Investec Switzerland. Natalie Obiko Pearson and Katia Dmitrieva, writing for Bloomberg, look at the UBS 2016 Global Real Estate Bubble Index report. While Switzerland’s two main cities, Zurich and Geneva, are not described as having “Bubble risk” they are in the next category: “Overvalued”. Vancouver, London and Stockholm rank as the cities most at risk of a housing bubble after a surge in prices in the past five years, according to a UBS Group AG analysis of 18 financial centers. Sydney, Munich and Hong Kong are also facing stretched valuations, UBS said in its 2016 Global Real Estate Bubble Index report, released Tuesday. San Francisco ranked as the most overvalued housing market in the U.S., while not yet at bubble risk. House prices in the near-bubble cities have increased on average by almost 50 percent since 2011, compared with less than 15 percent in other financial centers, UBS said. Low interest rates, global capital inflows and optimism among investors about returns have helped to inflate values, the bank said. Vancouver – © Barbara Helgason | Dreamstime.com “A change in macroeconomic momentum, a shift in investor sentiment or a major supply increase could trigger a rapid decline in house prices,” UBS said. “Investors in overvalued markets should not expect real price appreciation in the medium to long run.

Topics:

Investec considers the following as important: Business & Economy, Geneva property bubble, Geneva property prices, Property, Zurich property bubble, Zurich property prices

This could be interesting, too:

Investec writes Federal parliament approves abolition of imputed rent

Investec writes Abolition of imputed rent gets bogged down in complexity

Investec writes Tourism one quarter of Switzerland’s traffic

Investec writes New data on Switzerland’s gender pay gap

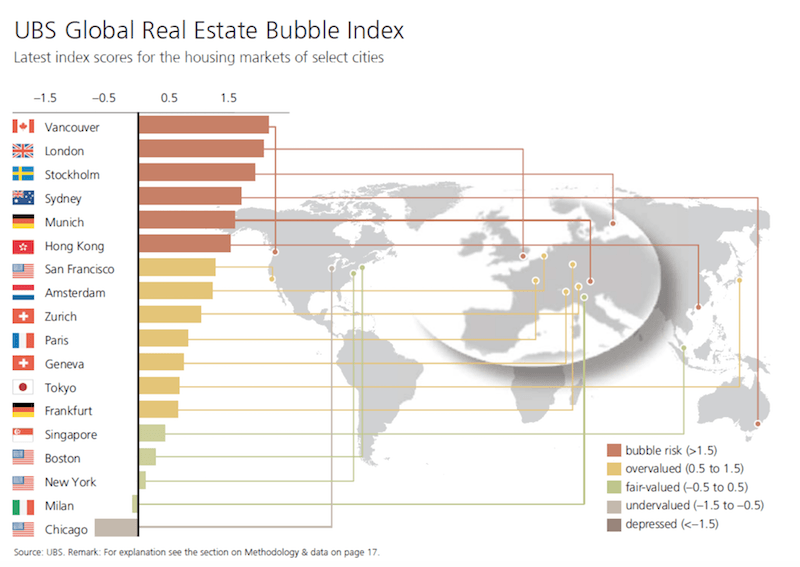

Natalie Obiko Pearson and Katia Dmitrieva, writing for Bloomberg, look at the UBS 2016 Global Real Estate Bubble Index report. While Switzerland’s two main cities, Zurich and Geneva, are not described as having “Bubble risk” they are in the next category: “Overvalued”.

Vancouver, London and Stockholm rank as the cities most at risk of a housing bubble after a surge in prices in the past five years, according to a UBS Group AG analysis of 18 financial centers.

Sydney, Munich and Hong Kong are also facing stretched valuations, UBS said in its 2016 Global Real Estate Bubble Index report, released Tuesday. San Francisco ranked as the most overvalued housing market in the U.S., while not yet at bubble risk.

House prices in the near-bubble cities have increased on average by almost 50 percent since 2011, compared with less than 15 percent in other financial centers, UBS said. Low interest rates, global capital inflows and optimism among investors about returns have helped to inflate values, the bank said.

Vancouver – © Barbara Helgason | Dreamstime.com

“A change in macroeconomic momentum, a shift in investor sentiment or a major supply increase could trigger a rapid decline in house prices,” UBS said. “Investors in overvalued markets should not expect real price appreciation in the medium to long run.”

Vancouver’s ranking soared to first from fourth place in 2015. Housing prices in the Canadian city have doubled in the past decade, prompting an outcry from local families struggling to afford homes that now chew up 90 percent of average before-tax income.

The typical detached single-family house in August was C$1.6 million ($1.21 million), according to the Real Estate Board of Greater Vancouver. The provincial government in August imposed a 15 percent tax on foreign buyers in an attempt to cool prices.

European Cities

UBS said all European cities are overvalued after low interest rates fueled an overheating of demand for urban residential properties. Amsterdam, Zurich, Paris and Geneva also ranked on its list of cities that have seen prices rise past long-term norms.

Chicago was at the bottom of the list of financial-center rankings, with prices that have failed to recover from the recession.

The survey didn’t include mainland China, where major cities have been experiencing a runaway boom, due to the lack of consistent data, a UBS spokesman said in an e-mail.

Across most global cities, buying a 60 square-meter (645-square-foot) apartment is out of reach for the bulk of people earning an average annual income in the highly skilled service sector, UBS said.

By Natalie Obiko Pearson and Katia Dmitrieva (Bloomberg)