Coming and Going Like a Wildfire Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace. The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping 38.85 percent in just three months. The economy, on the other hand, was severely scorched. Decades of debt had built up like dead wood amongst a forest under-story. Then, at the worst possible time, government lockdown orders sparked a match and set it ablaze. The results were predictable to everyone but the

Topics:

MN Gordon considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, 7) Markets, Central Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

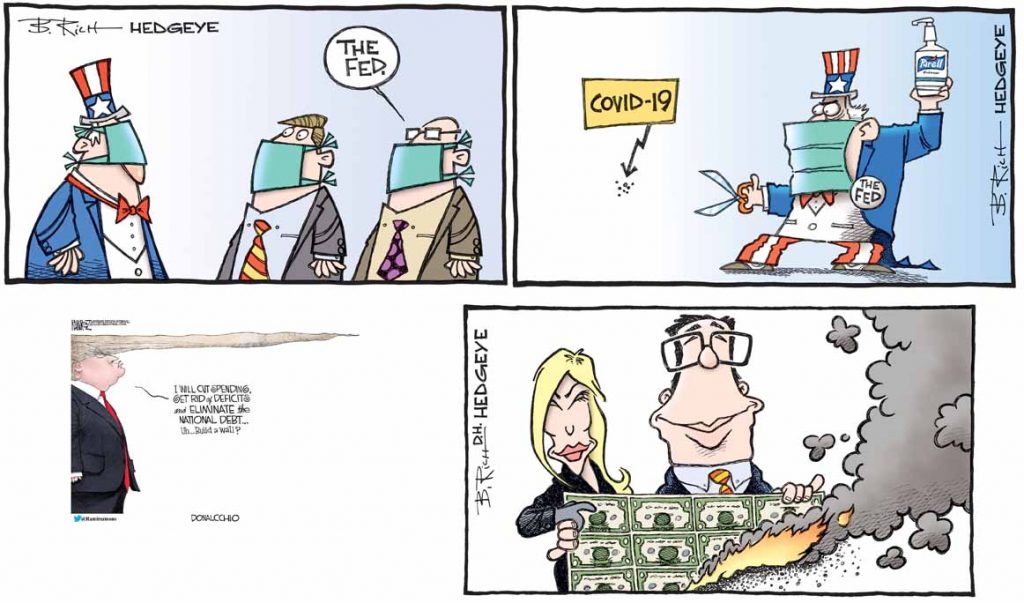

Coming and Going Like a WildfireSecond quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace. The Dow booked its best quarter in 33 years. The S&P 500 posted its best performance since 1998. And the NASDAQ had its biggest increase since 1999… jumping 38.85 percent in just three months. The economy, on the other hand, was severely scorched. Decades of debt had built up like dead wood amongst a forest under-story. Then, at the worst possible time, government lockdown orders sparked a match and set it ablaze. The results were predictable to everyone but the experts. Supply chain disruptions followed by retail disruptions, followed by declining sales, followed by disappearing cash flow, followed by layoffs, followed by business closures, followed by shrinking tax receipts, followed by no longer serviceable public and private debt, followed by mass bankruptcies, followed by riots, followed by full societal breakdown. The economic wildfire raged through so fast most people don’t comprehend what has happened. The interim solutions from Washington, in concert with the Federal Reserve, have been to add more fuel. That is, the solutions have centered around mega efforts to paper over the economic depression with massive amounts of fake money. |

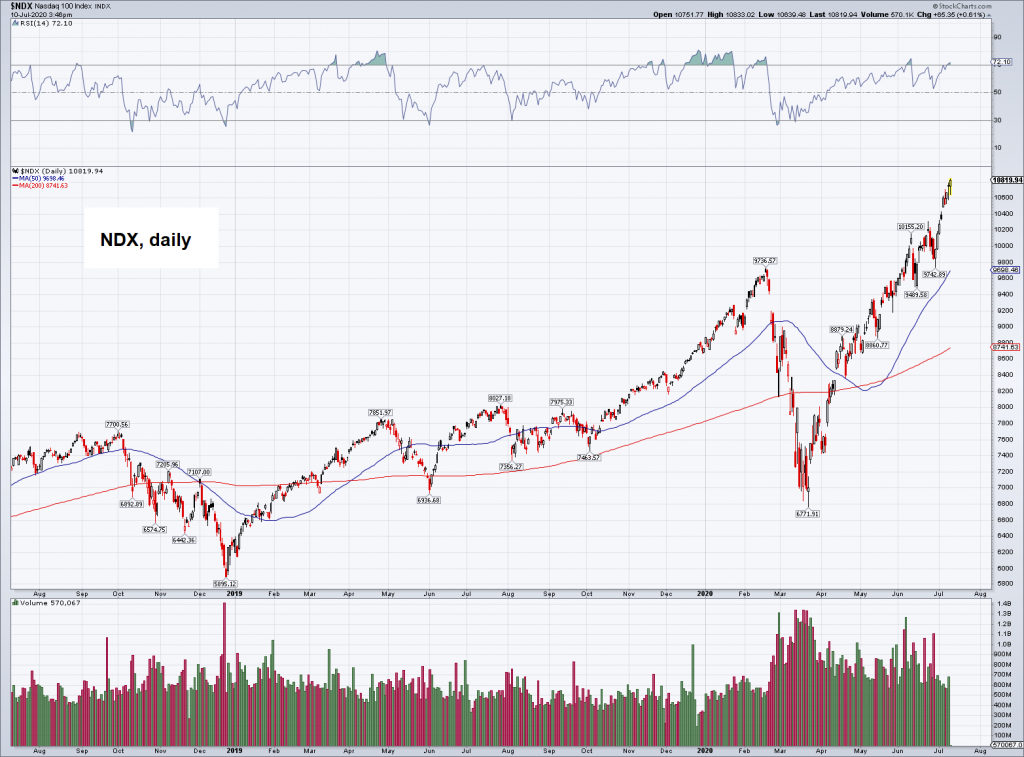

Nasdaq 100 (NDX), dailyThe Nasdaq 100 (NDX), daily – the strongest of the major US stock indexes. Since its 2019 low it has roughly doubled. Needless to say, neither the economy nor corporate profits are twice as good as they were in 2019. PT |

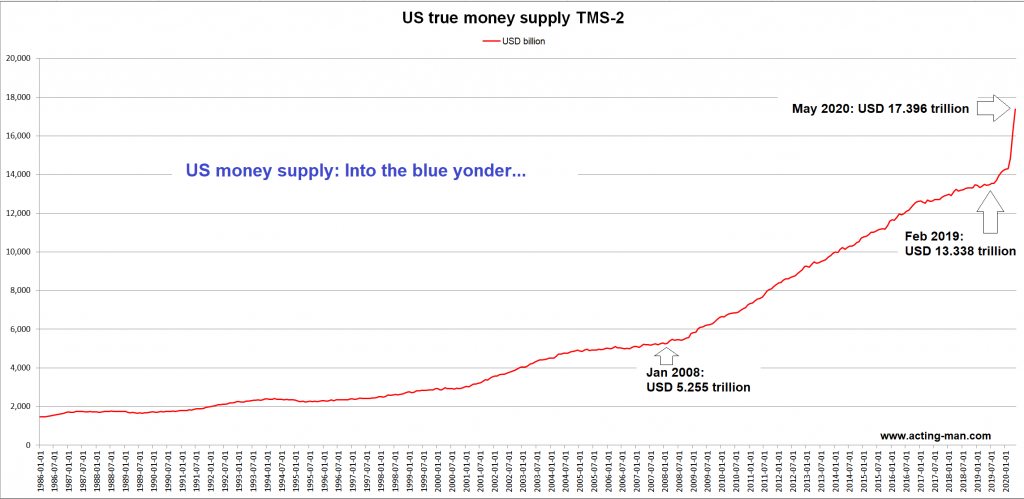

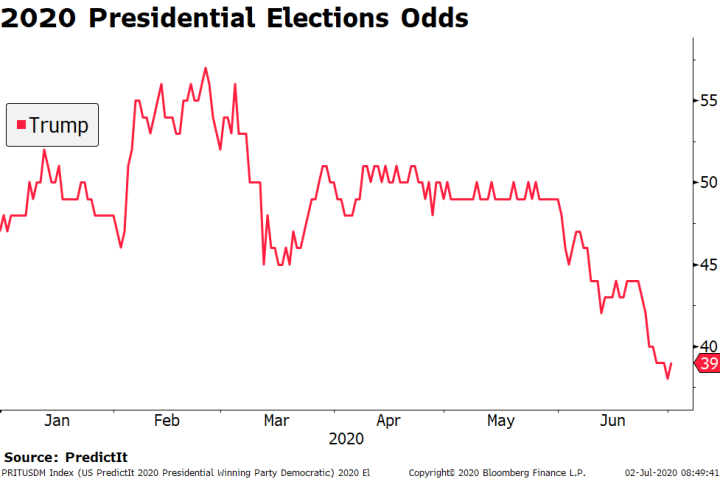

Money Printer Go BRRRMass corporate bailouts were just the beginning. Payroll Protection Program (PPP) loans were made to over 650,000 small businesses, including presidential candidate Kanye West’s clothing brand, Yeezy, and Grover Norquist’s anti-tax group, Americans for Tax Reform. On top of that, the Fed began creating money from thin air for the purpose of buying individual corporate bonds. As of June 28, the Fed’s bought $428 million worth of corporate bonds in 86 different companies. These companies include Berkshire Hathaway Energy, McDonald’s, Southwest Airlines, CVS, AT&T, Boeing, Coca-Cola, Exxon Mobil, Ford, Walmart, United Health Group, Philip Morris International, and many, many more. The CARES Act also gifted the lowly working stiff a $1,200 stimulus check. But it was the unemployed who really made out. Roughly 20 million unemployed Americans scored an additional $600 weekly payment to supplement their existing unemployment benefits. Has being unemployed ever been more lucrative? But, alas, for every beginning there is an end. The $600 weekly additional CARES Act payments are scheduled to end on July 31. The problem, however, is that many of the jobs lost because of government lock-downs aren’t coming back. So what’s an activist government to do? Currently, a second round of stimulus checks is already a foregone conclusion. In fact, Senate Majority Leader Mitch McConnell plans to hammer out the package when the Senate returns from recess between July 20 and August 7. According to Treasury Secretary Steven Mnuchin, the Treasury’s queuing the checks up so they can be sent out “very quickly”. And President Trump wants the checks to be “larger”. Who gets free money, and how much, is what the Senate will be hashing out later this month. As you can see, the solution of the central planners and policy makers, in essence, is printing press money. As in, money printer go BRRR. Yet how much more fake money can be emitted before there is a serious dollar devaluation? We may soon find out… |

Broad true US money supply TMS-2 |

Game Over SpendingThe realities of the madness are too awful for most journalists to offer any real deep analysis. The U.S. budget deficit in June was $863 billion. For perspective, an annual budget deficit of $863 billion is enormously massive and fiscally unsustainable. And yet, the U.S. government has just racked up $863 billion in debt in just one month. For additional perspective, the budget deficit for June 2019 was $8 billion. Hence, the deficit for June 2020 has increased 101x compared to June of last year. This, no doubt, is game over spending; desperate actions by a desperate government to keep this sucker from going down. Nonetheless, the mass emissions of printing press money will ultimately make a bad situation worse. Instead of just an economic depression and a financial crisis, we will also get a dollar crisis. This is how game over spending works. Here we turn to Jeffrey Gundlach, CEO of DoubleLine Capital, for clarification of what is at stake:

Indeed, the systematic destruction of the dollar, as a matter of policy, has grave consequences. Something big and ugly is coming. In anticipation of this, gold just hit a nine-year high and is closing in on its all-time high of $1,921 reached in September 2011. Make of it what you will, gold’s shine as a permanent and enduring store of wealth has ultra-luster in the face of the federal government’s game over spending. |

Charts by stockcharts, acting-man.com (data source: St. Louis Fed)

Tags: central-banks,Featured,newsletter