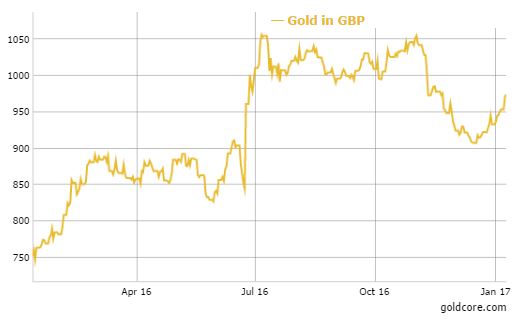

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks – Pound fell 2% against gold yesterday after Theresa May created Brexit concerns – May’s ‘Hard Brexit’ denial does not calm markets growing fears – Investors concerned about lack of government strategy and uncertainty – UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation – GBP gold builds on 31% gain in 2016 with 4% gain so far in 2017 Gold Price in GBP(see more posts on gold price, )Gold in GBP - 1 Year and Timeline (GoldCore) 1. June 24: Brexit: Gold surged 20% in sterling to £1,015/oz in two days after UK votes to leave EU 2. August 4: Bank of England expands QE - launches latest massive money printing experiment 3. October 6: “Flash crash” — pound collapses 5% against gold in just over a minute 4. January 9: Pound falls another 2% against gold as UK PM fails to reassure markets - Click to enlarge Gold rose to its highest in over one a month today as fears that the UK will have a ‘Hard Brexit’ with the EU led to safe-haven buying.

Topics:

GoldCore considers the following as important: Bank of England, China, currency, economy, Economy of the United Kingdom, European Union, Featured, flash, Gold, Gold and its price, Gold as an investment, International trade, Investment, Monetary Policy, Money, National Debt, newslettersent, Pound sterling, Precious Metals, Real estate, Reuters, Security, Silver as an investment, Sovereigns, Switzerland, Twitter, US Federal Reserve

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

|

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks – Pound fell 2% against gold yesterday after Theresa May created Brexit concerns – May’s ‘Hard Brexit’ denial does not calm markets growing fears – Investors concerned about lack of government strategy and uncertainty – UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation – GBP gold builds on 31% gain in 2016 with 4% gain so far in 2017 |

Gold Price in GBP(see more posts on gold price, ) Gold in GBP - 1 Year and Timeline (GoldCore) 1. June 24: Brexit: Gold surged 20% in sterling to £1,015/oz in two days after UK votes to leave EU 2. August 4: Bank of England expands QE - launches latest massive money printing experiment 3. October 6: “Flash crash” — pound collapses 5% against gold in just over a minute 4. January 9: Pound falls another 2% against gold as UK PM fails to reassure markets - Click to enlarge |

Gold rose to its highest in over one a month today as fears that the UK will have a ‘Hard Brexit’ with the EU led to safe-haven buying.

The pound fell sharply yesterday and gold in sterling terms rose from £954/oz to £973/oz after weekend comments from British Prime Minister Theresa May sparked concerns that Britain would drastically change trade, immigration and other relations with the EU after Brexit.

Gold has consoidated on those gains today and is over 4% higher in sterling terms so far in 2017 – building on the 31% gains seen in 2016.

The gains being seen are not simply related to Brexit. There are also substantial risks facing the UK economy in terms of the London property bubble (which shows signs of bursting), the very large UK current account deficit and the massive UK national debt.

Spot gold in dollar terms rose another 0.5% today to $1,187.60 an ounce, its highest since Dec. 5 at $1,187.61

There is also strong physical gold buying in China ahead of the Lunar New Year later in January.

Gold looks set to test $1,200 in the short term. In the coming days, attention will turn to U.S. President-elect Donald Trump’s inauguration and the geo-political and economic uncertainty regarding the next four years of his Presidency. This will likely further boost safe haven demand.

KNOWLEDGE IS POWER

For your perusal, below are in order of downloads our most popular guides in 2016:

10 Important Points To Consider Before You Buy Gold

7 Real Risks To Your Gold Ownership

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold and Silver Bullion – News and Commentary

Gold near 5-wk highs on weaker dollar, Brexit concerns (Reuters.com)

Gold hits fresh 6-week highs, then retreats (FXStreet.com)

U.S. Stocks Retreat, Treasuries Advance With Gold (Bloomberg.com)

Gold prices edge up; PGMs firm (BullionDesk.com)

Prince left behind $25 million in real estate, a cash horde, and 67 gold bars (StarTribune.com)

Gold: Getting There A Little At A Time (DollarCollapse.com)

Predicting a monetary hurricane (AgoraEconomics.com)

Era Of Cheap Money Is Ending: “This Is The Calm Before The Storm” (ZeroHedge.com)

2016: The Year Outsiders Said: “Enough!” (DavidMCWilliams.ie)

Gold Prices (LBMA AM)

10 Jan: USD 1,183.20, GBP 974.60 & EUR 1,118.12 per ounce

09 Jan: USD 1,176.10, GBP 968.75 & EUR 1,118.59 per ounce

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

Silver Prices (LBMA)

10 Jan: USD 16.66, GBP 13.73 & EUR 15.76 per ounce

09 Jan: USD 16.52, GBP 13.57 & EUR 15.69 per ounce

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

29 Dec: USD 16.06, GBP 13.10 & EUR 15.36 per ounce

Recent Market Updates

– 2016 Past is 2017 Prologue

– Gold Gains In All Currencies In 2016 – 9% In USD, 13% In EUR and Surges 31.5% In GBP

– Trump’s Twitter “140 Characters” To Push Gold To $1,600/oz in 2017?

– 2017 – The Year of Banana Skin

– US: Five Must Gold See Charts – Gold Miners Are “Running Out” of Gold

– Royal Mint And CME Make A Mint On The Blockchain?

– China Gold and Precious Metals Summit 2016 – GoldCore Presentation

– Trumpenstein ! Who Created Him and Why?

– Bail-Ins Coming? World’s Oldest Bank “Survival Rests On Savers”

– Fed’s “Fool Me…”, Silver Suppression, Euro Contagion In 2017?

– Fed Raised Rates 0.25% – Rising Rates Positive For Gold

– Shariah Gold Standard Is “Revolutionary” – Mobius

– Silver Fixing By Banks Proven In Traders Chats

Tags: Bank of England,China,Currency,economy,Economy of the United Kingdom,European Union,Featured,flash,Gold,Gold as an investment,International trade,investment,Monetary Policy,money,National Debt,newslettersent,Pound sterling,Precious Metals,Real Estate,Reuters,Security,Silver as an investment,Sovereigns,Switzerland,Twitter,US Federal Reserve