Solid US wage growth could lead to a more hawkish tone at the Federal Reserve.The January employment report showed that the US economy started 2018 on a strong footing, with particularly robust momentum in cyclical sectors such as construction and manufacturing. This supports our scenario that US growth will step up to 3% in 2018, from 2.3% in 2017, driven by an uptick in investment. With January’s increase of 200,000, the 3-month average growth in payrolls stands at 192,000/month, well above the one-year average of 176,000/month. This could entice the Fed to indicate more rate hikes at its March meeting. We see four quarter-point rate increases in the US in 2018.The highlight of the report was the sharp acceleration in wage growth, with average hourly earnings rising 2.9% year-on-year

Topics:

Thomas Costerg considers the following as important: Macroview, US economy, US employment, US nonfarm payrolls

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Solid US wage growth could lead to a more hawkish tone at the Federal Reserve.

The January employment report showed that the US economy started 2018 on a strong footing, with particularly robust momentum in cyclical sectors such as construction and manufacturing. This supports our scenario that US growth will step up to 3% in 2018, from 2.3% in 2017, driven by an uptick in investment. With January’s increase of 200,000, the 3-month average growth in payrolls stands at 192,000/month, well above the one-year average of 176,000/month. This could entice the Fed to indicate more rate hikes at its March meeting. We see four quarter-point rate increases in the US in 2018.

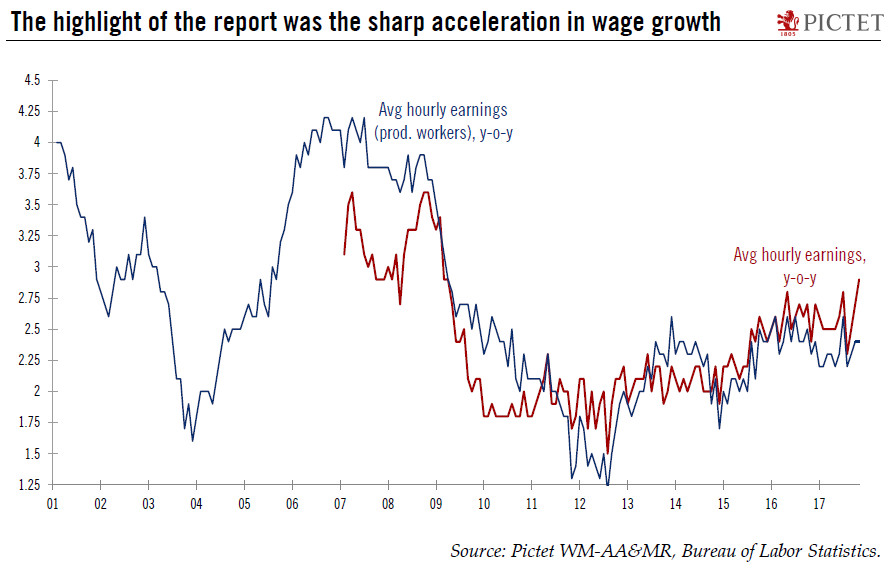

The highlight of the report was the sharp acceleration in wage growth, with average hourly earnings rising 2.9% year-on-year (y-o-y), the highest rate since 2009. But the wage gains were not broad-based. Manufacturing workers, for instance, saw only +1.9% y-o-y growth in wages. More broadly, production workers’ earnings rose 2.4% y-o-y, barely above the one-year average of 2.3%. Still, the overall trend in wage growth looks to be firming, echoing signs that the US labour market is nearing full employment.

At the microeconomic level, the real story is the sharp improvement in retail-sector employment. The sector has posted a 6,000/month gain on average in the last three months, versus an average loss of 2,000/month in the previous 12 months. Retail employment is ‘resisting’ online competition. Still, the share of retail in total employment fell to a new low of 10.74% in January.