A New Year of Symbiotic Disharmony The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control. Certainly, your ability to stop your neighbor’s cat from relieving itself in your side yard is limited, barring extreme measures. What we mean is each day shall unfold before you – both good and bad – in symbiotic disharmony. You can count on it. But what are the specifics and particulars for the year ahead? What about stocks, the

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

A New Year of Symbiotic DisharmonyThe New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control. Certainly, your ability to stop your neighbor’s cat from relieving itself in your side yard is limited, barring extreme measures. What we mean is each day shall unfold before you – both good and bad – in symbiotic disharmony. You can count on it. But what are the specifics and particulars for the year ahead? What about stocks, the 10-Year Treasury note, gold, bitcoin, and everything else? Are we fated for World War III? Will this be the year Hillary Clinton finally croaks? Today we endeavor to answer these questions – and more – with hesitation and humility. Obviously, predicting the future is more art than science. But so is Fed monetary policy, or a charted wave pattern that extends resistance and support lines out into the future. |

|

Predictive Methodology and Disclaimer“Past performance is no guarantee of future results,” counsels your broker. Thus, we eschew common forecasting techniques for a conjectural approach. We look to connect seemingly unrelated big picture nodes with the illogical grace of an Irish joke. To be clear, our methodology is as unscientific as your street corner palm reader’s. First, we engage all matters of fact, fiction, fakery, and fraud. Then, through induction, deduction, biased interpolation, and metaphysical reduction, we arrive at precise, unequivocal answers. But before we get to it, a brief disclaimer’s in order. This proviso from King Solomon should suffice:

Hence, today’s windbag contemplations are foolish in nature. Perhaps, they’re even being offered by a complete fool. You can decide and let us know. With that out of the way, we sharpen our pencils and face our limitations. What follows, for fun and for free, are several simple suppositions and suspicions for the year ahead. The only thing we ask of you in exchange for these utterances is to consider printing this out and thumb-tacking it to your office cork board. That way you can cross each prediction off as it comes to pass. |

King Solomon, the Queen of Sheba, their closest advisors and Fido meet in the antechamber to the temple’s small conference room. - Click to enlarge Less close advisors are waiting in the background. By dint of his wisdom, King Solomon proved to be a prolific fount of highly quotable sayings, which he bequeathed to posterity. We’re not sure what happened to the conference room. His advice against making predictions is traditionally widely ignored, despite the demonstrable fact that predictions are extremely resistant to correctness and improvement. Naturally, we won’t stand in the way of this well-worn tradition. |

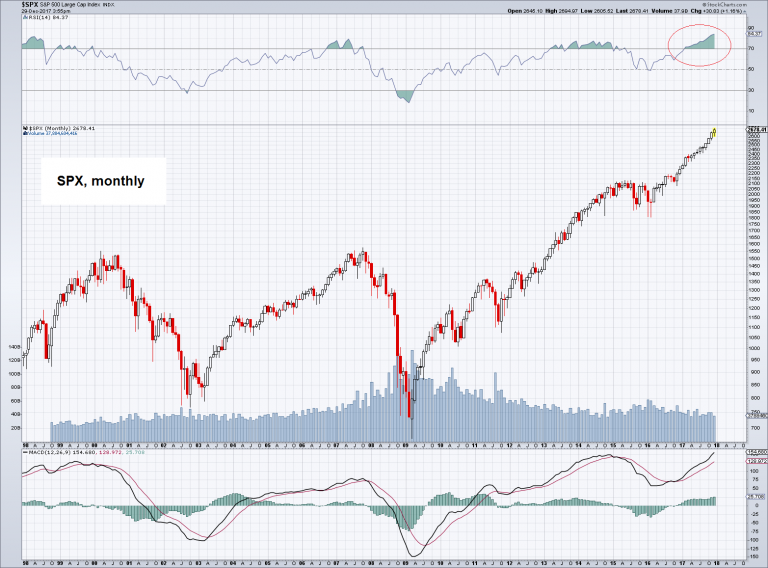

Several Simple Suppositions and Suspicions for 2018StocksTo begin, the animal spirits and bullish market optimism of President Trump’s first year in office will extend well into the New Year. The GOP tax reform bill should deliver a great short-term boon to businesses and corporate earnings. This will provide a further boost to the stock market via corporate share buybacks – bringing the Dow Jones Industrial Average to just a hair above 28,152. Nevertheless, the Federal Reserve’s efforts to reduce its balance sheet and raise the price of credit will ultimately exhaust the 9 year bull market. Sometime around late-summer the stock market will crack. An abrupt 10 percent correction will occur. Algorithmic traders will buy-the-dip as they’re pre-programmed to do. Stocks will quickly bounce upward and approach their all-time high like they have following every other market blip since 2009. However, this time a new all-time high will not be attained. Shrewd investors will sell the bounce and exit to the safety of cash. By October, pre-programmed buying will morph to pre-programmed selling, and an abrupt collapse will be triggered. Valuations will once again matter. A multi-year bear market will commence that will eventually end in the early part of the next decade, following a 60 percent decline of the S&P 500. But that’s nothing. Treasury investors are in for a much greater level of capital destruction. |

SPX Monthly, Aug 1998 - Dec 2017 A bubble in a class of its own. It doesn’t happen very often that the monthly RSI on the SPX reaches 85. - Click to enlarge We’re not sure how much longer the party can last, but luckily everybody else seems to be absolutely certain about the way forward. |

TreasuriesAs we close out the year, the yield on the 10-Year Treasury note has quietly inched up above 2.4 percent. From a historical perspective, this is extraordinarily low. But in early-July 2016, the 10-Year Treasury note bottomed out at just 1.34 percent. In other words, the yield has increased nearly 80 percent over the last 18 months. What to make of it? The last time the interest rate cycle bottomed out was during the early-1940s. The low inflection point for the 10-Year Treasury note at that time was a yield somewhere around 2 percent. After that, interest rates generally rose for the next 40 years. The high inflection point for the rising part of the interest rate cycle was in 1981. At the peak, the 10-Year Treasury note yielded over 15 percent. Bond prices – which move inverse to yields – had been going down for so long that Dr. Franz Pick declared them to be “guaranteed certificates of confiscation.” Pick, who was in his 80s, was looking backward, not forward. Perhaps if he’d looked forward – and peered over the yield summit – he’d have seen the forthcoming 35 year soft, slow slide in interest rates before his eyes. Of course, these broad trend reversals are only recognizable in hindsight. So, what about now? Could it be that credit markets are reversing, and returning to a long term rising interest rate trend? Quite frankly, we don’t know. We’ve been anticipating the conclusion of the great Treasury bond bubble for at least 8 years. Over this time, we were consistently fooled by a variety of head fakes. Instead of going up over the last 8 years like we thought they would, yields have gone down – and then they’ve gone down some more. The best rationale we can surmise is that the fiat based paper money system, and extreme central bank intervention, has served to push rates down well beyond what is honestly conceivable. Nonetheless, we’re confident that markets – and a determined Federal Reserve – will eventually succeed in reversing the long-term interest rate tide. Moreover, we’re highly confident that 2018 will be the year that yields commence their long-term rise in earnest. After 8 years of being wrong, it’s about time we got it right. The price of credit will steadily become more and more expensive over the next several decades. This one thing will change everything. |

Treasury Bond Yields, 1940 - 2017The bottoming phase in yields in the 1940s took quite a long time. JGB yields have likewise proved upside-resistant in recent years; many traders have tried to short JGBs over the years, all have failed dismally. It remains to be seen how resilient treasuries will turn out to be. |

GoldIf you haven’t noticed, gold has had a terrible run since peaking out at $1,895 per ounce in 2011. Gold fell to around $1,200 at the start of 2015. Then it slid to $1,060 per ounce by the close of 2015. That’s a loss of about 44 percent in dollar terms. At the close of 2017, gold is priced at about $1,290 per ounce. The trends that pushed gold up 645 percent from 2001 to 2011 are still in place. The federal debt – now over $20.6 trillion – continues to rise unabated. The dollar’s status as the world’s reserve currency continues to become increasingly suspect. The broad realization that the recovery’s a sham and that Fed monetary policy has inflated asset prices to a speculative mania will eventually prick the stock market bubble. The chickens of reckless money printing, unabated debt growth, and ultimate inflation, will come home to roost. Gold will inevitably resume its uptrend as the safe haven of last resort. As of late-2017, despite the awful beating over the last several years, gold’s price has stabilized and is setting up for a considerable rebound. What’s more, gold mining stocks are incredibly cheap. Quite frankly, this could be the mother of all speculations. |

Gold Continuous Contract, 1981 - 2017 At the late 2015 low in gold, a long term Coppock curve buy signal was given and confirmed by the curve first turning up from a higher low relative to a lower price low in gold, and then climbing above the zero line. - Click to enlarge Recently a third upturn in the Coppock curve has begun to take shape, which suggests that the long term advance in gold is likely to continue. |

BitcoinThe rise of bitcoin in 2017 has been nothing short of spectacular. How high the price of bitcoin goes is partially dependent upon the rate at which the world loses faith in the dollar and all paper currencies. Nonetheless, the recent gains in bitcoin have all the characteristics of a herd driven speculative mania. Cyber-security guru John McAfee has promised to eat his most private parts – on live TV, no less – if bitcoin doesn’t hit $1 million by 2020. Now, why would McAfee make such a promise? Is he hungry? Is he mad? Or does he have complete conviction? At the same time, Peter Schiff, CEO of Euro Pacific Capital, has said bitcoin and other cryptocurrencies will drop to $0. Who’s right? Who’s wrong? As far as we can tell, both are wrong. Bitcoin’s not going to $1 million and it’s not going to $0. How’s that for a prediction? |

|

| What is certain is that the underlying blockchain distributed ledger technology isn’t going away. In fact, this technology is a game changer. In 2018, the greater population will wake up to the fact that bitcoin and other competing cryptocurrencies offer a vast improvement to the archaic and fee driven services of banks, brokers, and other financial intermediaries.

New applications of the blockchain technology will mushroom in the New Year. Forthcoming innovations in supply chain management, health care, peer to peer transactions, voting, big data, records management, cyber-security, and much, much more, will all be blockchain based. |

|

Geopolitical MadnessLike 2017, the coming year will be one of great distress. As the global economy – including the U.S. economy – approaches recession in late-2018, world leaders will seek to deflect blame from their own blunders. They’ll stumble outward in search of a greater cause to channel the frustrations of their populace towards. Global factions are on a collision course for war. We wish this weren’t so. The ongoing territorial dispute between China, Malaysia, Philippines, Taiwan, and Vietnam over the Spratly Islands in the South China Sea will intensify in 2018. Ancient territorial disagreements between Japan and China over the Senkaku-Diaoyu Islands in the East China Sea will deepen. These age-old disputes will complicate the attainment of a consensus approach to addressing the North Korean nuclear threat. This, along with the strengthening oil trade nexus of Russia, Iran, and China, and the imminent roll out of the petro-yuan, will further marginalize the United States’ influence on geopolitical matters and undermine the petro-dollar. Proxy wars will intensify in the Middle East – specifically, Syria and Yemen. Military buildups will escalate along with the insane rhetoric of national leaders. New sagas will be invented to focus public support for war. A major conflict between rival superpowers – perhaps, Iran and Saudi Arabia – will breakout by year’s end. |

Shi’ite Chief Mullah Ayatollah Ali Khamenei and Wahabbi King Salman Abdel-Aziz al-Saud, both in traditional headgear. - Click to enlarge They definitely don’t like each other much; ironically, an oppressed Shi’ite minority lives near the most important Saudi oil fields, while an oppressed Sunni minority lives near the most important Iranian oil fields… |

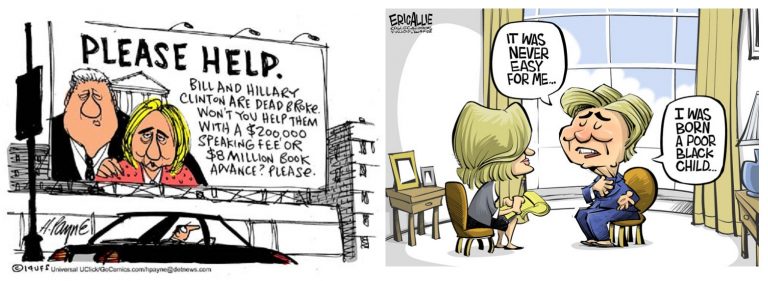

Hillary Clinton Finally CroaksThe New Year, no doubt, will be the year Hillary Clinton finally croaks – if not literally, then figuratively. Indeed, her political career is beyond resurrection. But there’s an awful lot further for her to fall. Hillary has been caught with her hand in the cookie jar one too many times. While her cohorts in the FBI did a glorious job running interference over her private server transgressions, they’ll be unable to fully cover her tracks on Uranium One related contraventions. Furthermore, President Trump has turned up the heat with his recent executive order, which targets Clinton-linked individuals and lobbyists. Hillary may be above the law; she may never go to jail. But she’ll be the equivalent of O.J. Simpson. Disrepute, distrust, and downright disgust will float around her like the repugnant odor emanating from a construction yard latrine. Not even Bill will go near her. |

Imagine being born a poor black child, and leaving the job as first Lady dead broke. This is only survivable by deft charitable foundation management, writing speeches so exciting they fetch between $250K to $500K apiece, while keeping a finger in every establishment pie. The occasional bit of warmongering also helps. |

Closing

In closing, 2018 will be a year both like and unlike any other. We hope you make the most of it – however you choose to do so.

Here’s to a healthy and prosperous New Year!

Tags: Featured,newslettersent,On Economy,On Politics