But latest employment report shows the US economy remains in fine fettle. The November employment report revealed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest-rate hikes (although it is still very...

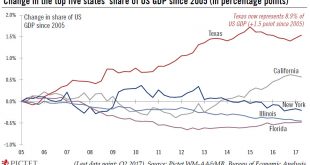

Read More »How oil-rich Texas fares will be key for the US outlook

The US economy is increasingly reliant on activity in Texas, itself very dependent to oil.Texas, the second state by GDP after California, but better endowed than the latter with oil resources, has become a major driver of US growth, especially since the energy boom of the 2010s. What we’ve learned with the ups and downs of oil prices over the past few years is that high oil prices are great for Texas and therefore positive for the US economy, in spite of the hit to the individual US...

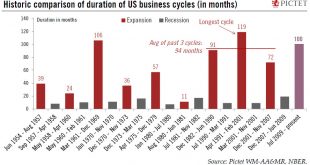

Read More »US business cycle celebrates its 100-month anniversary

The US expansion has crossed the 100-month mark. But while it has aged, the economy still has legs.The US expansion, which started in July 2009, just crossed its 100-month mark, making it – for now – the third longest in the National Bureau of Economic Research database, which stretches back to 1854. The longest growth was 119 months between April 1991 and February 2001.The exceptional length of this expansion, already well above the 94-month average for the three previous growth cycles,...

Read More »Signs that US rental boom could slow

After a sharp rise in the construction of rental units, vacancy rates are rising, and slowing rent growth could weigh on inflation metrics.The US has witnessed a striking boom in the construction of rental residential units in recent years. This can in part be explained by the rising allure of downtown living among millennials and ageing baby boomers alike. The boom can also be explained by the lingering effects of the subprime crisis, and the restrained access to mortgage credit that has...

Read More »Stagnant tax collection is a further challenge to tax cuts

The rise in the US deficit may sap support for Trump’s ambitious plans to cut taxes.US fiscal year 2017, which ended on September 30, did not end on a high note. The deficit rose to 3.5% of GDP, edging up 0.3 percentage point from fiscal year 2016. This deterioration stands in stark contrast to the overall improvement in the US economy. GDP growth remains above potential, and unemployment has been on a downward trend throughout the year.What is particularly puzzling, if not worrying, is the...

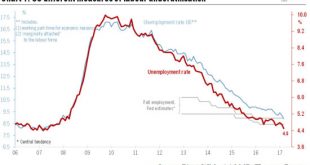

Read More »U.S. job creation slows but unemployment drops to a new record low

Job growth was strong in the first quarter as a whole, however, and latest numbers may not lead Fed to change its overall assessment of the economic outlook.Non-farm payrolls increased by 98,000 m-o-m in March, well below consensus expectations (180,000). Adverse weather conditions likely weighed on the aggregate numbers. Moreover, job creation averaged 177,000 in Q1 2017, above the Q4 average of 147,000.Importantly, the US unemployment rate fell to a new cycle low of 4.5% in March, from...

Read More »US consumption growth is on a strong footing

Data on US consumer spending in July were quite robust, auguring well for consumer spending growth in Q3. Data on US household consumption and income were published today (29 August) by the Bureau of Economic Analysis. Real personal consumption rose by a solid 0.3% m-o-m in July, slightly above consensus estimates (+0.2%). Previously published data on retail sales were soft, but car sales and output of utilities for July had been quite upbeat, suggesting a healthy reading for overall...

Read More »US improving, but constraints on Fed rate hikes

The domestic economy is picking up, but downbeat manufacturing and inflation data may still be factors in Fed policy decisions After a habitually disappointing first-quarter GDP figure of 0.5% (first estimate, to be revised on May 27), we expect a significant pick-up in US GDP to about 2.5% in the second quarter, not least because of strong consumer spending, which, according to our estimates, could grow by 3.0% in Q2 2016. Admittedly, consumer spending in the first quarter was...

Read More »Despite March disappointment, we remain upbeat on US spending

Although US core retail sales increased only slightly in March and consumer spending growth was probably modest in Q1 overall, we remain sanguine on household spending for the rest of the year. According to the US Department of Commerce, nominal total retail sales fell by 0.3% m-o-m in March, well below consensus expectations (+0.1%). However, February’s number was revised up slightly, from -0.1% to +0.0%. In March, total retail sales were dented by a 2.1% m-o-m fall in nominal auto...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org