Summary: Part of the US Republican tax reforms call for a border adjustment. It will tax imports fully and not exports. This will likely be challenged at the WTO. Many economists say the dollar will automatically appreciate by 20%. WE are bullish the dollar but skeptical of the logic here. While hearings on US President-elect Trump’s nominees will begin this week, the Republicans are preparing dramatic changes in taxes. In this note, we will look closely at one element of the proposed tax changes that involve trade. It is the border tax adjustment. In essence, the proposal calls for export revenue (not just profits) to be exempt from corporate taxes, while none of the import costs can be deducted from taxable income. A tax on imports and a tax exemption on exports sounds like the epitome of protectionism. Not all forms of protectionism are prohibited by the World Trade Organization. WTO rules allow for some types of borders adjustments, but only for indirect taxes, like a VAT. However, the Republican plan “Better Way” uses the border adjustment on corporate taxes, which are a form of direct taxes. In the present form, the border adjustment would likely be challenged before the WTO, and likely judged to be a discriminatory subsidy. There is another issue.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, JPY, Martin Feldstein, newslettersent, PPP, Taxes, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

Part of the US Republican tax reforms call for a border adjustment.

It will tax imports fully and not exports.

This will likely be challenged at the WTO.

Many economists say the dollar will automatically appreciate by 20%.

WE are bullish the dollar but skeptical of the logic here.

While hearings on US President-elect Trump’s nominees will begin this week, the Republicans are preparing dramatic changes in taxes. In this note, we will look closely at one element of the proposed tax changes that involve trade.

While hearings on US President-elect Trump’s nominees will begin this week, the Republicans are preparing dramatic changes in taxes. In this note, we will look closely at one element of the proposed tax changes that involve trade.

It is the border tax adjustment. In essence, the proposal calls for export revenue (not just profits) to be exempt from corporate taxes, while none of the import costs can be deducted from taxable income.

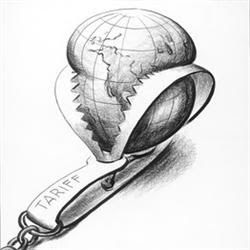

A tax on imports and a tax exemption on exports sounds like the epitome of protectionism. Not all forms of protectionism are prohibited by the World Trade Organization. WTO rules allow for some types of borders adjustments, but only for indirect taxes, like a VAT. However, the Republican plan “Better Way” uses the border adjustment on corporate taxes, which are a form of direct taxes. In the present form, the border adjustment would likely be challenged before the WTO, and likely judged to be a discriminatory subsidy.

There is another issue. Many economists, including among the most respected, like Martin Feldstein, argue that border adjustment will fuel a 25% rise in the dollar’s value. This is important. The reason the border adjustment is not going to result in higher priced imports and a rise in US inflation is that the foreign exchange market will offset it by driving the dollar higher.

Feldstein explained in the op-ed in the Wall Street Journal at the end of last week: “These calculations make it look as if the border tax adjustment causes the U.S. consumer to pay 25% more for imported products and the foreign consumer to pay 20% less than they otherwise would. But the price changes that I have described would never happen in practice because the dollar’s international value would automatically rise by enough to eliminate the increased cost of imports and the reduced price of exports.”

Whenever economists, even the dean of economists and a Harvard professor, talk about “automatic” adjustments, get suspicious, very suspicious. Feldstein continued: “Here’s why. If the exchange rate remained unchanged, the higher price of U.S. imports would reduce the U.S. demand for imports, and the lower dollar price of U.S. exports would raise the foreign demand for American exports. That combination would reduce the existing U.S. trade deficit.”

Feldstein argued that due to 1) the economic identity that holds imports minus exports equals savings minus investment, and 2) that the border adjustment does not change the US savings or investment, it follows that the foreign exchange market will bear the adjustment and the dollar will rise significantly. The Professor says that the dollar rise will be beneficial.

This is a weak version of purchasing power parity. It states that currencies ought to move to equalize the price of a basket of internationally traded goods. Two points need to be made here.

First, foreign exchange prices deviate from purchasing power parity by significant magnitudes for extended periods of time. Presently, according to the OECD, the euro is the most undervalued currency in its universe. It is a little more than 26.6% undervalued. Sterling is 18.3% undervalued, and the Japanese yen is about 14% undervalued according to the OECD.

The Swiss franc is the most overvalued currency at nearly 18.4% above where the OECD estimates are fair value. The Swiss franc has not been below the OECD’s calculation of its purchasing power parity level for more than 30 years. It was overvalued by more than 20% from late 2002 until late 2015.

Second, the growth of the capital markets over the past 35 years and the increased internationalization of savings and investment means that the cross-border movement of money overwhelms the cross-border movement of good and services. Consider that world trade may be around $20 trillion annually. Turnover in the foreign exchange market is around $5 trillion a day. Capital flows arguably have a greater influence on currency movement than trade in goods and services. Moreover, as numerous countries have found, including Japan, and backed up by extensive research, perhaps partly due to extensive global supply chains, the link between currencies and export volumes appear to have loosened from what many were taught at the university.

There a body of literature that debates the flaws of purchasing power parity models. Over the last couple of decades, economists have devised alternative measures that take capital flows into account and address other shortcomings of PPP.

Here is the difficult line we are trying to walk. We are bullish on the US dollar. In 2008-2009 we argued that the dollar was about to enter a secular uptrend (see my 2009 book Making Sense of the Dollar). For the last couple of years we have been arguing that before the Obama (and now Trump) dollar rally, the third such rally since the end of Bretton Woods, is over, the euro will retest its historic lows near $0.8250. We project the Dollar Index to rise toward 120 (currently around 102).

Our view was based on the divergence of monetary policy broadly understood. It was based on economic divergence. Since the middle of 2015, we added the anticipation of a supportive policy mix of tighter monetary policy and looser fiscal policy. Also, for this year and next, we have expressed concern about the risk of a resurgence of nationalism-populism in Europe, which erodes the integration that is at the heart of the European Project. We have also suggested that long-term investors ought to be thinking about a post-Merkel Germany and a post-Draghi ECB. Both are not imminent, but likely take place within the next few years.

In conclusion, we are bullish the dollar but are concerned that the border adjustment may spur other countries to do the same thing, inadvertently spurring protectionism and further weakening international trade, which has not yet recouped the decline associated with the Great Financial Crisis. In a similar vein ,that the some of the lessons of the Great Depression, like those embodied in Glass-Steagall, were either repealed, diluted, or unenforced, so too are the lessons of protectionism seemingly lost and now hidden in mental gymnastics based on an automatic adjustment of currency values and an outdated understanding of PPP.

Tags: #USD,$EUR,$JPY,Featured,Martin Feldstein,newslettersent,PPP,Taxes