Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce. The Federal Reserve, the European Central Bank, the People’s Bank of China and many emerging market economies have eased monetary policy in recent weeks. The Bank of Canada and the Bank of England did not join the party, but they softened their neutrality. The Bank of Japan hinted it could cut rates, while Prime Minister Abe has promised a JPY5 trillion supplemental

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Drivers, Featured, Germany, newsletter, trade, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce.

The Federal Reserve, the European Central Bank, the People’s Bank of China and many emerging market economies have eased monetary policy in recent weeks. The Bank of Canada and the Bank of England did not join the party, but they softened their neutrality. The Bank of Japan hinted it could cut rates, while Prime Minister Abe has promised a JPY5 trillion supplemental budget to ostensibly rebuild from the recent typhoon.

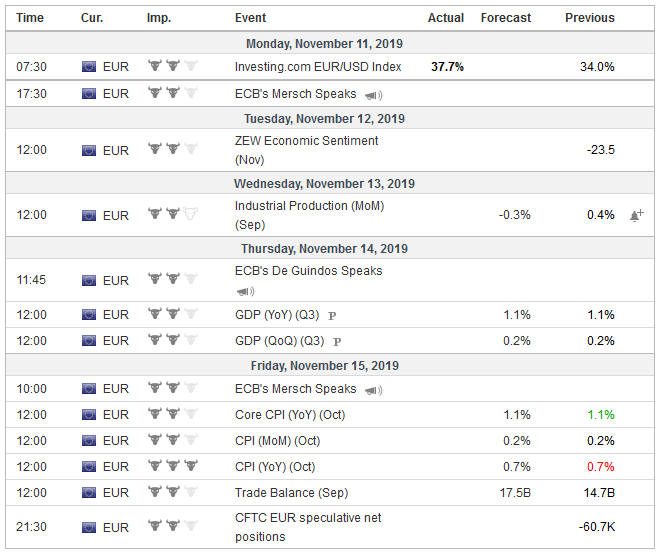

EurozoneThe markets are not in the mood to be distracted by the facts, and it is dangerous to fight the momentum. But the fundamentals have not changed. As risk assets continued to rally, the IMF warned in its Regional Economic Outlook for Europe that officials should be making contingency plans since monetary policy has been exhausted. Significant risks (Brexit, trade, geopolitics) remain. Next week Germany will confirm that it recorded its second consecutive quarterly economic contraction. The contention that the risk of no-deal Brexit has been reduced is fanciful. Labour leader Corbyn had to claim that to back out of the corner, he painted for himself in and support the call for an election. Spain’s election (November 10), its fourth in as many years, illustrates the naivete that an election can solve something when the people themselves are so divided. If the Tories do not win an outright majority at the December 12 election, what kind of coalition can be put together, and how long will it take? Like time decay of an option or Hemingway’s explanation of going bankrupt, the January 31 deadline approaches slowly at first and then quickly. And even then, we are sorry to acknowledge that the story does not end there, but if a trade deal cannot be hammered out by the end of next year, the UK would leave the EU after the transition period with the WTO the basis for trade–a hard exit by any reckoning. Another deadline, more brinkmanship, and more drama are in store even if Johnson’s gamble pays off. You can bank on it. |

Economic Events: Eurozone, Week November 11 |

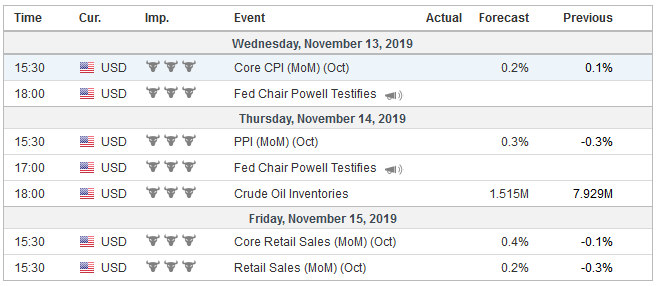

United StatesPolicymakers are interested in personal consumption and the personal consumption price deflator. Next week’s proxies for these will be reported. This includes CPI, retail sales, and also industrial production at the start of Q4. The Empire State manufacturing survey for November will also be reported. Consumer prices are expected to edge up, but due to the base effect, the year-over-year rates are expected to be steady at 1.7% for the headline rate and 2.4% for the core. Consumers ended Q3 on a soft note with headline retail sales falling by 0.3%, and the components used for GDP calculations were flat. A small sequential uptick is likely. The median forecast in the Bloomberg survey is anticipating a 0.1% gain. The average monthly rise of retail sales through September was 0.6% compared with a 0.3% average for the same year-ago period. If the median forecast is correct, the three-month moving average for fall to less than 0.2%, half the Q2 and Q3 pace, and well off the 0.9% rate seen in Q1. The GDP components rose by an average of 1.2% in Q1, 0.6% in Q2, and 0.4% in Q3. The median forecast in the Bloomberg survey is for a 0.3% increase. Industrial output likely fell in October by around 0.4%, the same as in September. Industrial production has been weak this year, falling by an average of 0.1% a month through September. In the first nine months of 2018, it rose by an average of 0.3%. The strike at GM still likely weighed on auto output in October. It fell by 0.5% in September and has fallen by an average of 0.2% this year through September. It is, of course, early in terms of data to get a solid read on the economy, but the Atlanta and NY Fed’s GDP trackers are estimating Q4 growth at 1.0% and 0.7%, respectively. Although Q3 US corporate earnings season is not quite over, analysts continue to cut Q4 projections, and the median now stands near 0.8%, according to Reuters. That compares with a 4.1% projection at the beginning of Q4 a lofty 7.2% at the start of Q3. Earnings growth forecasts for the first three quarters of 2020 have been cut be at least two percentage points in recent weeks, Don’t fight the tape, advises the old adage. However, we caution that prices appear to be racing away from macro considerations. Back at the end of September and early October, when the fear of a repeat of Q4 18 colored narratives, we pushed back against it. Now the pendulum has swung too hard in the other direction. It does not mean that the markets cannot ‘overshoot’ further, but it does mean that markets are stretched and maybe running on fumes. It is a call for disciplined risk management and capital preservation strategies. It is not, after all, how much money one makes, but how much can be kept. |

Economic Events: United States, Week November 11 |

Progress on US-China trade talks had been cited as a factor boosting the animal spirits and risk-taking. The ebb and flow of the news do not have much impact. China has been demanding that not only are the tariff threats removed but even for a phase one agreement, actual levies have to be unwound. The US appears to have finally relented, but still seems to be at odds with Beijing and wants to keep a majority of the tariffs in place. Reports suggest that the Trump Administration wants to reduce the tariff schedule by doling, like an IMF loan, as certain targets have been met. The markets barely registered Trump’s claim before the weekend that he has not agreed to rollback any tariffs, even though that is what China wants.

Nearly a month after mission accomplished was declared, and a handshake deal announcement was made, there is nothing to show for it. The cancellation of the APEC meeting in Santiago due to domestic unrest due to economic hardship has bought the Trump and Xi more time. The latest signal is a meeting in December rather than this month, but an agreement still has not been struck. The rollback of tariffs is predicated an agreement being struck. The US and China have not even been able to agree on the location of the heads of state meeting. China reportedly is resisting being used as a prop in Trump’s re-election bid.

A trade agreement between the US and China is no panacea. China’s economy is slowing down regardless of trade relations with the US. Partly it is cyclical, and part of it is structural. Part of it may be related to efforts to encourage de-leveraging. Moreover, China is doing a lot of things without a trade deal, like buying more plant and animal protein from the US and is reportedly contemplating lifting the ban on US poultry. It eased restrictions on foreign investment by abolishing the previous quota system (QFII and RQFII). It is easing access for foreign financial institutions, and PayPal became the first foreign payments company with a presence in China. It has toughened its laws, according to report on intellectual property violations, and participated in a joint investigation (with the US) that led to the arrest of nine in China for smuggling fentanyl.

The US has endless complaints against China’s trade practices. Last week the US Commerce Department concluded that Chinese-made ceramic tiles were being dumped. It levied new tariffs ranging from 114.4% to more than 350% on several Chinese companies. A final ruling is expected by the end of Q1 20. The trade was worth about $480 mln. Meanwhile, legislation is moving through Congress that will require Hong Kong’s autonomy to be affirmed every year, and that may limit US government employee pension funds from being invested in China.

The US has many unresolved issues with Europe, from the gas pipeline with Russia, to NATO spending, to using Huawei for 5G. to the embargo against Iran and participation in China’s Belt and Road Initiative. Imports of European steel and aluminum still face US duties on national security grounds, the US is due to decide whether to extend the argument to autos. Six months ago, the Commerce Department found that auto imports were indeed a threat to national security. A decision on whether to place a tariff on them is expected soon. Reports suggest that the US has been talking directly to European producers, and reports suggest that some compromise could avert the full force of America’s threat.

Many economic models project Trump’s re-election next year. We are suspicious of economic determinist approaches, especially given the wide and growing gender gap. Moreover, given the importance of the electoral college, more granular (state and congressional districts) data is likely more important, especially in swing states in the midwest. Nevertheless, our base case is that record-long expansion is losing altitude. The market is pricing in one rate cut next year. We suspect two.

Tags: Brexit,Drivers,Featured,Germany,newsletter,Trade,US