Job growth was strong in the first quarter as a whole, however, and latest numbers may not lead Fed to change its overall assessment of the economic outlook.Non-farm payrolls increased by 98,000 m-o-m in March, well below consensus expectations (180,000). Adverse weather conditions likely weighed on the aggregate numbers. Moreover, job creation averaged 177,000 in Q1 2017, above the Q4 average of 147,000.Importantly, the US unemployment rate fell to a new cycle low of 4.5% in March, from 4.7% in February. The U6 measure of underemployment dropped to 8.9%, from 9.2%. Wage growth was in line with expectations, up 0.2% m-o-m and 2.7% y-o-y in March.Overall, we suspect that today’s jobs report will not lead to a material reassessment of the economic outlook by the Fed. Barring a sharper slowdown in job creation or the economy, the main driver for monetary policy in the next few months is likely to be the prospects of fiscal stimulus, or lack thereof.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview, US economy, us job creation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Job growth was strong in the first quarter as a whole, however, and latest numbers may not lead Fed to change its overall assessment of the economic outlook.

Non-farm payrolls increased by 98,000 m-o-m in March, well below consensus expectations (180,000). Adverse weather conditions likely weighed on the aggregate numbers. Moreover, job creation averaged 177,000 in Q1 2017, above the Q4 average of 147,000.

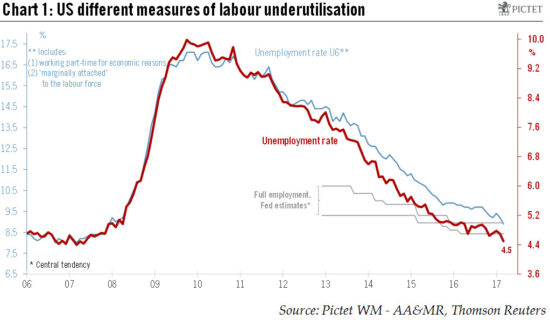

Importantly, the US unemployment rate fell to a new cycle low of 4.5% in March, from 4.7% in February. The U6 measure of underemployment dropped to 8.9%, from 9.2%. Wage growth was in line with expectations, up 0.2% m-o-m and 2.7% y-o-y in March.

Overall, we suspect that today’s jobs report will not lead to a material reassessment of the economic outlook by the Fed. Barring a sharper slowdown in job creation or the economy, the main driver for monetary policy in the next few months is likely to be the prospects of fiscal stimulus, or lack thereof.