Is the dollar heading to new heights or new lows? Brent Johnson of Santiago Capital joins the Gold Exchange Podcast LIVE in New Orleans! Listen to Brent discuss the historic rise of the DXY, the effects on (d)emerging markets, and how he sees a currency and sovereign debt crisis playing out. Will Powell be able to solve Triffin’s Dilemma? Can foreign central banks escape the zugzwang position? Will the financial justice warriors finally be vindicated? Watch the full...

Read More »History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions. From what we can learn from the Romans through to why we need to consider gold’s utility rather than its price, this is an interview bringing a new perspective as to why we...

Read More »Is Gold Starting to Behave Itself?

Gold is doing what it is supposed to do! Equity markets are tumbling, “NASDAQ 100 Rout Erases $1.5 Trillion in Market Value in 3 Days” reads one Bloomberg headline. The big names such as Apple lost over US$225 billion, Microsoft almost US$200 billion, Amazon and Tesla each lost US$175 billion market value over the three trading days from May 4 to May 9. Bonds are also declining in value as yields are rising. The market selloff has been the most extreme in the tech...

Read More »The Inflation Tide is Turning!

In our post on January 28, 2021 “Gold, The Tried-and-True Inflation Hedge for What’s Coming!” we outlined four reasons that we expect higher inflation over the next several years. The brief bullet points are: Money Supplies have risen dramatically Commodity Prices are rising again Reduced Globalization as ‘Made at Home’ policies are proliferating Pent up demand Headlines such as this one last week from Bloomberg “Inflation gauge Hits Highest Since 1991 as Americans...

Read More »The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency. The concept of pegging a digital currency to an...

Read More »Discussion of Benigno, Schilling and Uhlig’s (2020) “Cryptocurrencies, Currency Competition, and the Impossible Trinity,” 2020, Bank of Canada

Discussion at the 2020 Bank of Canada Annual Economic Conference: The Future of Money and Payments: Implications for Central Banking. PDF.

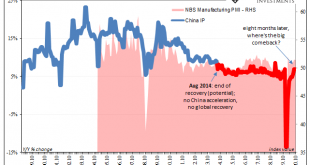

Read More »Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless. In September 2014, however, massive setback. Though it had been building all year by...

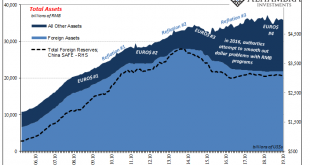

Read More »China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled. If you thought the Western media was liberal with the...

Read More »Motte and Bailey Fallacy, Report 13 Oct

This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it. A Clever Ruse We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant. The trick is intended to foreclose debate of the broad assertion, not really to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org