After a sharp rise in the construction of rental units, vacancy rates are rising, and slowing rent growth could weigh on inflation metrics.The US has witnessed a striking boom in the construction of rental residential units in recent years. This can in part be explained by the rising allure of downtown living among millennials and ageing baby boomers alike. The boom can also be explained by the lingering effects of the subprime crisis, and the restrained access to mortgage credit that has forced many people to give up on the idea of homeownership. The US construction industry has responded particularly briskly to the robust demand for rental units. Between 2014 and Q2 2017, construction starts on multifamily units destined for rental was, on average, 64% above the pre-subprime crisis

Topics:

Thomas Costerg considers the following as important: Macroview, US economy, US housing, US rental vacancy rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After a sharp rise in the construction of rental units, vacancy rates are rising, and slowing rent growth could weigh on inflation metrics.

The US has witnessed a striking boom in the construction of rental residential units in recent years. This can in part be explained by the rising allure of downtown living among millennials and ageing baby boomers alike. The boom can also be explained by the lingering effects of the subprime crisis, and the restrained access to mortgage credit that has forced many people to give up on the idea of homeownership. The US construction industry has responded particularly briskly to the robust demand for rental units. Between 2014 and Q2 2017, construction starts on multifamily units destined for rental was, on average, 64% above the pre-subprime crisis levels.

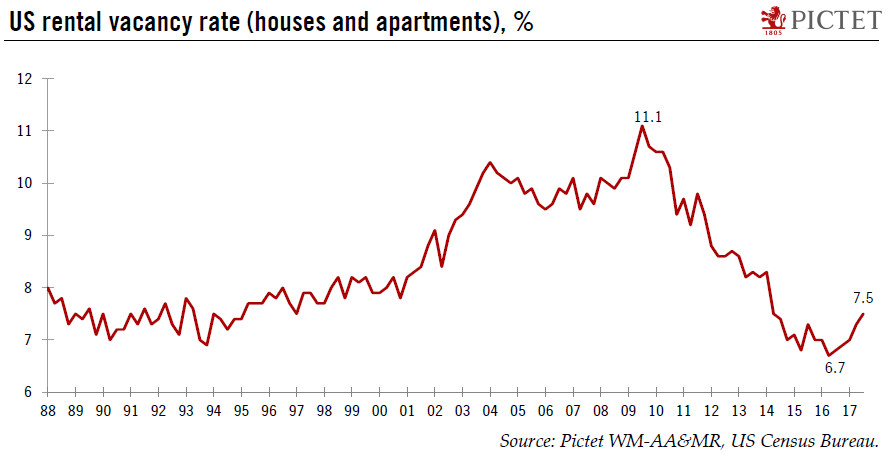

Fundamentals for such construction projects were solid until recently, with rental vacancies falling from a high of 11.1% in September 2009 to 6.7% in June 2016 (the average since 1980 is 7.9%). Demand pressure meant that rents rose much faster than normal inflation.

But the tide seems to have turned lately. Demand for rentals has slowed as access to mortgage credit has improved and homeownership has crept up again. The appeal of suburban living remains strong in the US, including among millennials. Meanwhile, a surge of rental projects is coming on the market nationwide. We are witnessing a gradual rise in the vacancy rate as a result. In Q3 2017, it stood at 7.5%, up from 6.8% a year before, and the vacancy rate is likely to climb further in coming quarters.

The consequence is that rental unit construction is likely to slow, which could affect the health of the US construction industry at large. Another area worth watching is rents, which may start to slow after solid growth in recent years. This could in turn keep core inflation metrics below 2% next year.