Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce. The Federal Reserve, the European Central Bank, the People’s Bank of...

Read More »FX Weekly Preview: The Week Ahead Excluding Brexit

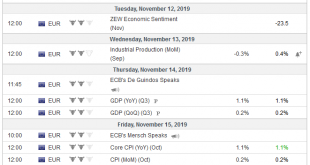

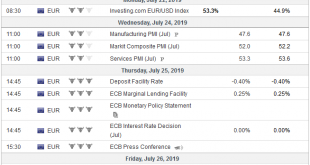

I feel a bit like the proverbial guy that asks, “Besides that, Mrs. Lincoln, how did you like the play?” in trying to discuss the week ahead without knowing the results of the UK Parliament’s decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate. Europe is front and center. Three...

Read More »FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

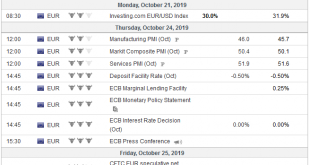

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

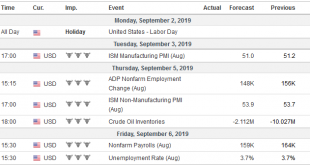

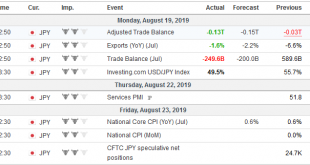

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

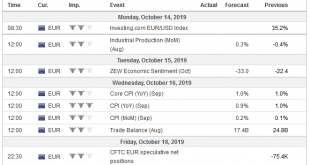

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0. China set the reference rate for the dollar lower than models based on the basket the PBOC uses implied for the past three sessions, and this...

Read More »FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market’s attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa. Japan goes to the polls on July 21 to elect the upper chamber of the Diet. There...

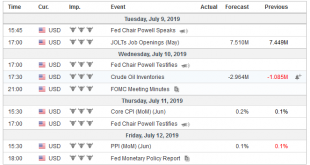

Read More »FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing. United States The jobs report trumps the PMI/ISM data and suggests...

Read More »FX Daily, June 19: Still Patient?

Swiss Franc The Euro has fallen by 0.21% at 1.1169 EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-taking was bolstered by the dramatic shift in Draghi’s rhetoric less than two weeks after the ECB meeting and a Trump’s tweet announcing that there was going to be an “extended” meeting between him and Xi at the G20 meeting and that...

Read More »FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

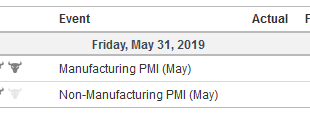

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces–trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org