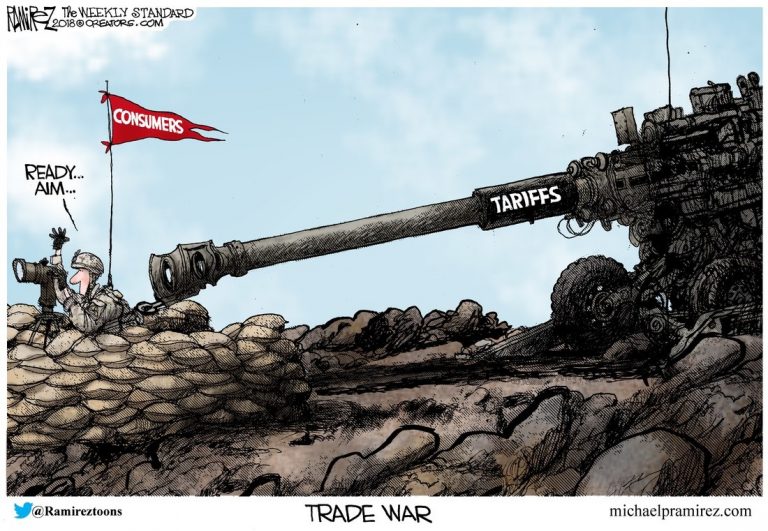

Interesting Times Arrive “Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee. Ancient Chinese curse alert… - Click to enlarge “One moment markets are gorging on financial slop like fat pigs in mud. The next they’re collectively vomiting on themselves. I’ll tell you one thing. President Trump’s trade war with China won’t end well. I mean, come on. China’s outplayed the U.S. at this game for over a quarter century. They have the upper hand. “Besides, what’s the point? If we no longer buy stuff from China, then how will China buy Uncle Sam’s debt? And the timing for all this couldn’t be worse.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, Humor, newslettersent, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Interesting Times Arrive“Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee. |

|

| “One moment markets are gorging on financial slop like fat pigs in mud. The next they’re collectively vomiting on themselves. I’ll tell you one thing. President Trump’s trade war with China won’t end well. I mean, come on. China’s outplayed the U.S. at this game for over a quarter century. They have the upper hand.

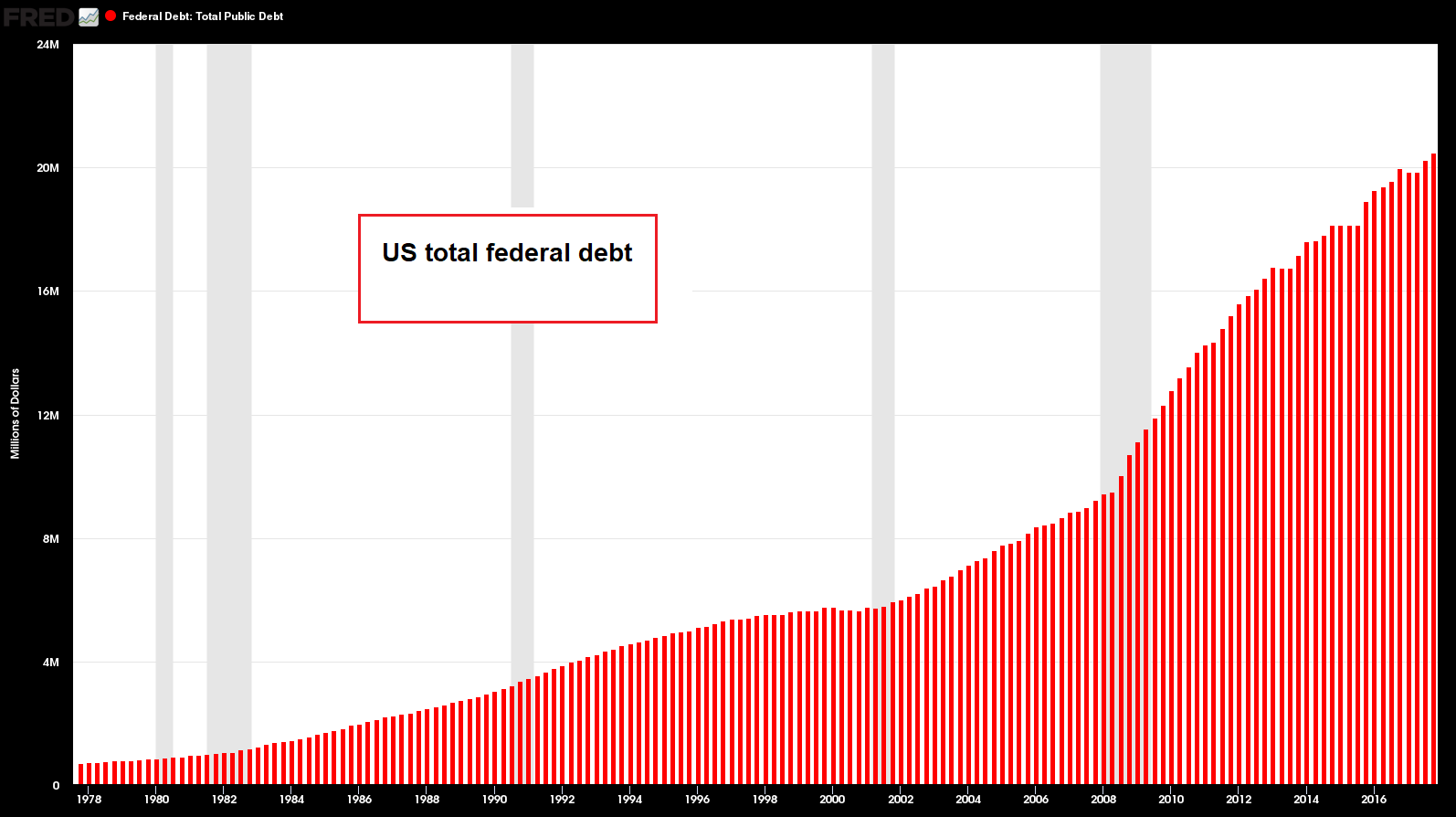

“Besides, what’s the point? If we no longer buy stuff from China, then how will China buy Uncle Sam’s debt? And the timing for all this couldn’t be worse. Deficits are spiraling out of control. We’re talking $1 trillion or more a year for the next decade. I don’t see any way out of this quagmire, do you? “Printing money to buy government debt is no solution at all. And a trade war will just hasten America’s insolvency. What is it that Trump thinks he’ll accomplish, anyway? “I’ve also heard that China’s tickled the debt poodle way more than we have. So they may be worse off at absorbing an economic shock than us. But I wouldn’t bet my life on it. “Obviously, like I said, this won’t end well. Yet there’s no turning back now. The trade war genie’s already out of the bottle. That’s easy enough to see. And maybe President Trump is right, and a trade war with China is warranted. |

|

| “But in the end, something big – like a massive fighting war or worldwide depression – will need to happen before this genie can be put safely back inside the bottle. How do I know this?

“I know this because this is how these peacocks on the walk contests always play out. The invisible line has been crossed. Trump and Xi Jinping have both gone all in. There’s no backing up. There’s no walking away. They’ll keep chest bumping each other until something serious happens. Then it will really be game on.” |

US Federal Debt, 1978 - 2018 |

Integration and DisintegrationCertainly, our colleague brings up some good points. Is a trade war upon us? If so, where will it lead? Here we take a deep breath, and a sip of coffee, and endeavor to offer some perspective. Expansions and contractions in global trade have rotated back and forth over long secular trends for thousands of years. The Silk Road, for example, was established by the Han Dynasty of China in 130 BC. This trade route provided continuous conduit for the exchange of goods, culture, and knowledge, between east and west for nearly 1,600 years. Trade along the Silk Road came to an abrupt end when the Byzantine Empire fell to the Turks in 1453 AD. For whatever reason, maybe a madman was President, geopolitical trends turned inward towards isolation. The Ottoman Empire closed the Silk Road and cut all ties with the west. |

|

| Global trade these days is conducted by shipping cargo across the international waters of the high seas. Trade cycles over the last 200 years have often expanded for such a lengthy duration that several generations will come and go while only knowing the expansionary half of the trend. These extended expansionary episodes compel people to believe that increased global trade is a linear phenomenon.

You have to go back to pre-1960 in the United States, Japan, and Western Europe to find someone with living memory of a global trade contraction. China’s latest trade expansion began in the 1970s. Eastern Europe’s began in the early 1990s. Just because global trade has expanded for the last 50 years doesn’t mean it will continue to expand without interruption. In fact, geopolitical shocks have periodically disrupted or reversed overall long-term trends in expanding global trade. According to the World Trade Report 2013:

|

|

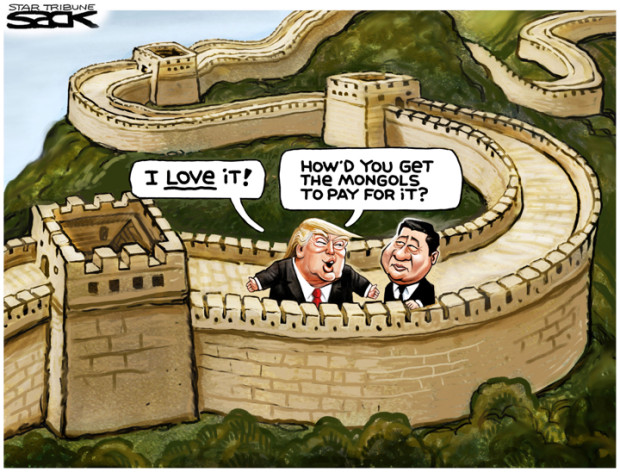

Trade War Game On!Presently, it’s unclear if we’re in the early stages of a global trade contraction. The trend in expanding global trade appears to have slowed over the last decade, following the 2008 financial crisis. The budding trade war between the United States and China just might be the geopolitical shock that closes out the ‘second age of globalization.’ |

|

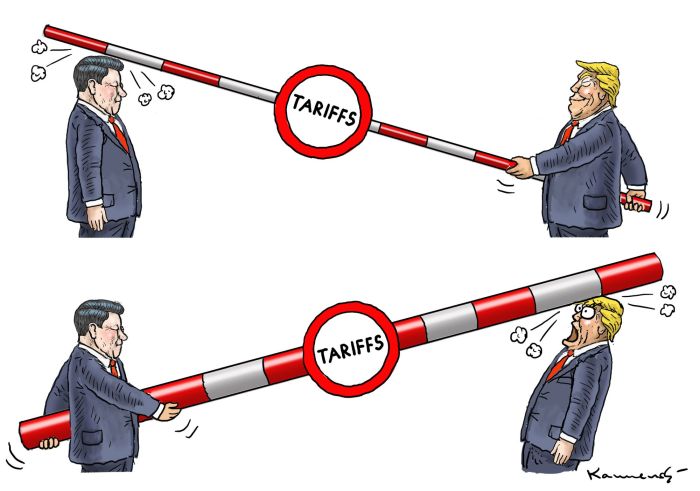

| This week Trump and Xi likely pushed the trade war past the point of no return. They called each other’s bluffs and raised the stakes as the week progressed. By Thursday things had hit a fever pitch.

Our friends at Zero Hedge have been closely monitoring the situation. Here are several choice quotes they alerted us to from an editorial published in the Global Times, China’s state-owned party mouthpiece:

|

|

| By Thursday evening Trump had ordered US Trade Representatives to consider raising Chinese import tariffs an additional $100 billion, from $50 billion to $150 billion. | |

| Several hours later, “Beijing vowed to defend China’s national interest against U.S. trade actions and protectionism.”

Now we’re talking. Trade war game on! |

Chart by: St. Louis Fed

Chart and image captions by PT

Tags: Featured,Humor,newslettersent,On Economy,On Politics