Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently suggested that the more President Trump denied interest in an interim agreement with China, the more likely it was. The disinflationary forces remain but seem to have stabilized, helped by some better indications coming from the interest rate-sensitive sectors in the US economy, like housing, and a rise in

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Featured, Federal Reserve, newsletter, trade, U.K., US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently suggested that the more President Trump denied interest in an interim agreement with China, the more likely it was. The disinflationary forces remain but seem to have stabilized, helped by some better indications coming from the interest rate-sensitive sectors in the US economy, like housing, and a rise in German industrial output.

While the details of the apparent Brexit breakthrough are not clear, the positive comments by two key participants, Ireland and the EU chief negotiator, suggest it is real. The Irish backstop has been the key hurdle. There is no way to square the circle. If the UK is out of the EU, there is no politically viable place to put the hard border (customs office). It does not work between Northern Ireland and the rest of the UK or between Northern Ireland and the Irish Republic. The potential solution is a free-trade agreement between the UK and the EU that does not require a hard border. Whether this will be sufficient to appease the hardline Brexiters is a different story, but something along these lines may be enough to attract moderates across political parties.

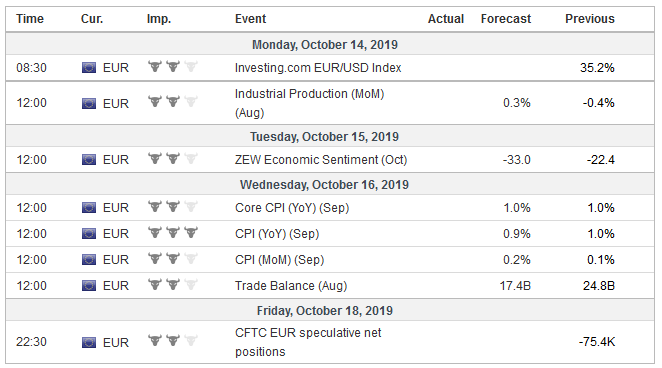

EurozoneThe next step has been dubbed “the tunnel.” The UK and EU negotiators work in private line-by-line to hammer out the legal agreement. Ideally, this is done ahead of the critical EU summit on October 17-18. Unanimity among the 27 other EU members is necessary, but provided the EC endorses it, and Ireland agrees, it should not be a problem. Ironically, it seems that the UK Parliament is more fractious than the EU on this issue, at least. We suspect some extension past the October 31 deadline is likely. Johnson will not have to violate his pledge of not asking for one. It can be extended by Europe for technical reasons. An election by the end of next month remains a likely scenario. A successful non-disruptive Brexit could see the Tories build on their plurality that they were already polling. On the margins, the risk of what the British call a hung parliament and others refer to as a coalition government appears to have diminished. This seems just as much about the lack of confidence in Labour leader Corbyn as it is a reward for the Conservatives. Perceptions that the downside risks have been minimized sparked a dramatic rally in UK’s FTSE 250. It gained almost 3% last week, the most in nearly a year. The 10-year Gilt yield rose 25 bp to 70 bp. In terms of basis points, it was the most in two years. Sterling’s 2.8% gain is also the most in two years. The market sentiment also appears to have swung against a rate cut. Next week’s data may give the market pause. Although consumer inflation may tick up (both September CPIH and CPI may edged up to 1.8% from 1.7%), other reports will likely show some sluggishness. Employment growth is expected to have continued to slow in the three months through August to around 26k (3m/3m). It would be the weakest in a year, and average weekly earnings are expected to be unchanged from July. September retail sales are expected to have fallen for the second consecutive month and the fourth in the past six. That said, UK retail sales remain robust. They have risen by an average of 0.4% through the first eight months of 2019 compared with an average pace of 0.5% for the same year-ago period. |

Economic Events: Eurozone, Week October 14 |

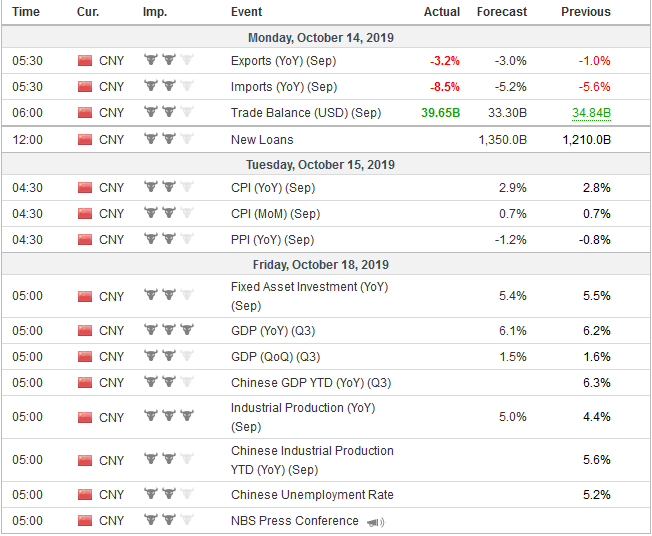

ChinaThe possibility of what is being called an interim trade agreement with China appears to have risen, but we suspect the implications are neither broad nor deep. And more importantly, such an agreement says nothing about the long-term rivalry between the world’s two largest countries. The asymmetrical coverage of the negotiations is striking and lends credence to our sense that the US was more eager for an agreement now. The Trump Administration played it up as is its wont. The US emphasized that an interim agreement had been reached and that it would not go forward with the October 15 increase (from 25% to 30% on roughly $250 bln of Chinese goods). The agreement, it claimed covered intellectual property protection and currency as well. China would buy $40-$50 bln of US agriculture products. Chinese press (state organs) seemed to take it in stride, noting no final agreement was reached or deal signed. The Financial Times reported that China’s media alluded to “substantial progress was achieved” while the Trump claimed it was as “substantial phase-one deal.” Not only did China seem to recycle past “concessions,” but it succeeded in stretching out the negotiations. Time, Chinese officials believe, is on their side, as political considerations restrain Trump officials. At the same, Trump’s penchant for over-selling agreements and hyperbole risks future “disagreements” and misunderstandings. Indeed, it almost recognizes this, may not suspending the tariffs that are to be levied in mid-December. Another indication that no deal was really achieved is that US Treasury Secretary Mnuchin said that until a final “phase-one” deal is struck, China will continue to be cited as a “currency manipulator.” The Treasury’s semi-annual report is expected in the coming weeks. No final agreement has been struck and won’t be until at least the APEC meeting in mid-November when Trump and Xi meet. We think that the political elites in both countries (which is to say it is a bipartisan view in the US and the dominant view among the Chinese Communist Party leadership) that the economic integration between the two has gone too far. The decoupling will not take place overnight or be straightforward. China has a food shortage. Even in its command economy, prices can be indicative of supply/demand pressures. Pork prices were around 47% year-over-year in August, and that lifted food CPI 10%. China will report September CPI on October 14. The rise in food prices may be concealing the disinflationary forces elsewhere. Producer prices began falling on a year-over-year basis, as opposed to rising less slowly in June, and the pace is expected to have accelerated to about -1.2% from -0.8% in August. China will report other data in the week ahead, but the two that will capture the market’s attention are the trade figures and the Q3 GDP. The median forecast in the Bloomberg survey expects exports and imports to weaken further in dollar terms. Exports are projected to have fallen by nearly 3% year-over-year after a 1.0% decline in August. Imports are anticipated to have fallen by 6.0% year-over-year, accelerating from 5.6% previously. Note that in CNY terms, exports are growing and not far from last year’s pace. August exports in CNY rose 2.6% from a year ago. The average pace this year is about 5.6% compared with almost 6.5% in the first eight months of 2018. Skepticism over the validity of Chinese GDP figures is thick. Nevertheless, economists try to forecast it. The median guesstimate from the Bloomberg survey is for the world’s second-largest economy to have grown by 1.5% in Q3, which is more than many high-income countries will grow in the entire year. The year-over-year pace, then, will tick down to 6.2% from 6.3%. Disappointment could weigh on the Australian dollar, among the majors, An admission that the Chinese economy is expanding slower than 6.0% could spark larger risk-off moves, especially in the region. |

Economic Events: China, Week October 14 |

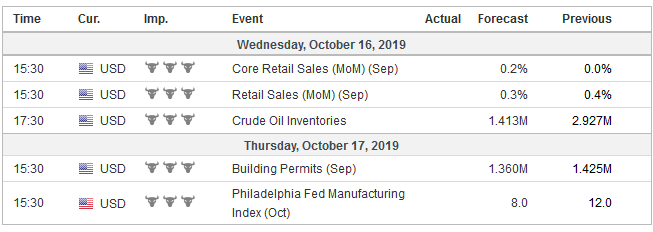

United StatesThe US reported softer than expected consumer and producer prices last week. The week’s data ended with the University of Michigan’s consumer confidence survey that saw the 5-10-year inflation outlook fall to a record low of 2.2%. It has visited the upper-end of its three-year range (2.6%) as recently as August. This should reinforce the trade-off that the Federal Reserve is willing to make: while the economy is said to be in a “good place,” the low inflation levels makes the costs to extend the recovery inexpensive. Our reservation was the Fed had to address some plumbing issues. To separate from monetary policy proper, we expected to it have dominated the meeting at the end of the month. This would have meant a cut in December, a few days before the next round of tariffs for the first time many consumer goods would be hit (December 15). However, last week, the Federal Reserve announced several details of how it will address the plumbing issues, and this makes a rate cut at the October 30 meeting, more likely in our view. The Fed has cited uncertainties and risks. The odds have increased of an orderly UK exit, and an interim US-China trade agreement help reduce the risks. This, coupled with the rally in stocks, saw investors downgrade the chances of a Fed cut to around 2/3 from little above 80%. The high-frequency economic data next week includes the first Fed (NY and Philadelphia) survey for October. The economy does not appear to have re-accelerated at the start of Q4. The US also reports retail sales, which have taken on added weight in the eyes of investors because the consumer is the key to the economy, not simply because it always is, but especially so know because other engines may be stalling. September retail sales at both the headline and core levels are expected to rise 0.3%, largely matching the August pace. Industrial output, led by manufacturing, remains under pressure. In the first eight months of 2018, manufacturing output rose by an average of 0.2% a month. This year it is contracting at an average pace of 0.1%. After a 0.5% jump in August, manufacturing is expected to have slumped by 0.3%. At least nine Fed officials speak next week, six of which are regional presidents. It seems pretty clear where they stand, and both Rosengren and George, who have dissented in favor of leaving rates steady at the past two meetings, remain adamant. Three governors speak (Brainard, Bowen, and Clarida), and this where if there real cracks in confidence in Powell where it would show. The governors seem to agree to try harder to reach the 2% inflation target. |

Economic Events: United States, Week October 14 |

Tags: Brexit,China,Featured,federal-reserve,newsletter,Trade,U.K.,US