Under the Influence “This feels very sustainable.” – Federal Reserve Chairman Jerome Powell, October 8, 2019 Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict. Free of government intervention, the economy and financial markets would get along within a low standard deviation. Extremes would appear from time to time. But they would be quickly reconciled and balance would be restored within the normal

Topics:

MN Gordon considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, Central Banks, Featured, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Under the Influence

Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict. Free of government intervention, the economy and financial markets would get along within a low standard deviation. Extremes would appear from time to time. But they would be quickly reconciled and balance would be restored within the normal distribution of the mean. Free of government intervention, an agreeable stability would be maintained. This can still be observed in remote areas; places free from the heavy hands of Washington, Beijing, and Brussels. For example, in remote areas, every village has an idiot. So, too, every idiot has a village. Free of government intervention, near perfect harmony is preserved. This is how the world should work. Of course, how the world should work, and how the world actually works are dramatically different. And how the world actually works, circa 2019, is under the extreme influence of central planners. Programs, policies, and procedures warp the bell curve, sending it askew. Throw unrelenting central bank fake money credit creation into the mix, and things become lopsided to the extreme. What’s more, the natural reconciliation process becomes overwhelmed with greater and greater issuance of credit. The heat and pressure build until the whole thing melts down. |

Understandable confusion… PT |

The End is NighOver the last two decades we have conducted our own empirical research of the influence of central bank fake money credit creation. Our methodology is simple. We observe the world about us – both good and bad. When something cockeyed crosses our sights we zoom in for a closer look. With our ears to the ground and our eyes scanning the horizon we ask two basic questions. Where is the money coming from? Where is it going? By following the money, some – but not all – aspects come into focus… Million dollar shacks. Unicorn money consuming vision companies valued at $47 billion. The S&P 500 at nearly 3,000. Face tattoos. Ghost cities. Shale oil drillers that hemorrhage capital. Junk bonds with negative yields. Sovereign debt with negative yields. Century bonds yielding 1.2 percent. Trillion dollar deficits. Donald Trump. Bernie Sanders. Elizabeth Warren. Nancy Pelosi. Adam Schiff. Hunter Biden. Lockheed Martin. The China Miracle. AOC’s Just Society. Boris Johnson. Justin Bieber. Micro-aggressions. Soy lattes. And much, much more… These are all fabrications and distortions of the mass money debasement of central bankers. Maybe some of these fabrications would still exist in a world with more honest monetary policy. But they would be less exaggerated and less destructive. Here, in the main, are the findings of our research… Central bank fake money credit creation has distorted capital markets, and by extension the entire economy and culture, so far past the extreme that it goes largely unrecognized. Mass distortions, insane debt bubbles, and levered madness are now perceived as normal. Nonetheless, these extreme distortions are far from normal. Nor can they go on forever. In fact, the end is nigh… |

|

Fed Chair Powell’s Inescapable ContradictionCentral banks are presently failing. The debt edifice is breaking down. There is no escaping the pending crash and depression. The onset of what is coming, which may coincide with the 2020 election, is going to be especially awful, dreadful, and terrible. Yet, Fed Chair Powell is trapped in a contradiction… |

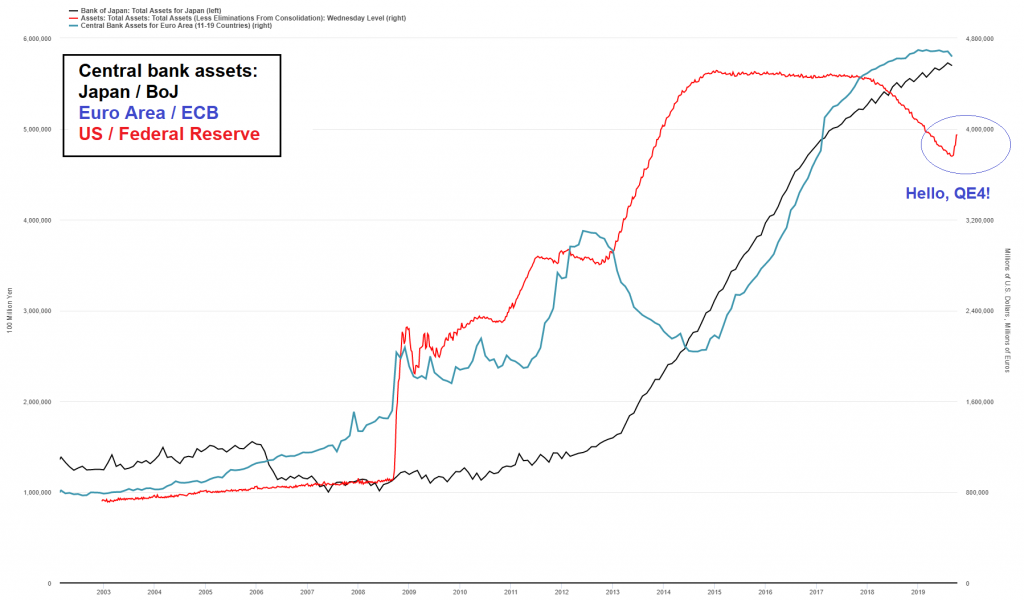

Bloated central bank balance sheets, 2003-2019Bloated central bank balance sheets – note that no matter what it is called, “QE4” has in fact begun with the recent liquidity injections in support of o/n repo markets. Evidently the Fed’s balance sheet is expanding again. It remains to be seen to what extent the money supply will be affected, but our guess is that these amounts will essentially translate into deposit money at a 1:1 ratio (as primary dealers are legally organized as non-banks). PT |

On Monday, a new report from the Bank for International Settlements (BIS) described something that anyone who has bothered to think about it already knows. The Financial Times provided the following summary:

Perhaps Fed Chair Powell didn’t read the BIS report. Because the very next day, during a speech at the annual meeting of the National Association of Business Economics, Powell said the Fed would soon start again doing precisely what the BIS report said has a negative impact on financial markets:

Somehow, Powell does not consider this to be quantitative easing (QE):

|

“Ressssservesssss… resssservessss….” Don’t call it QE, or it will bite you. PT |

The fact is, balance sheet growth is quantitative easing regardless of whether Powell says it is for “reserve management purposes.” Moreover, despite its negative impact on financial markets, he must expand the Fed’s balance sheet further. If he stops now, the financial system melts down.

Do you get it?

Powell must damage tomorrow’s credit markets so they can function today. He must destroy the credit markets to save them. In short, we are doomed.

Tags: central-banks,Featured,newsletter,On Economy,On Politics