Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and fighting are not mutually exclusive, but China may not play by American baseball rules and wait for three strikes until you are out. The second abrupt end to a tariff truce by the US may have been enough to push China over the edge. It appears an agreement with the US now is not possible. Trump’s claim that

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Canada, China, ECB, Featured, Italy, newsletter, RBA, Sweden, trade, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and fighting are not mutually exclusive, but China may not play by American baseball rules and wait for three strikes until you are out.

The second abrupt end to a tariff truce by the US may have been enough to push China over the edge. It appears an agreement with the US now is not possible. Trump’s claim that Chinese official called to restart negotiations has been confirmed to have been baseless goes beyond the pale from a counterparty’s negotiating perspective. Imagine if it were the other way around. To be sure, it is not that a Democrat victory in 2020 would ease the pressure on China. To the extent that it has been addressed, many of the candidates talk about leading an international coalition to confront China’s disruptive economic behavior.

This is why our medium-term base case is for the world’s two largest economies is disengagement. While many businesses do not seem prepared to take Trump’s “order” of leaving China particularly seriously, there will likely be a further cooling off of new direct investment, as well as the impact of the new tariff schedule, which one must assume will last for some time. After the September 1 implementation, the game over the next couple of months will be can the talks defer the next round of tariffs announced for mid-December.

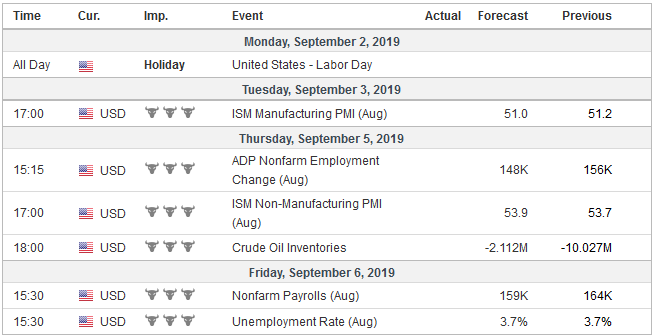

United StatesThe start of the new month sees a slew of high-frequency economic data that will likely confirm what we already know about the US economy. Two data points, in particular, stand out, the employment report and auto sales data. US job growth has slowed. It averaged 165k a month through July. Estimates for August hover around this average. In the first seven months last year, job growth averaged 227k. Still, at 3.7% the unemployment rate is just above the cyclical low of 3.6%, which had not been seen in a generation, and the underemployment rate fell to a new low of 7.0% in July. Average earnings growth has also lost some momentum, but consumption is a bright spot. Consumption in Q2 GDP was revised up to 4.7% from 4.3%. This is the strongest since Q4 14, which itself was the strongest since 2003. The third quarter began on a firm note, Ahead of the weekend, the US reported a 0.6% jump in personal consumption expenditures in July. Auto sales are part of the consumption story, and demand leads production and investment. Vehicle sales in August are likely to be near this year’s average of 16.93 mln. Auto sales averaged 17.05 mln in the first seven months of 2018. The US also reports construction spending, factory and durable goods orders, and the PMI/ISM. The take-away we expect is that the pace of activity remains steady.The Beige Book that will be released September 4 should offer confirmation. Averaging the Atlanta and NY Fed GDP trackers, the US appears to be growing around 2% here in Q3. The January 2020 fed funds futures contract implies 66 bp of easing this year is discount. This is consistent with two 25 bp cuts and about 2/3 chance of a third cut. Three FOMC meetings remain this year. Treasury Secretary Mnuchin wants to re-look at issuing extra-long maturities (50 and 100 years) which other countries have done to lock low interest rates. The short-term advantage is clear, lower debt servicing costs. However, it is a marginal benefit at best, given the size of the stock of US debt. Also, the extra-long bonds might not be consistent with the regular auctions. Without offering much greater duration (sensitivity of price to yield change), the new bonds may not be net additive but take away liquidity of the US 30-year bond. The Treasury’s Borrowing Advisory Committee has been consistently opposed when the issue has arisen over the past several years. One industry survey found that while there was a little more market interest than a couple of years ago, there was more interest in a 20-year bond than a 50-100 year issue. |

Economic Events: United States, Week September 02 |

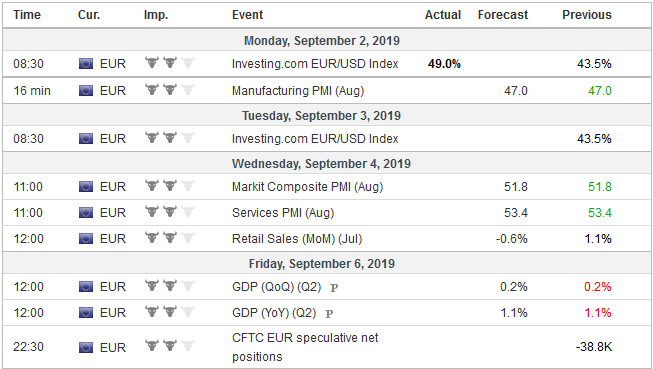

EurozoneEurope will remain in focus the week ahead of the ECB meeting. At the end of last week, a few of the hawks (Dutch and German) pushed back against renewing asset purchases. This is a dog-bites-person story. Draghi (and soon Lagarde) led the ECB down the unconventional path over the objections of the hawks. Those objections, including the Bundesbank testifying before the European Court of Justice that the ECB exceeded its mandate, were consistently overcome. The preliminary rate of August CPI, reported before the weekend, showed measuring inflation had slowed to 1%, around half of the ECB’s target (close to but lower than 2%). There is no reason to expect the final August composite reading will be much different than the preliminary estimate of 51.8, compared to a 51.7 average through the first seven months and 53.6 average in 2018. The composite bottomed in January at 51.0 and peaked in June at 52.2. |

Economic Events: Eurozone, Week September 02 |

GermanyA key weight has emanated from the German auto sector, and we suspect that it poised to recover. However, there are three more risks on the horizon, and it is all political. UK, Italy, and Germany. Johnson’s prorogation (suspension of Parliament) will be challenged in the courts in the coming days. The purpose of it may be two-fold. First, it sends a signal to the EU that if no compromise is struck, Parliament will not be able to prevent a no-deal exit. Second, it could position Johnson for an election over his domestic rivals. There was also some suggestion the EU could withdraw the October 31 Brexit deadline. Johnson’s gambit requires the EC moderating its position on the backstop, which is dubious at best. Moreover, some hardline Tory Brexiters, like Rees-Mogg, has threatened that jettisoning the backstop is not sufficient to secure their support. Next week is make-it or break-it for Italy to avoid a political (and likely economic) crisis. The Five Star Movement (M5S) and the Democrat Party (PD) are in negotiations to form a government following the departure of the League. It seems very messy, and there may not be sufficient common ground given the relative size of egos. Italy’s 10-year yield fell to a record low below 1% on August 29, when it sold four billion euros of new bonds at 96 bp, down 66 bp from its last auction of 10-year bonds. If the market concludes that a coalition between these two unlikely partners is not going to crystalize, or that it will be stillborn, it will likely react dramatically and punish Italian bonds and stocks (especially bank shares, for which in an index rose 4.6% last week, its third consecutive weekly advance). German politics will be an important talking point following the September 1 elections in Brandenburg and Saxony. The nationalist AfD is polling well and the risk that it comes in first in one or both states. It may not be enough for it to form a government if the other main parties refuse to work the AfD. Nevertheless, it will likely have ripple effects through German national politics. Merkel’s CDU will be under pressure to tack right to protect its flank. A poor showing by the SPD could strengthen the arguments of those who want it to leave the governing coalition to return to its base to prepare for the post-Merkel era. |

Economic Events: Germany, Week September 02 |

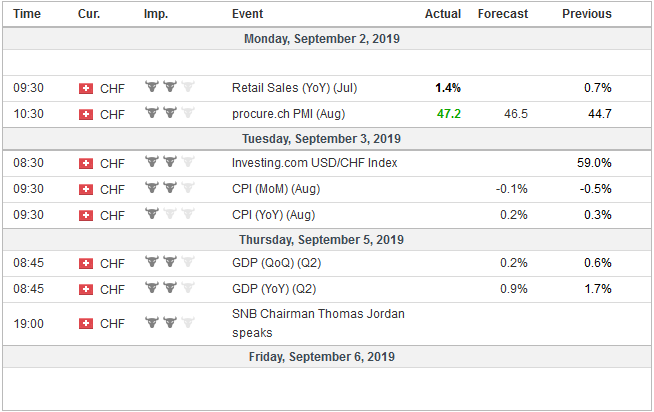

Switzerland |

Economic Events: Switzerland, Week September 02 |

Australia

There are three G10 central bank meetings in the first week of September: Australia (September 3), Canada (September 4), and Sweden (September 5). None are expected to cut rates, but all three are expected to prepare the groundwork for a rate cut at the next meetings.

The Reserve Bank of Australia cuts rates in May and June. Since the end of April, the currency has fallen around 4.8%. The combination of some fiscal stimulus (tax cuts and spending increases) couple with the lower rates and weaker currency ought to help the economy find traction, but it has not yet. The market has about a one-in-eight chance of a cut priced now and about a two-in-three chance of a cut at the October 1 meeting. The market has a little more than a 50% chance discounted that 1% cash rate is 50 bp or less by the end of the year, which at this point, with the current information set, looks aggressive.

The global slowdown and the prospects of more Fed cuts have spurred speculation that the Bank of Canada, where the monetary policy setting is on neutral, will have to cut rates. At the end of July, the market was discounting about a one-in-four chance of a cut this year. At the end of last week, the odds stood a little below 60% for a cut at the October 30 meeting and a little more than 70% chance of a move this year. And this is after the Q2 GDP reported before the weeks showing growth surged 3.7% at an annualized rate after the Q1 pace was revised to 0.5% from 0.4%. If the Bank of Canada is seriously thinking about the possibility of cutting rates in two months, it may begin softening its neutral rhetoric.

Sweden’s Riksbank meets in the middle of the week. Its minus 25 bp deposit rate is unlikely to be cut further. The derivatives market suggest there is a little less than a 20% chance of 25 bp cut discounted. The odds rise a bit more to about 26% chance at the October 24 meeting. The euro made new 10-year highs against the krona ahead of the weekend (~SEK10.8550). The dollar rose to its best level against the krona in 17 years. The slowing of world growth impulses and the weaker euro are drags on the krona. The krona lost 2.3% against the dollar last week, and the Norwegian krone, supported by arguably stronger fundamentals fell 2%, making them the two weakest major currencies last week. Year-to-date krona is the weakest, depreciating nearly 10% against the dollar. The Norwegian krone is in third place, losing 5.2%, while the New Zealand dollar, which also fell to new four-year lows ahead of the weekend, is in second place, off about 6.3%.

Tags: Brexit,Canada,China,ECB,Featured,Italy,newsletter,RBA,Sweden,Trade,US