Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years. It was the best real growth quarter since Q2 and Q3 of 2014. The last 12 months has been mostly about services, here are the biggest contributors to YoY GDP: Consumption of Services Consumption of Goods Lower imports Government Non-residential investment in structures Intellectual property Q2 to Q3, we saw an acceleration in goods...

Read More »New Study Sheds Light on Crypto’s Super-Rich

Over the past decade, the rise of cryptocurrency has created a new class of millionaires and billionaires. The early adopters, investors, business founders, and more broadly, those who bought in early and held onto their investments, became extremely rich, accumulating massive wealth as prices soared. A new report by wealth and investment migration specialists Henley and Partners, released on September 05, 2023, shares insights into the state of crypto wealth,...

Read More »Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023. Is the FED’s institutional history about to repeat...

Read More »Market Pulse: Mid-Year Update

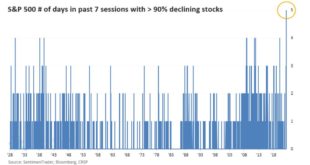

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »GDP Red Flag

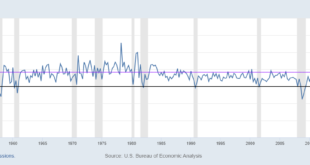

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%. It was only two months ago, mid-August, when the Blue Chip consensus pegged quarterly growth at better than 7%. Such a fast drop-off immediately brings up delta...

Read More »The Inflation Tide is Turning!

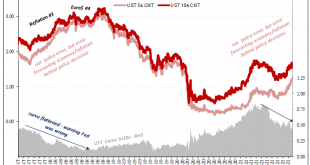

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are: Money Supplies have risen dramatically Commodity Prices are rising again Reduced Globalization as ‘Made at Home’ policies are proliferating Pent up demand Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans...

Read More »“Austerity,” EJ, 2021

Economic Journal, February 2021, with Harris Dellas. PDF. We study the optimal debt and investment decisions of a sovereign with private information. The separating equilibrium is characterised by a cap on the current account. A sovereign repays debt amount due that exceeds default costs in order to signal creditworthiness and smooth consumption. Accepting funding conditional on investment/reforms relaxes borrowing constraints, even when investment does not create collateral, but it...

Read More »Economic Aspects of the Energy Transition

In an NBER working paper, Geoffrey Heal discusses some aspects of the energy transition to come. On infrastructure investments: the likely net investment required to go carbon-free is now as little as $0.179 trillion renewable power from wind and solar PV plants is now less expensive than power from gas, coal or nuclear plants … If it were not for the intermittency of renewables, we would save money by converting to clean power. the social benefits from stopping the CO2 emissions...

Read More »“Austerity,” EJ, forthcoming

Economic Journal, forthcoming, with Harris Dellas. PDF. We study the optimal debt and investment decisions of a sovereign with private information. The separating equilibrium is characterized by a cap on the current account. A sovereign repays debt amount due that exceeds default costs in order to signal creditworthiness and smooth consumption. Accepting funding conditional on investment/reforms relaxes borrowing constraints, even when investment does not create collateral, but it...

Read More »“Monetary Policy for a Bubbly World”

In an VoxEU column, Vladimir Asriyan, Luca Fornaro, Alberto Martin, and Jaume Ventura lay out their perspective on bubbly money as a complementary store of value and the role of monetary policy in supporting optimal levels of investment.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org