Trade Deficit with China Widens on Trump’s Watch Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again. Photo credit: Jonathan Ernst / Reuters - Click to enlarge We are often willing to give Donald Trump the benefit of the doubt, despite the fact that his delivery needs a lot of work. Considering his enemies and most vociferous detractors, we reckon he must be doing something right; but we vehemently disagree with his views on trade, some of which are unfortunately becoming

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Trade Deficit with China Widens on Trump’s WatchMost things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again. |

We are often willing to give Donald Trump the benefit of the doubt, despite the fact that his delivery needs a lot of work. Considering his enemies and most vociferous detractors, we reckon he must be doing something right; but we vehemently disagree with his views on trade, some of which are unfortunately becoming policy now. As Murray Rothbard once noted: “[P]rotectionist arguments, many plausible at first glance, are really a tissue of egregious fallacies. They betray a complete ignorance of the most basic economic analysis. Indeed, some of the arguments are almost embarrassing replicas of the most ridiculous claims of 17th-century mercantilism: for example, that it is somehow a calamitous problem that the United States has a balance-of-trade deficit, not overall, but merely with one specific country.” At the time Rothbard penned these words, Japan was in the position China finds itself in now; the Japanese stood widely accused of practically bankrupting the US by means of a nefarious scheme that consisted of providing US consumers with cheap high quality consumer goods and investing large amounts of money in the US. The hand-wringing over this was just as ridiculous then as that over China is now. Recently the POTUS imposed punitive tariffs on washing machines and solar panels. The winners: Whirlpool and two bankrupt solar panel manufacturers that aren’t even US-owned companies. The losers: every US consumer and the entire rest of the US solar industry! As noted in this Reuters article: “President Donald Trump on Tuesday signed into law a steep tariff on imported solar panels on Tuesday, a move billed as a way to protect American jobs but which the solar industry said would lead to tens of thousands of layoffs.” Winning! |

In May 2016, he even told a campaign crowd:

Yet as Trump approaches the conclusion of his first year in office, he’s achieved the exact opposite of what he said. The trade deficit with China hasn’t gotten smaller. It has gotten bigger. Actually, it has gotten a lot bigger. For example, the U.S. trade deficit with China from January through November 2017 was approximately $342 billion. Over this same period in 2016, the trade deficit with China was $317.4 billion. This amounts to a 7.7 percent widening of the U.S. trade deficit with China that has occurred on Trump’s watch. What gives? Is China better at manipulating its currency than the U.S.? Does China somehow outplay the U.S. when it comes to both trade strategy and strategery? Certainly, The Donald will get to the bottom of it… |

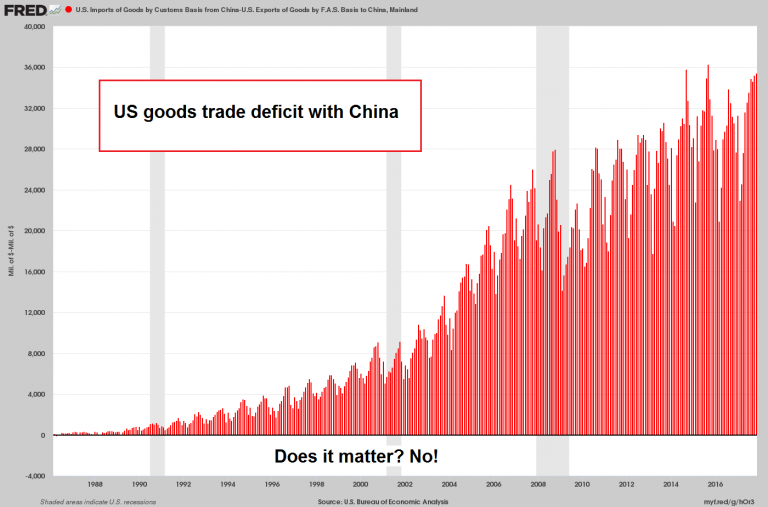

US Goods Trade Deficit with China, 1988 - 2018As we often point out in these pages, aggregated economic data as a rule tend to obscure more than they reveal. Data on the trade balance between countries – especially large countries – are standing out in this respect, as they are particularly useless. It may well be that the negative connotations of the term “deficit” make it easy to believe that a trade deficit must be somehow be “bad” – but one has to keep in mind that a trade deficit is merely mirroring an offsetting capital account surplus. Rothbard referred to trade deficits as “a pseudo-problem created by the existence of customs statistics”, which is hitting the nail on the head. He also remarked: “Protectionism is simply a plea that consumers, as well as general prosperity, be hurt so as to confer permanent special privilege upon groups of less-efficient producers, at the expense of more competent firms and of consumers”. We would add to this that instead of interfering with trade and arbitrarily picking winners and losers, the president would do better to focus on the real problem, which is the creation of enormous amounts of money ex nihilo enabled by the central bank-administered fiat money system. |

Unintended ConsequencesEarlier this week President Trump called up Chinese President Xi Jinping to have a frank phone conversation on the matter. From what we gather, Trump “expressed disappointment that the United States’ trade deficit has continued to grow.” We don’t know what Xi said in response. But what he could have said was, “Donald, you ain’t seen nothin’ yet!” One of the unintended consequences of increasing the budget deficit to pay for the GOP tax reform bill is that it also increases the trade deficit. In other words, the budget imbalance between taxes and government expenditures has a direct impact on foreign trade imbalances. In an article published in Asia & the Pacific Policy Studies, economist Ralph W. Huenemann explains:

So if Trump doesn’t want a trade deficit with China then he needs to reduce the government’s budget deficit. However, reducing the government’s budget deficit is near impossible under the new GOP tax reform bill. Hence, President Trump is left with a weak hand of bluster. |

|

Tax Reform and Trump’s Chinese Trade Deficit ConundrumThis week Reuters released parts of its exclusive interview with President Trump. On the prospect of a trade war with China, Trump remarked that he hopes a trade war won’t ensue, “But if there is, there is.” Trump also commented that any change in China’s purchases of U.S. Treasuries would not hurt the U.S. economy. This is because, according to Trump, “everybody wants to buy Treasuries.” Let’s hope Trump knows what he’s talking about. At the moment, China and Japan account for one-third of all foreign-held Treasuries. However, China has recently tapered back its Treasury holdings to a four month low. And Japan has reduced its Treasury holdings to a four year low. But maybe Trump is right. Maybe China and Japan don’t matter. Maybe someone else – like the Swiss National Bank – will pick up the slack to finance Trump’s deficit. Still, what would this get him? It wouldn’t address his trade deficit conundrum; rather, it would make it worse. The point is attempting to spend a nation to prosperity using borrowed money is not without consequences. In the short run, an illusion of wealth can be created. In the long run, the illusion slips into decay and disrepair at the precise moment the bill comes due. This is one of the tradeoffs of deficit spending based government stimulus that politicians fail to mention when promising free lunches. Any economic boost that deficit-financed tax reform delivers will be short-lived. Quite frankly, such a contrived economic boost is akin to burning one’s furniture to stay warm. The heat it produces feels good while it lasts. But once the furniture is all burned up, it’s game over. |

As an aside, although the US trade deficit with China remains quite high (which is actually a sign that the economy was recently strong), gross US exports to China have nevertheless reached a new record high as well. |

Tags: Featured,newsletter,On Economy,On Politics