At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more. That’s been the basis of this thing from Day 1; or, more accurately, Day 3.01. Reflation #3 wasn’t really any different in type from...

Read More »The Yin and Yang of the US-China Relationship

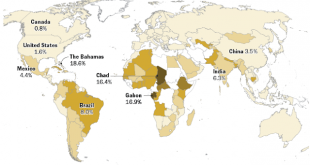

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China’s rise over the last 40 years has been predicated on Deng Xiaoping’s political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States. America seems to hold two seemingly...

Read More »Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought. It has become fashionable to talk about reciprocity and intuitively has much...

Read More »Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues. In the first clip, which runs about 2.5 minutes, I sketch out the argument for the US economy being in a late-stage expansion. I cite the 12-month moving average of...

Read More »FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers. China The PBOC modified the way the reference rate is set. Currencies are allowed to trade in a band around...

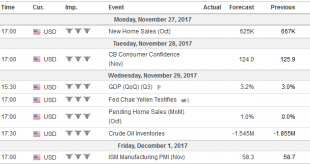

Read More »FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let’s briefly summarize the performance of the dollar and main asset markets. After recovering from a five-month decline in September and October, the dollar has lost ground against all the major currencies here in November,...

Read More »FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

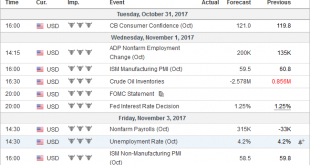

Summary Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain. The week ahead will be among the busiest in Q4. In this note, we provide a brief sketch of the different events and data points that will shape the investment climate. Given the importance of initial conditions, we will begin with an overview of the...

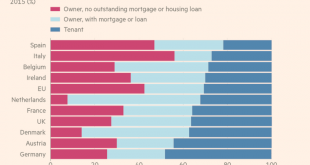

Read More »Great Graphic: Home Ownership and Measuring Inflation

Summary Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not. This Great Graphic was in the Financial Times recently. It shows home ownership rates several EU countries. The useful chart also shows those who own (red bar) and those...

Read More »How will Yellen Address Fostering a Dynamic Global Economy?

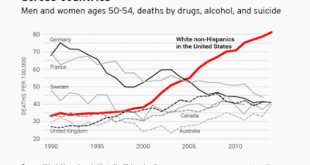

Summary Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues. The topic at...

Read More »Fed Still Committed to Hike

The Fed's new forecasts show a third rate hike in 2017 for the second half of the year and three more in 2018. As expected, the US Federal Reserve raised the target range for the policy rate by 25 basis points to 1.00 percent – 1.25 percent. It also updated its policy normalization principles with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org