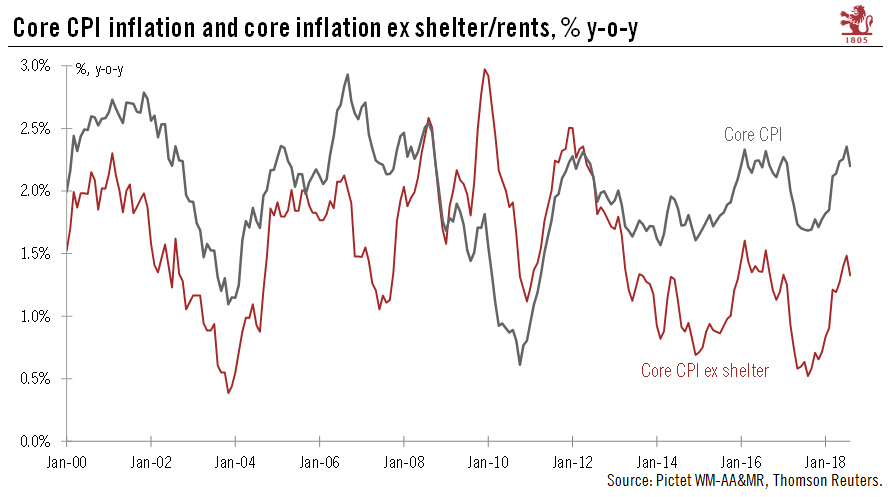

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still creating little inflationary pressure, contradicting all the economic textbooks.US inflation remains dampened by structural factors like globalisation and technology. While wages have been on an uptrend lately, with average hourly earnings up 2.9% y-o-y in August, the link between wages and inflation

Topics:

Thomas Costerg considers the following as important: FED, Macroview, US economy, US inflation

This could be interesting, too:

investrends.ch writes Neuer Fed-Chef Warsh könnte US-Geldpolitik umkrempeln

investrends.ch writes Powell-Ermittlungen erhöhen den Druck auf die Fed – Auswirkungen auf Gold und den Dollar

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.

Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still creating little inflationary pressure, contradicting all the economic textbooks.

US inflation remains dampened by structural factors like globalisation and technology. While wages have been on an uptrend lately, with average hourly earnings up 2.9% y-o-y in August, the link between wages and inflation remains tenuous. Also, expectations for future inflation remain tame, sustaining the current moderate inflation regime. In particular, competition between brick-and-mortar retail and retail and online stores may explain the continued moderation in apparel prices (-1.4% y-o-y).

Another important factor is that expectations for future inflation remain well anchored, both at the business and consumer level, as seen in recent surveys by the Atlanta and New York Feds. The persistent expectation that we will remain in a low inflation environment is perhaps the biggest obstacle to actual inflation moving meaningfully higher. However, ongoing trade scuffles may pose a major near-term risk to inflation perceptions, as concerns arise about the price of imported goods. We will continue to monitor developments on that front.

From a Federal Reserve perspective, the latest soft core inflation data is no game changer. The ‘auto pilot tightening’ can and will continue. We still expect four quartder-point rate hikes within the next 12 months.