The outcome of the March Fed meeting had a strong dovish undertone, crystallising the dovish policy shift at play since early January.The Fed confirmed the end of balance sheet reduction for September 2019. Meanwhile, the dot plot showed an overwhelming majority of members expected no rate hike at all this year (versus two rate increases expected at the December meeting).As expected, Powell took his ‘central banker to the world’ hat, expressed concern about the global economy, including the situation in Europe and China (and Brexit).Powell emphasised a strongly ‘neutral’ monetary stance, framed by the proximity of the theoretical neutral rate and the still-muted inflation pressures. At the same time, he remained optimistic about the US economy, pushing back against the idea of cutting

Topics:

Thomas Costerg considers the following as important: Fed meeting, Macroview, US economy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The outcome of the March Fed meeting had a strong dovish undertone, crystallising the dovish policy shift at play since early January.

The Fed confirmed the end of balance sheet reduction for September 2019. Meanwhile, the dot plot showed an overwhelming majority of members expected no rate hike at all this year (versus two rate increases expected at the December meeting).

As expected, Powell took his ‘central banker to the world’ hat, expressed concern about the global economy, including the situation in Europe and China (and Brexit).

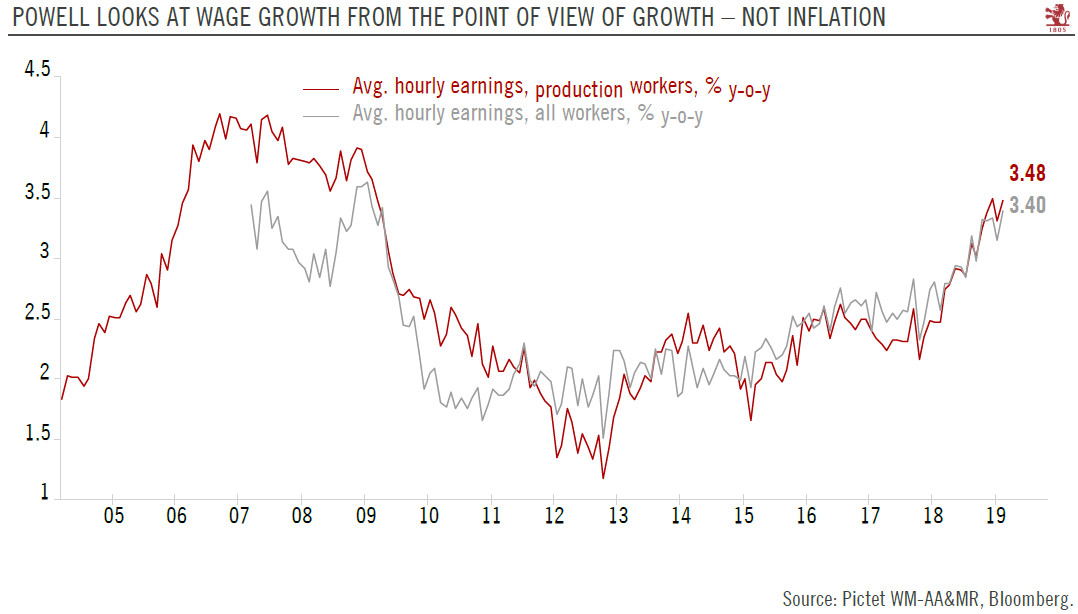

Powell emphasised a strongly ‘neutral’ monetary stance, framed by the proximity of the theoretical neutral rate and the still-muted inflation pressures. At the same time, he remained optimistic about the US economy, pushing back against the idea of cutting rates soon (as now priced by money markets).

What next? We believe that, at this stage, the Fed’s rate bias is still implicitly to the upside rather than the downside. US GDP is likely to bounce back in Q2 after a weak Q1 – which is also encapsulated in the Fed’s 2019 growth forecast, even if reduced to 2.1% from the 2.3% estimated in December.

At the same time, the pressures against another rate hike are high, and will rise further in coming months. The problem is that re-guiding markets towards a hike could be a Herculean task. Furthermore, the US business cycle clock (implicitly a worry for Powell) is going against the Fed, and core inflation is unlikely to pick up above the now-key threshold of 2.5%.

Meanwhile, the FOMC will be busy with balance sheet practicalities over the coming months and, in our view, it will be difficult to slip in another rate hike in coming months.

After expecting one rate hike later this year with risk of zero hike, we now expect zero hike. In other words, we believe we are at a rate plateau. That said, we think a rate cut is premature as there are no signs of imminent recession.

More fundamentally, this dovish meeting provided further confirmation that US monetary policy is now is a ‘debt dominance’ regime, where the high level of debt, and the constraints from financial markets, mean that monetary normalisation will remain impossible. The fear of crossing the nominal theoretical neutral rate (which the Fed puts at 2.75%) is very prevalent at the Fed. If there is one further rate hike down the line, we believe it will mainly be ‘symbolic’.