Planning on Your Behalf Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life. Your future earnings are being directed to boondoggles galore. Yet these claims are in addition to everything Washington has already signed you up for. At last count of the U.S. National Debt, every American citizen’s on the hook for nearly ,000. Add U.S. Unfunded Liabilities – which includes Social Security, Medicare Parts A, B, and D, federal debt held by the public, plus federal employee and veteran benefits

Topics:

MN Gordon considers the following as important: 6b.) Acting Man, 6b) Austrian Economics, 7) Markets, Featured, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Planning on Your BehalfWatch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life. Your future earnings are being directed to boondoggles galore. Yet these claims are in addition to everything Washington has already signed you up for. At last count of the U.S. National Debt, every American citizen’s on the hook for nearly $70,000. Add U.S. Unfunded Liabilities – which includes Social Security, Medicare Parts A, B, and D, federal debt held by the public, plus federal employee and veteran benefits – and each citizen owes almost $383,000. And this sum is going to double in the years ahead faster than you can say lickety-split. These professional economists, enamored by the genius of their graphs, see the recessions of tomorrow and know just how to prevent them. Their master plan for reversing a recession before it strikes amounts to preemptive stimulus. What’s more, in concert with Washington’s professional politicians, they are laboring day and night to roll out their bold plans before it is too late. Fiscal space don’t know how much there is, but there is clearly more. Magic money a bunch of light bulbs that went off in a bunch of politicians’ heads. Unmet social needs opportunities to spend. A generous spending package $1.7 trillion. An excuse for fiscal action fighting climate change. Automatic programs sending checks to households as soon as a recession starts. As you can see, the pros are on the case… |

Strange and strangely persistent beliefs… PT |

‘Don’t Fret About Debt’These – and many other – preemptive stimulus plans were outlined in a recent Reuters article. The article, if you happened to miss it, was titled: In planning for next U.S. recession, economists say, don’t fret about debt. What to make of it? Here at the Economic Prism we relish bumper sticker wisdom like we relish political campaign slogans. A colorful mix of mindless absurdity appears when something is distilled down to several words or less. Plus, when the expression rhymes… it is just the cat’s meow. Without question, ‘don’t fret about debt’ is a fine – and poetic – example of everything that is wrong with everything. As far as we can tell, no one has fretted about the debt for at least a generation or two. In fact, the 21st century has been one big fat debt binge. |

The wonderful sinkhole legacy (admittedly this doesn’t matter, since we are all fated to burn to a crisp in 12 years anyway… or 18 months if you prefer. It depends on which eminent scientific authority one believes, Ms. AOC or Prince Charles). PT |

| The reality is the growth of federal debt has been out of control for decades. The solution that is always repeated for reeling this back is that, somehow, the economy will grow its way out of it. This has yet to transpire, despite a variety of policies over the years that have generally involved borrowing money from the future and spending it today.

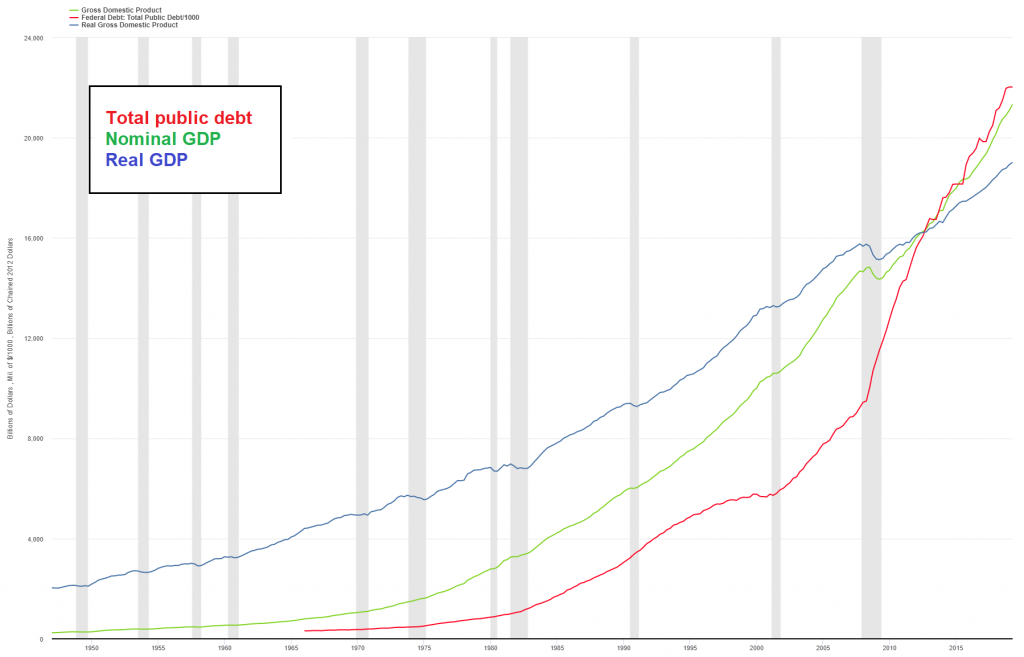

The simple fact is you cannot grow your way out of debt when the debt is increasing faster than gross domestic product (GDP). For example, in 2000 the federal debt was about $5.6 trillion and real U.S. GDP was about $12.5 trillion. Today the federal debt is over $22.8 trillion and real U.S. GDP is about $19.02 trillion. In just 19 years the federal debt has increased by over 307 percent while real U.S. GDP has increased just 52 percent. This, by all practical means, is the opposite of an economy that is growing its way out of debt. Moreover, these diverging trajectories are the opposite of what happens when people fret about debt. |

Federal debt vs. nominal and real GDP |

America’s Road Map to $40 Trillion National Debt by 2028When people fret about debt, they tighten their belts, spend less than they make, and pay down what they owe. Instead, public and private debt has rapidly outpaced economic growth. And now, with professional economists and professional politicians tripping over themselves to borrow money and spend it, things are about to really get ugly. The professional economists that were quoted in the article, the ones that say ‘don’t fret about debt,’ include: Karen Dynan (former Fed and Treasury official now at the Peterson Institute for International Economics), Julia Coronado (former Fed staffer and founder of Macropolicy Perspectives Consultants), Catherine Mann (global chief economist at Citi), and Laurence Meyer (former Fed governor). Certainly, these – and many other professional economists – are the same pickle heads that got us into this mess to begin with. A twisted place, where preemptive stimulus is the standard operating procedure (SOP) for scientific management of the economy. No doubt, the professional politicians love it. Preemptive stimulus and other popular delusions, like MMT, give them carte blanche power to rack up debt on an enormous scale. |

Papering the world to prosperity. Rumor has it that it has worked wonders on many occasions in the past. From Diocletian’s crumbling empire to John Law’s Mississippi adventure to Weimar Germany to Zimbabwe – everywhere this wondrous device created entire populations of billionaires in no time at all. When it hasn’t worked, it was presumably just not done right. PT |

| Alas, with the pros in charge, America is en route to $40 trillion national debt by 2028. The road map to get there from here has little to no resistance…

The federal budget deficit for fiscal year 2019 was nearly a trillion dollars. Project that out over eight years and the national debt has jumped to $30 trillion – but remember, the economy was growing in 2019. At some point over the next eight years, the economy will fall backwards. The deficit will quickly jump to $2 trillion. Then the professionals will spring into action… They will push through a $1.7 trillion spending package – on top of a $2 trillion deficit. They will take the fight to the scourge of climate change. They will send out automatic checks. They will redistribute wealth. They will fabricate nonsense jobs for everyone. They will take a massive whack at abolishing poverty. They will marshal all forces and laser focus them on the task of delivering the new earth. By 2028 – or earlier – America will have a $40 trillion national debt with little of value to show for it. Consumer prices will be sky-high. The citizenry will be forever upside down. And the schemers in Washington will hatch even greater plans to save us from the mess of their making. This, of course, assumes catastrophe doesn’t strike first. |

Future possibilities: considering the proclivities of the politicians who have publicly come out in support of “MMT”, one possibility is clearly a future in which we eventually end up being regaled with images of vaguely aggressive-looking, square-jawed wielders of red flags and hammers & sickles, their determined gaze fastened on the glorious socialist paradise right around the corner. For some reason Marxists seem to believe that such imagery is inspirational and makes everyone pine for socialism. That alone strongly suggests that the cupboard of these people is short a few plates. But there is a more benign possibility – namely that they will mistakenly conclude that MMT stands for mold-making technology and will therefore put Izzy in charge. The only drawback would be that the new mold-maker is apparently a real butcher. PT |

Chart by St. Louis Fed

Chart and image captions by PT

Tags: Featured,newsletter,On Economy,On Politics