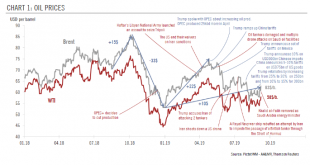

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in...

Read More »Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

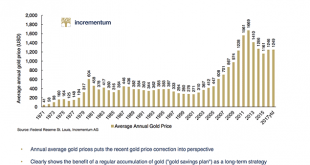

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

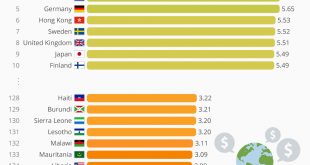

Read More »Switzerland Tops World’s Most Competitive Countries Index (Yemen Least)

Something else ‘Murica is no longer #1 in… A recently released World Economic Forum report has found that the global economy is recovering well nearly a decade on from the start of the global financial crisis with GDP growth hitting 3.5 percent in 2017. The eurozone in particular is regaining traction with 1.9 percent growth expected this year. As Statista’s Niall McCarthy points out, the improvement in...

Read More »Top Institutions and Economists Now Say Globalization Increases Inequality

We’ve all heard that globalization lifts all boats and increases our prosperity … But mainstream economists and organizations are now starting to say that globalization increases inequality. The National Bureau of Economic Research – the largest economics research organization in the United States, with many Nobel economists and Chairmen of the Council of Economic Advisers as members – published, a report in May finding: Recent globalization...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump’s violating the “One China” policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office. Even Bank...

Read More »Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks – Pound fell 2% against gold yesterday after Theresa May created Brexit concerns – May’s ‘Hard Brexit’ denial does not calm markets growing fears – Investors concerned about lack of government strategy and uncertainty – UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation – GBP gold builds on 31% gain in 2016 with 4%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org