‘Real McCoy’ Bubble in a World Gone Mad

December 21, 2020The Lure of Easy Money

Right now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia?

The stock of the semiconductor company is up more than 170 percent over the last 9-months. Perhaps it will double again from here.

Of course, there is nothing like an epic stock market bubble that warms the hearts and softens the minds of men to ideas that would otherwise be impossible. One idea du jour, for example, is that low interest rates justify high valuations. Another is that the Fed can permanently inflate stocks using its seemingly

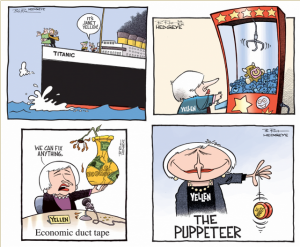

Janet Yellen: Too Dumb To Stop

December 10, 2020Janet Yellen – first she got to print a lot of funny money, now she gets to autograph it. The Titanic meanwhile finds itself in uncharted waters and rumor has it that there may be icebergs lurking not too far from here. [PT]

Autographing Funny Money

The United States Secretary of the Treasury bears a shameful job duty. They must place their autograph on the face of the Federal Reserve’s legal tender notes. Here, for the whole world to witness, the Treasury Secretary provides signature endorsement; their personal ratification of unconstitutional money.

If you recall, Article I, Section 8, of the U.S. Constitution empowers Congress to coin money and regulate its value. What’s more, Article I, Section 10, specifies that money be coined of gold and silver and cannot

Game Over Spending

July 12, 2020Coming and Going Like a Wildfire

Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace.

The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping 38.85 percent in just three months.

The economy, on the other hand, was severely scorched. Decades of debt had built up like dead wood amongst a forest under-story. Then, at the worst possible time, government lockdown orders sparked a match and set it ablaze.

The results were predictable to everyone but the

The Secret to Fun and Easy Stock Market Riches

February 17, 2020Post Hoc Fallacy

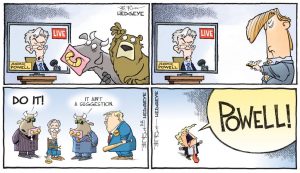

On Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down.

Were the DJIA operating within the framework of a free capital market it would be normal for the index to go both up and down. But remember, the U.S. stock market is hardly a free market. Not when it is under the influence of extreme Fed intervention.

When the Fed speaks, the DJIA should go up. At least, that is the opinion of President Trump. And as Powell spoke, the Real Donald Trump took to Twitter and delivered his play-by-play assessment:

“When Jerome Powell started

Read More »The Triumph of Madness

February 13, 2020Historic Misjudgments in Hindsight

Viewing the past through the lens of history is unfair to the participants. Missteps are too obvious. Failures are too abundant. Vanities are too absurd. The benefit of hindsight often renders the participants mere imbeciles on parade.

The moment Custer realized things were not going exactly as planned. PT

Was George Armstrong Custer really just an arrogant Lieutenant Colonel who led his men to massacre at Little Bighorn? Maybe. Especially when Sitting Bull, Crazy Horse, and numbers estimated to be over ten times his cavalry appeared across the river.

Were George Donner and his brother Jacob naïve fools when they led their traveling party into the Sierra Nevada in late fall? Perhaps. Particularly when they resorted to munching

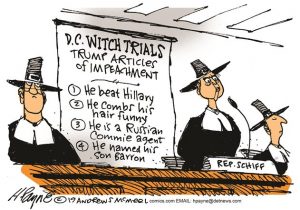

Real High Crimes and Misdemeanors

December 24, 2019World Class Entertainer in the Cross-Hairs

Christmas is no time to be given the old heave-ho. This is a time of celebration, redemption, and excess libation. A time to shop ‘til you drop; the economy depends on it. Don’t get us wrong. There really is no best time to receive the dreaded pink slip. But Christmas is the absolute worst. Has this ever happened to you?

Well, believe it or not, this is precisely what House Speaker Nancy Pelosi and her Democrat degenerates in the House did this week with their partisan impeachment of President Trump. Not even Ebenezer Scrooge had a cold enough heart to fire Bob Cratchit on Christmas. In fact, Scrooge gave Cratchit Christmas day off – with pay.

The verdict: Orange man bad! [PT]

For the record, Trump is a repulsive

Banana Republic Money Debasement In America

December 15, 2019Addicted to Spending

There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad!

The inescapable logic of tax & spend: empty vault… empty pockets… gimme more! PT

According to the Congressional Budget Office, the federal budget deficit for the first two months of fiscal year 2020 is $342 billion. This amounts to $36 billion more than the deficit recorded during the same period last year. At this rate, Washington is going to add over $1 trillion to the national debt in FY 2020.

Still, the figures from the CBO aren’t all bad. Revenues in October and November of 2019 were 3

Riding the Type 3 Mega Market Melt Up Train

November 10, 2019Beta-driven Fantasy

The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past.

Gandalf, quant of Middle-Earth, dispensing sage advice. [PT]

For the big financial outfits, optimizing systematic – preprogrammed – delta hedges is an essential aptitude of the 21st century. Our guess is that many of today’s high-fliers will crash and burn during the next bear market. But what do we know?

As far as we can tell, the stock market, circa November 2019, is an absolute fantasy. The Dow Jones Industrial Average

America’s Road Map to $40 Trillion National Debt by 2028

October 20, 2019Planning on Your Behalf

Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it.

While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life. Your future earnings are being directed to boondoggles galore. Yet these claims are in addition to everything Washington has already signed you up for.

At last count of the U.S. National Debt, every American citizen’s on the hook for nearly $70,000. Add U.S. Unfunded Liabilities – which includes Social Security, Medicare Parts A, B, and D, federal debt held by the public, plus federal employee and veteran benefits

Fed Chair Powell’s Inescapable Contradiction

October 14, 2019Under the Influence

“This feels very sustainable.”

– Federal Reserve Chairman Jerome Powell, October 8, 2019

Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week.

On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict.

Free of government intervention, the economy and financial markets would get along within a low standard deviation. Extremes would appear from time to time. But they would be quickly reconciled and balance would be restored within the normal

Is Inflation Beginning? Are You Ready?

March 25, 2019Extrapolating The Recent Past Can Be Hazardous To Your Wealth

“Those who cannot remember the past are condemned to repeat it,” remarked George Santayana over 100 years ago. These words, as strung together in this sequence, certainly sound good. But how to render them to actionable advice is less certain.

Aren’t some facets of the past – like the floppy disk – not worth remembering? And aren’t others – like a first taste of romance – worth repeating… if only it were possible?

Where investing is concerned, remembering the past – and discerning what to make of it – can actually be a handicap. Where does the past begin? How does it influence the future? How does one invest one’s capital accordingly?

These are

The Recline and Flail of Western Civilization and Other 2019 Predictions

December 31, 2018The Recline and Flail of Western Civilization and Other 2019 Predictions

“I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018

Darts in a Blizzard

Today, as we prepare to close out the old, we offer a vast array of tidings. We bring words of doom and despair. We bring words of contemplation and reflection. And we also bring words of hope and sunshine.

After all, the New Year’s nearly here. What better time than now to turn over a new leaf? New dreams, new directions, and new delusions, are all before us like a patch of ripe strawberries. Today’s the day to make a double-fisted grab for all of them – and more.

Rest assured, 2019 will

How Faux Capitalism Works in America

December 17, 2018Stars in the Night Sky

The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes.

The short-term significance of the DJIA’s 8 percent decline since early-October is uncertain. For all we know, stocks could run up through the end of the year. Stranger things have happened.

What is also uncertain is the nature of this purge: Is this another soft decline like that of mid-2015 to early-2016, when the DJIA fell 12 percent before quickly

The Intolerable Scourge of Fake Capitalism

November 20, 2018Investment Grade Junk

All is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend.

Chartists witnessed the take out of the January high and affirmed all was clear for the S&P 500 to continue its ascent. They called it a text book confirmation that the bull market was still intact. Now, just two months later, a great breakdown may be transpiring.

Obviously, this certain fate will be revealed in good time. Still, as

Pushing Past the Breaking Point

November 6, 2018Schemes and Shams

Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up.

Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make everyone rich.

Central to these promises are the central government and central planning authorities. They take your money and, in return, they make you a dependent. They promise you a secure retirement, and free drugs, while running a scheme that’s well beyond anything Charles Ponzi ever dreamed of.

Tales from “The Master of Disaster”

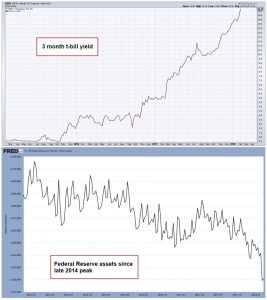

May 24, 2018Tightening Credit Markets

Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent.

If yields continue to rise, this one thing will change everything. To properly understand the significance of rising interest rates some context is in order. Where to begin?

In 1981, professional skateboarder Duane Peters was busy inventing tricks like the invert revert, the acid drop, and the fakie thruster, in

How to Get Ahead in Today’s Economy

May 14, 2018“Literally On Fire”

This week brought forward more evidence that we are living in a fabricated world. The popular story-line presents a world of pure awesomeness. The common experience, however, falls grossly short.

There are many degrees of awesomeness, up to total awesomeness – which is where we are these days, in the age of total awesomeness, just a short skip away from the Nirvana era. – Click to enlarge

What is Nirvana, you may wonder? We only know for sure that Nirvana is what the stock market has priced in – other than that, we will have to wait and see

On Tuesday, for example, the Labor Department reported there were a record 6.6 million job openings in March. Based on the Labor Department’s data, there

The Oil Curse Comes to Washington

May 5, 2018Meandering Prices

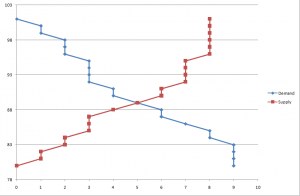

Prices rise and prices fall. So, too, they fall and rise. This is how the supply and demand sweet spot is continually discovered – and rediscovered. When supply exceeds demand for a good or service, prices fall. Conversely, when demand exceeds supply, prices rise.

Supply and DemandSupply and demand (the curves usually shown in such charts are unrealistic, as bids and offers in the market are arranged in discrete steps). – Click to enlarge

Producers use the information communicated by changing prices to make business decisions. High demand and rising prices inform them to increase output. Excess supply and falling prices inform them to taper back production.

This, in basic terms, is how

From Fake Boom to Real Bust

April 27, 2018Paradise in LA LA Land

More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf.

Normally, judgment would be passed on a Thursday, but we are making an exception. – Click to enlarge

For example, here in the land of fruits and nuts, things are whacky, things are zany. Last month, State Senator, Dick Pan, introduced Senate Bill (SB) 1424, which would require California based websites to utilize fact checkers to verify news stories prior to publishing them.

Who exactly these fact checkers would be – the moral servants

Negative Rates: Rise of the Japanese Androids

April 17, 2018Good Intentions

One of the unspoken delights in life is the rich satisfaction that comes with bearing witness to the spectacular failure of an offensive and unjust system. This week served up a lavish plate of delicious appetizers with both a style and refinement that’s ordinarily reserved for a competitive speed eating contest. What a remarkable time to be alive.

It seemed a good idea at first… – Click to enlarge

Many thrilling stories of doom and gloom were published across the tops of the finest digital news sites. The main object of our satisfaction, however, was buried further down the pages, well below the latest Trump tweets and relentless reports on the global war buildup. Nonetheless, our focus is not

Trade War Game On!

April 9, 2018Interesting Times Arrive

“Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee.

Ancient Chinese curse alert… – Click to enlarge

“One moment markets are gorging on financial slop like fat pigs in mud. The next they’re collectively vomiting on themselves. I’ll tell you one thing. President Trump’s trade war with China won’t end well. I mean, come on. China’s outplayed the U.S. at this game for over a quarter century. They have the upper hand.

“Besides, what’s the point? If we no longer buy stuff from China, then how will China buy Uncle Sam’s debt? And the timing for all this couldn’t be worse.

What Fed Chair Powell Forgot to Mention

March 26, 2018Son of the Imperial City

What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high.

The new central planner-in-chief. – Click to enlarge

Central banks are facing a special case of the socialist calculation problem pertaining to the financial system. Like the comrades in the former Eastern Bloc, who tried to adjust their plans based on prices they were able to observe in the capitalist West, their best bet is to simply follow market rates. Unfortunately market rates – especially at the short end of the yield curve –

Haunted by Ghosts of the Old Eastern Bloc

February 27, 2018Ridiculous Minutia

Jerome Powell, the new Chairman of the Federal Reserve, just completed his third week on the job. He’s hardly had enough time to learn how to operate the office coffee maker, let alone the all-in-one printer. He still doesn’t know what roach coach menu items induce a heinous gut bomb.

Photo credit: A. Brandon / AP – Click to enlarge

The perpetually slightly worried looking new Fed chairman Jerome Powell, here seen warily inspecting the Rose Garden at the White House. Everybody wants to know if he has a “better plan” – but there is no better plan, thus no-one has one.

Yet across the planet, folks high and low are already telling him exactly how he should do his job. What’s more, they’re

What Kind of Stock Market Purge Is This?

February 17, 2018Actions and Reactions

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

Memorable moments from the annals of dentistry. – Click to enlarge

For example, the days following a market correction are full of restoration and redemption. Like the prayer of Saint Francis of Assisi, Tuesday’s 567 point DJIA bounce brought hope where there was

How to Buy Low When Everyone Else is Buying High

February 6, 2018When to Sell?

The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s when investors should sell their stocks and go to cash.

Certainly, this sounds like a great strategy. But, practically speaking, how are you supposed to pull it off? Specifically, how are you supposed to know the exact moment the stock market peaks?

Is the definitive sign of the top when your shoeshine

The Donald Saves the Dollar

February 1, 2018Something for Nothing

The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon.

Looking at the expression of this Mickey’s Malt Liquor tester one might initially get the impression that he is disappointed. – Click to enlarge

We assure you that is not the case – this is actually his happy face, he is probably just about to enter Nirvana. Countless taste tests prove it, see this comparison of the “entire bottom shelf” of malt liquors, or these

Tax Reform and Trump’s Chinese Trade Deficit Conundrum

January 26, 2018Trade Deficit with China Widens on Trump’s Watch

Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again.

Photo credit: Jonathan Ernst / Reuters – Click to enlarge

We are often willing to give Donald Trump the benefit of the doubt, despite the fact that his delivery needs a lot of work. Considering his enemies and most vociferous detractors, we reckon he must be doing something right; but we vehemently disagree with his views on trade, some of which are unfortunately becoming

As the Controlled Inflation Scheme Rolls On

January 21, 2018Controlled Inflation

American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come.

After an extended period of indulging in excessive moderation (left), the US consumer makes his innermost wishes known (right). – Click to enlarge

On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to the Fed’s bean counters, U.S. consumers racked up $28 billion in new credit card debt and in new student, auto, and other non-mortgage loans in November. This amounted to an 8.8 percent increase in consumer borrowing. It also ran total outstanding consumer debt up to $3.83 trillion.

US Non-mortgage

Read More »Several Simple Suppositions and Suspicions for 2018

January 4, 2018A New Year of Symbiotic Disharmony

The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control.

Certainly, your ability to stop your neighbor’s cat from relieving itself in your side yard is limited, barring extreme measures. What we mean is each day shall unfold before you – both good and bad – in symbiotic disharmony. You can count on it.

But what are the specifics and particulars for the year ahead? What about stocks, the