Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading. For example, the ability to find substitutes for the more expensive tariff imports could be a critical part of the evaluation....

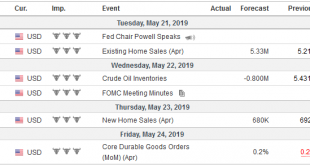

Read More »FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »FX Weekly Preview: Six Events to Watch

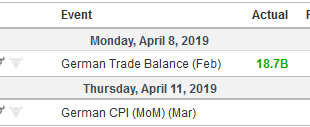

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan’s flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%). This coupled with the new cyclical...

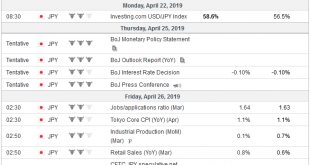

Read More »FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession. The economy previously contracted when the tech...

Read More »Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market’s sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month. Europe’s relationship with China will eclipse the US-China trade talks that resume with Mnuchin...

Read More »FX Weekly Preview: Three Highlights in the Week Ahead

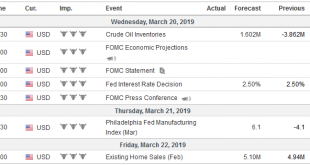

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident. There is...

Read More »There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions. The end of the first expansion since the Great Financial Crisis may be drawing close. There is a concern among officials and investors that the tools that...

Read More »FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

Read More »Socialism, Keynesianism, and Fascism

The American political discourse has changed since the 2018 midterm election. Enthusiasm and passion were to be found on the left-wing of the Democratic Party. A new sense of hope and mission replaced the defeatism and cynicism seen in 2016. Some identified with democratic socialism, but in the political rhetoric the broad brush of “socialism” has been used to paint the entire party. The 2020 contest is already being...

Read More »Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December’s estimate, which brings it to 222k (from 312k). The participation rate edged...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org