Data on US consumer spending in July were quite robust, auguring well for consumer spending growth in Q3. Data on US household consumption and income were published today (29 August) by the Bureau of Economic Analysis. Real personal consumption rose by a solid 0.3% m-o-m in July, slightly above consensus estimates (+0.2%). Previously published data on retail sales were soft, but car sales and output of utilities for July had been quite upbeat, suggesting a healthy reading for overall consumer spending, although not to that extent.In accordance with the revised Q2 GDP data published last Friday (26 August), which included an upward revision of personal consumption growth from an already very strong 4.2% q-o-q annualised to an even higher 4.4%, previous monthly figures for consumption were adjusted up. Notably, June’s monthly increase was revised up from +0.3% to +0.4%. The end result is that between Q2 and July, personal consumption in the US grew by a strong 4.1% annualised.Real disposable income rose by a strong 0.4% m-o-m in July, following +0.2% in June. As consumer spending growth was slightly lower than disposable income growth in July, the corollary was some increase in savings. The savings rate picked up from 5.5% in June (revised up from 5.3%) to 5.7% in July.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumption, US economy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Data on US consumer spending in July were quite robust, auguring well for consumer spending growth in Q3.

Data on US household consumption and income were published today (29 August) by the Bureau of Economic Analysis. Real personal consumption rose by a solid 0.3% m-o-m in July, slightly above consensus estimates (+0.2%). Previously published data on retail sales were soft, but car sales and output of utilities for July had been quite upbeat, suggesting a healthy reading for overall consumer spending, although not to that extent.

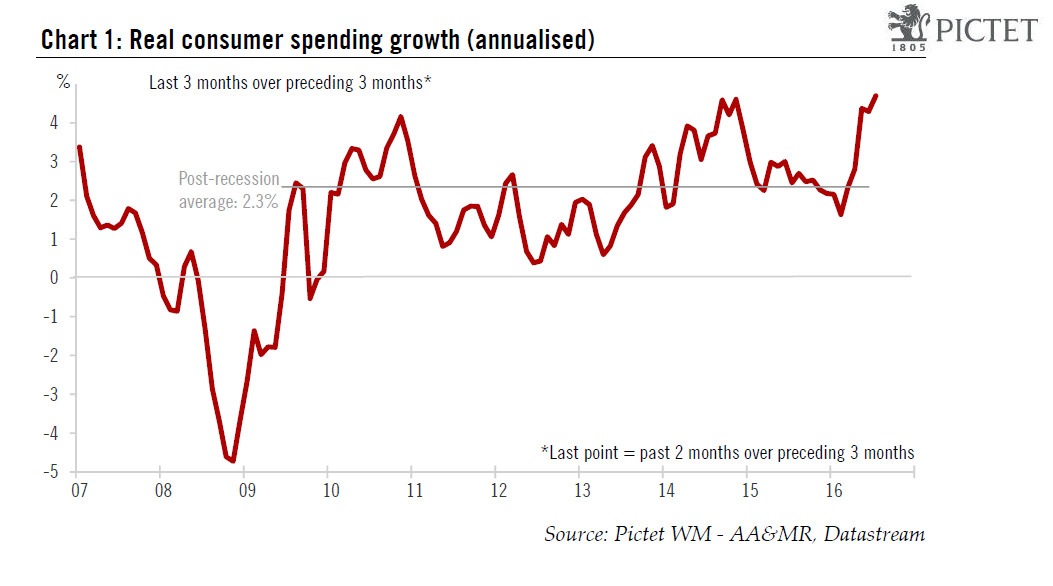

In accordance with the revised Q2 GDP data published last Friday (26 August), which included an upward revision of personal consumption growth from an already very strong 4.2% q-o-q annualised to an even higher 4.4%, previous monthly figures for consumption were adjusted up. Notably, June’s monthly increase was revised up from +0.3% to +0.4%. The end result is that between Q2 and July, personal consumption in the US grew by a strong 4.1% annualised.

Real disposable income rose by a strong 0.4% m-o-m in July, following +0.2% in June. As consumer spending growth was slightly lower than disposable income growth in July, the corollary was some increase in savings. The savings rate picked up from 5.5% in June (revised up from 5.3%) to 5.7% in July. It is also worth remembering that the entire savings rate series for the past few years was revised significantly higher just a month ago.

All this supports our optimistic view on US consumer spending growth. Employment growth will probably slow down somewhat over the coming months but should nevertheless remain relatively healthy, while wage increases are likely to pick up gradually. And although the savings rate has fallen quite substantially over the past six months or so, it remains relatively high when compared with the level of consumer confidence and to the behaviour of household wealth.

In that context, and with the very upbeat data published today, we believe personal consumption growth may well top 2.5% on average in H2 2016. Our forecast that US GDP will grow by 2.5% q-o-q annualised in Q3 remains unchanged, as do our projections for yearly average growth of 1.5% in 2016 and 2.0% in 2017. However, following today’s strong consumption numbers, any changes to our projections for Q3 are likely to be to the upside.